Understanding FICA Taxes and Wage Base Limit

Por um escritor misterioso

Last updated 25 março 2025

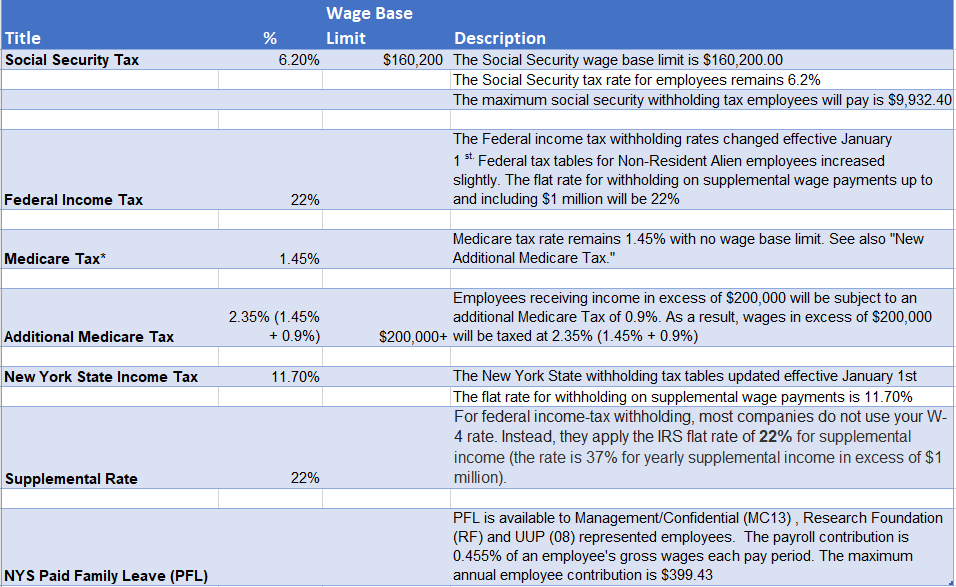

Employers deduct a certain amount from employee paychecks to pay federal income tax, Social Security tax, Medicare (Hospital Insurance) tax, and state income

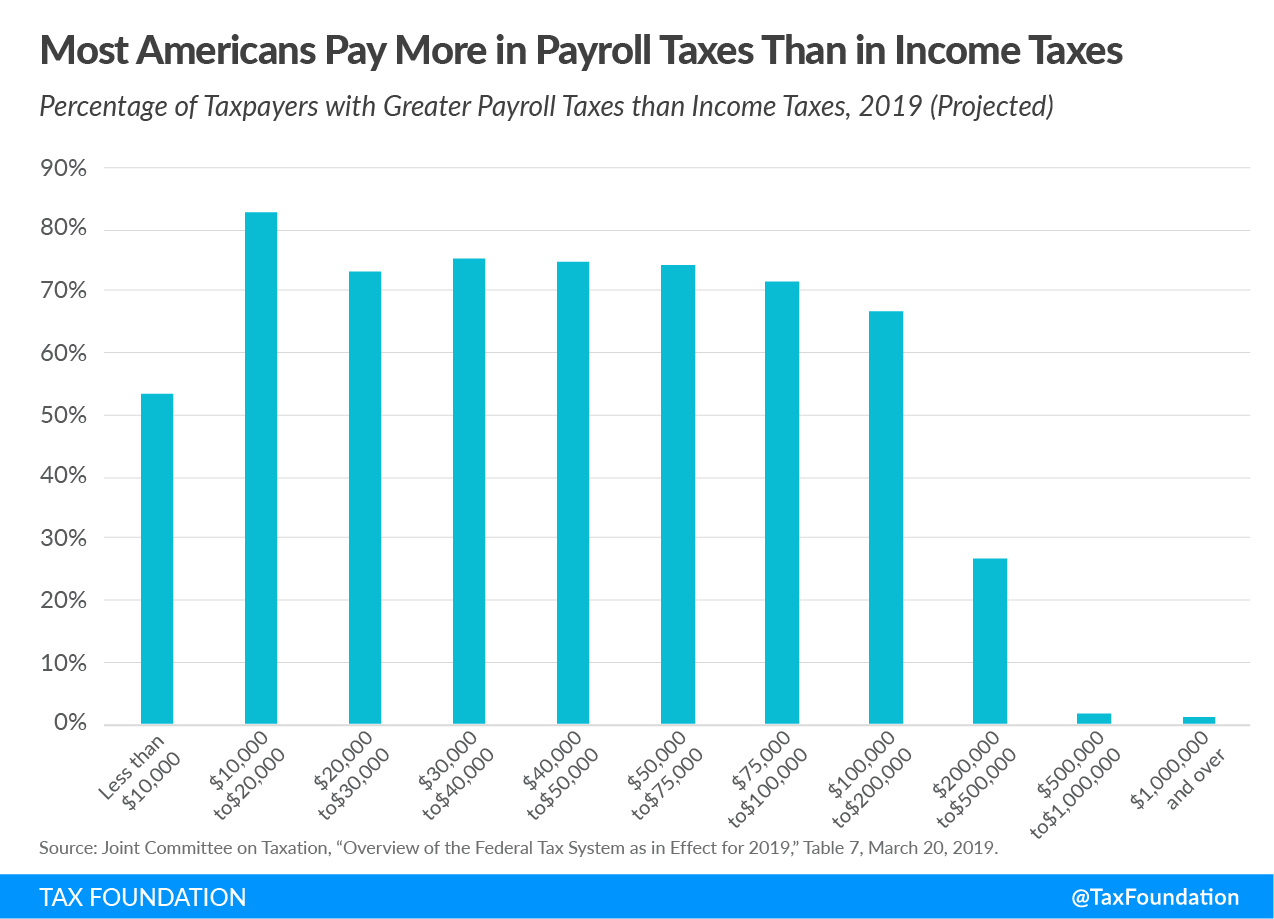

Payroll Tax Definition, What are Payroll Taxes?, TaxEDU

Payroll tax - Wikipedia

Wage Base Limit - FasterCapital

Minimum Wage and Overtime Pay, FICA

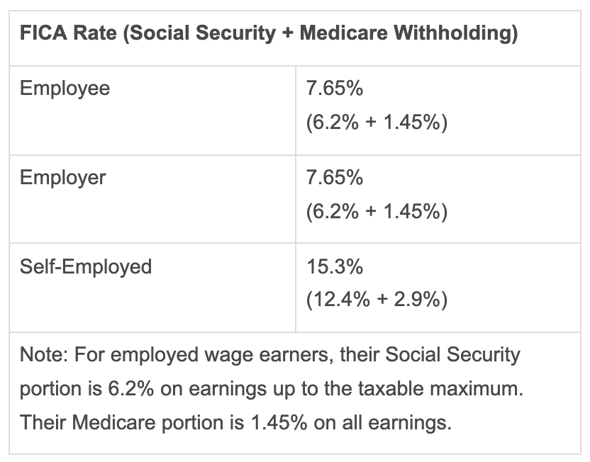

FICA Tax: Everything You Need to Know

What is payroll tax?

2023 Social Security Wage Cap Jumps to $160,200 for Payroll Taxes

Forms & Documents, Payroll

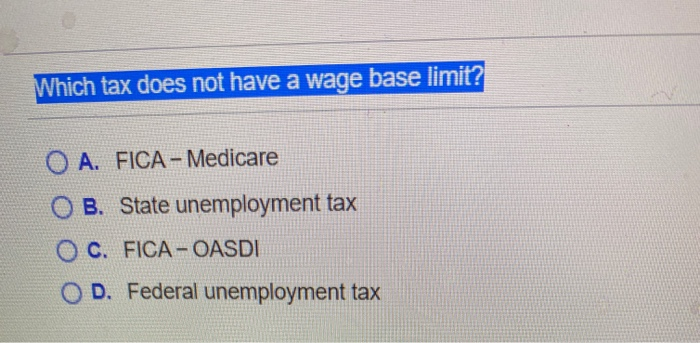

Solved Which tax does not have a wage base limit? O A. FICA

2021 Wage Base Rises for Social Security Payroll Taxes

:max_bytes(150000):strip_icc()/self-employed-contributions-act-seca-tax-5198333_final-e6dcd593b641422493714b7275b9df73.gif)

What Is the Self-Employed Contributions Act (SECA) Tax?

Maximum Taxable Income Amount For Social Security Tax (FICA)

Understanding solo 401(k) after-tax / total additions limit for

Recomendado para você

-

What is Fica Tax?, What is Fica on My Paycheck25 março 2025

What is Fica Tax?, What is Fica on My Paycheck25 março 2025 -

What Is FICA Tax: How It Works And Why You Pay25 março 2025

What Is FICA Tax: How It Works And Why You Pay25 março 2025 -

What Is FICA Tax? A Guide to FICA Taxes for Business Owners (2023) - Shopify New Zealand25 março 2025

What Is FICA Tax? A Guide to FICA Taxes for Business Owners (2023) - Shopify New Zealand25 março 2025 -

Employee Social Security Tax Deferral Repayment25 março 2025

Employee Social Security Tax Deferral Repayment25 março 2025 -

FICA Tax Rate: What Are Employer Responsibilities? - NerdWallet25 março 2025

FICA Tax Rate: What Are Employer Responsibilities? - NerdWallet25 março 2025 -

Solved 2016 FICA Tax Rates 1 1 FICA taxes include Social25 março 2025

-

Withholding FICA Tax on Nonresident employees and Foreign Workers25 março 2025

Withholding FICA Tax on Nonresident employees and Foreign Workers25 março 2025 -

What Is FICA Tax?25 março 2025

What Is FICA Tax?25 março 2025 -

FICA explained: Social Security and Medicare tax rates to know in 202325 março 2025

FICA explained: Social Security and Medicare tax rates to know in 202325 março 2025 -

.jpg) What is FICA tax? Understanding FICA for small business25 março 2025

What is FICA tax? Understanding FICA for small business25 março 2025

você pode gostar

-

O QUE FAZER NO PARQUE DA CIDADE DE JUNDIAÍ? 🤔 Separei aqui uma listin25 março 2025

-

Confira a altura mínima das principais atrações da Islands of Adventure - 04/09/201925 março 2025

Confira a altura mínima das principais atrações da Islands of Adventure - 04/09/201925 março 2025 -

The True Message in Isekai de Cheat Skill « Medieval Otaku25 março 2025

The True Message in Isekai de Cheat Skill « Medieval Otaku25 março 2025 -

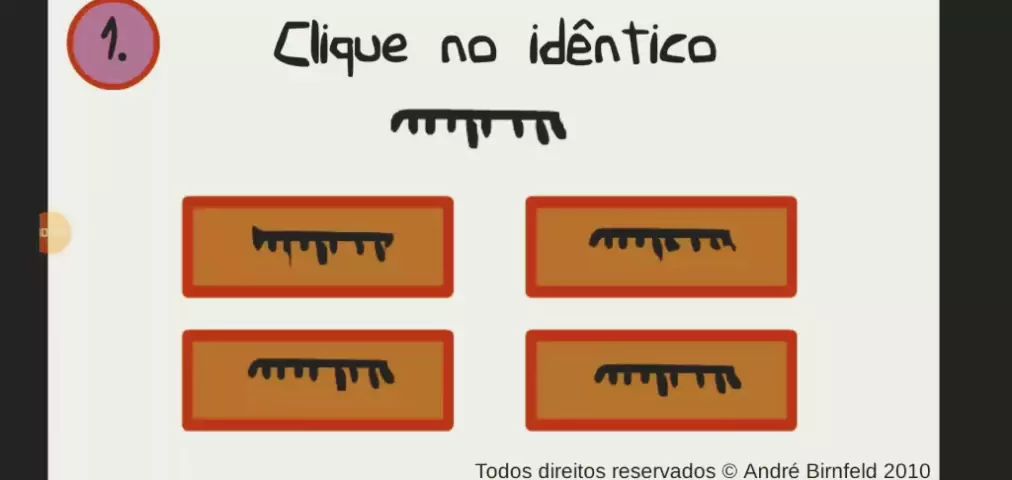

Racha Cuca - Problema de Lógica de Black Friday25 março 2025

-

All Tricky Phases In fnf 0-6 Pt.4 #madnesscombat #tricky25 março 2025

All Tricky Phases In fnf 0-6 Pt.4 #madnesscombat #tricky25 março 2025 -

830+ Corrida De Carros Na Rua fotos de stock, imagens e fotos25 março 2025

830+ Corrida De Carros Na Rua fotos de stock, imagens e fotos25 março 2025 -

gênio quiz respostas25 março 2025

gênio quiz respostas25 março 2025 -

Cavalos de Salto: de A a Z – Cavalo de Salto Argentina25 março 2025

Cavalos de Salto: de A a Z – Cavalo de Salto Argentina25 março 2025 -

Rumble Run! na App Store25 março 2025

Rumble Run! na App Store25 março 2025 -

Dance se Souber Músicas mais tocadas do Tik Tok 2023 🎶 #musi25 março 2025