FICA Tax Rate: What Are Employer Responsibilities? - NerdWallet

Por um escritor misterioso

Last updated 01 abril 2025

Employers and employees must pay FICA taxes to contribute to social security and medicare. What you need to know.

SUGGESTIONS FOR IMPROVING TAX COMPLIANCE THROUGH GREATER TAX SYSTEM TRANSPARENCY AND ACCOUNTABILITY - California Lawyers Association

Minimum Car Insurance Requirements by State - NerdWallet

Federal Insurance Contributions Act - Wikipedia

Self-Employment Tax: What It Is, How to Calculate It - NerdWallet

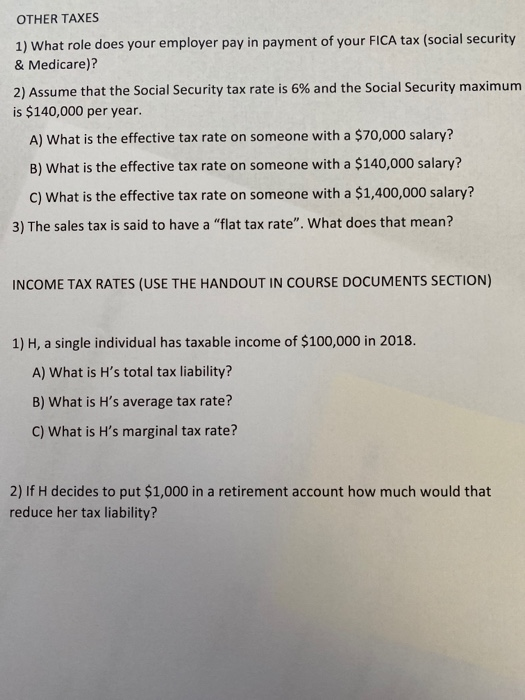

OTHER TAXES 1) What role does your employer pay in

How to Start a Business in 15 Steps - NerdWallet

DEF 14A

The ABCs of FICA: Federal Insurance Contributions Act Explained - FasterCapital

Employment Practices Liability Insurance - NerdWallet

:max_bytes(150000):strip_icc()/fica-taxes-social-security-and-medicare-taxes-398257_FINAL-5bbd10af46e0fb00266df9ec-b3794e561e094118ad5b5ed3c6898880.png)

Learn About FICA, Social Security, and Medicare Taxes

9 Essential Business Tasks That Take an Hour or Less - NerdWallet

Recomendado para você

-

What Is FICA Tax? A Complete Guide for Small Businesses01 abril 2025

What Is FICA Tax? A Complete Guide for Small Businesses01 abril 2025 -

What is FICA Tax? - The TurboTax Blog01 abril 2025

-

FICA Tax: What It is and How to Calculate It01 abril 2025

-

Important 2020 Federal Tax Deadlines for Small Businesses - Workest01 abril 2025

Important 2020 Federal Tax Deadlines for Small Businesses - Workest01 abril 2025 -

FICA Tax: Understanding Social Security and Medicare Taxes01 abril 2025

-

How Do I Get a FICA Tax Refund for F1 Students?01 abril 2025

How Do I Get a FICA Tax Refund for F1 Students?01 abril 2025 -

How to get your FICA tax REFUND?, Form 843 & Form 8316, F1 Student, International Student01 abril 2025

How to get your FICA tax REFUND?, Form 843 & Form 8316, F1 Student, International Student01 abril 2025 -

.jpg) What is FICA tax? Understanding FICA for small business01 abril 2025

What is FICA tax? Understanding FICA for small business01 abril 2025 -

2019 US Tax Season in Numbers for Sprintax Customers01 abril 2025

2019 US Tax Season in Numbers for Sprintax Customers01 abril 2025 -

What is FICA and How To Calculate FICA Tax 2023 With Complete Guide?01 abril 2025

What is FICA and How To Calculate FICA Tax 2023 With Complete Guide?01 abril 2025

você pode gostar

-

Ilustração para diferenciação dos padrões espaciais. Tradução própria01 abril 2025

Ilustração para diferenciação dos padrões espaciais. Tradução própria01 abril 2025 -

Zacian V - SWSH10: Astral Radiance Trainer Gallery - Pokemon01 abril 2025

Zacian V - SWSH10: Astral Radiance Trainer Gallery - Pokemon01 abril 2025 -

Most Aggressive FM21 Tactic / 82% Win Rate!01 abril 2025

Most Aggressive FM21 Tactic / 82% Win Rate!01 abril 2025 -

Watch NieR:Automata Ver1.1a - Crunchyroll01 abril 2025

-

Tower Defense Simulator SCRIPT01 abril 2025

Tower Defense Simulator SCRIPT01 abril 2025 -

Withered Chica Fan Casting for Five Nights At Freddy's A Shattered Awakening01 abril 2025

Withered Chica Fan Casting for Five Nights At Freddy's A Shattered Awakening01 abril 2025 -

Mbappé tirou card de goleiro argentino no Fifa? - MonitoR7 - R701 abril 2025

-

Gold Digger FRVR 1.0 Free Download01 abril 2025

Gold Digger FRVR 1.0 Free Download01 abril 2025 -

Android — Microsoft Flight Simulator Freeware — MSFS Addons01 abril 2025

Android — Microsoft Flight Simulator Freeware — MSFS Addons01 abril 2025 -

30 de novembro: dia do Evangélico01 abril 2025

30 de novembro: dia do Evangélico01 abril 2025