FICA Tax: Understanding Social Security and Medicare Taxes

Por um escritor misterioso

Last updated 14 abril 2025

Both employees and employers are required to pay FICA tax, which is withheld from an employee

How To Calculate Payroll Taxes? FUTA, SUI and more

Which taxes are only paid by the employer? - Quora

What Are FICA Taxes And Do They Affect Me?, by M. De Oto

Withholding Social Security Tax from Wages—Things to Consider

Social Security wage base is $160,200 in 2023, meaning more FICA taxes for higher earners - Don't Mess With Taxes

Maximum Taxable Income Amount For Social Security Tax (FICA)

What Are FICA Taxes? – Forbes Advisor

What is FED MED/EE Tax?

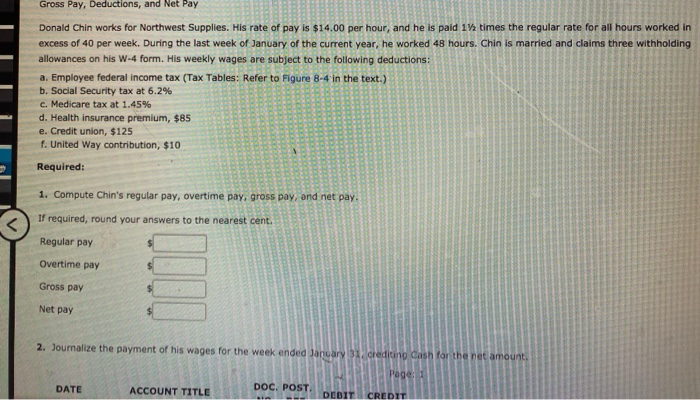

Solved Calculating Social Security and Medicare Taxes Assume

Recomendado para você

-

FICA Tax Refund Timeline - About 6 Months with Employer Letter and Required Documents14 abril 2025

FICA Tax Refund Timeline - About 6 Months with Employer Letter and Required Documents14 abril 2025 -

FICA Tax Tip Credit for Salons & Spas - Rosy Salon Software14 abril 2025

FICA Tax Tip Credit for Salons & Spas - Rosy Salon Software14 abril 2025 -

FICA Tax in 2022-2023: What Small Businesses Need to Know14 abril 2025

FICA Tax in 2022-2023: What Small Businesses Need to Know14 abril 2025 -

What Are FICA Taxes And Do They Affect Me?, by M. De Oto14 abril 2025

What Are FICA Taxes And Do They Affect Me?, by M. De Oto14 abril 2025 -

Withholding FICA Tax on Nonresident employees and Foreign Workers14 abril 2025

Withholding FICA Tax on Nonresident employees and Foreign Workers14 abril 2025 -

Professional Beauty Association Push for Extension of FICA Tax Tip Credit to Self-Care Businesses – SalonEVO Magazine14 abril 2025

Professional Beauty Association Push for Extension of FICA Tax Tip Credit to Self-Care Businesses – SalonEVO Magazine14 abril 2025 -

2019 US Tax Season in Numbers for Sprintax Customers14 abril 2025

2019 US Tax Season in Numbers for Sprintax Customers14 abril 2025 -

FICA Tax Tip Fairness Pro Beauty Association14 abril 2025

FICA Tax Tip Fairness Pro Beauty Association14 abril 2025 -

:max_bytes(150000):strip_icc()/GettyImages-576720420-27eaa138a2e144d2b957315f18ef2725.jpg) What Is Social Security Tax? Definition, Exemptions, and Example14 abril 2025

What Is Social Security Tax? Definition, Exemptions, and Example14 abril 2025 -

FICA TAX PROVISIONS (1967-1980)14 abril 2025

FICA TAX PROVISIONS (1967-1980)14 abril 2025

você pode gostar

-

Sonic: O Filme A alta velocidade dos videojogos para o grande14 abril 2025

Sonic: O Filme A alta velocidade dos videojogos para o grande14 abril 2025 -

MarkScan (@MarkScandigital) / X14 abril 2025

MarkScan (@MarkScandigital) / X14 abril 2025 -

ASUS TUF Gaming GeForce RTX® 4080 OC Edition Graphics14 abril 2025

ASUS TUF Gaming GeForce RTX® 4080 OC Edition Graphics14 abril 2025 -

123654789.edu - Replit14 abril 2025

123654789.edu - Replit14 abril 2025 -

Reaper 2 Aizen PT2 Update Log and Patch Notes - Try Hard Guides14 abril 2025

Reaper 2 Aizen PT2 Update Log and Patch Notes - Try Hard Guides14 abril 2025 -

Roll the Dice: D10 and D6 Gaming Systems14 abril 2025

Roll the Dice: D10 and D6 Gaming Systems14 abril 2025 -

Box Reshiram E Charizard Pokémon Gx - Copag 99366 na Americanas Empresas14 abril 2025

Box Reshiram E Charizard Pokémon Gx - Copag 99366 na Americanas Empresas14 abril 2025 -

Buy Robux Roblox14 abril 2025

Buy Robux Roblox14 abril 2025 -

MKWarehouse: Mortal Kombat Mobile: Shang Tsung14 abril 2025

MKWarehouse: Mortal Kombat Mobile: Shang Tsung14 abril 2025 -

GitHub - Pittvandewitt/dinogame-client: Make the offline Google14 abril 2025