FICA Tax in 2022-2023: What Small Businesses Need to Know

Por um escritor misterioso

Last updated 04 abril 2025

FICA taxes are paid by all workers. The FICA taxes are paid based on your total income from all sources. Here is what small businesses need to know.

FICA tax rate: Figures and formulas employers need to know

FICA Tax in 2022-2023: What Small Businesses Need to Know

IRS outlines what you need to know to prepare for tax filing in 2023

Tax filing tips: What to know to help get biggest refund on 2022 taxes

How to Calculate Quarterly Estimated Taxes in 2023

FICA Tax in 2022-2023: What Small Businesses Need to Know

2024 State Business Tax Climate Index

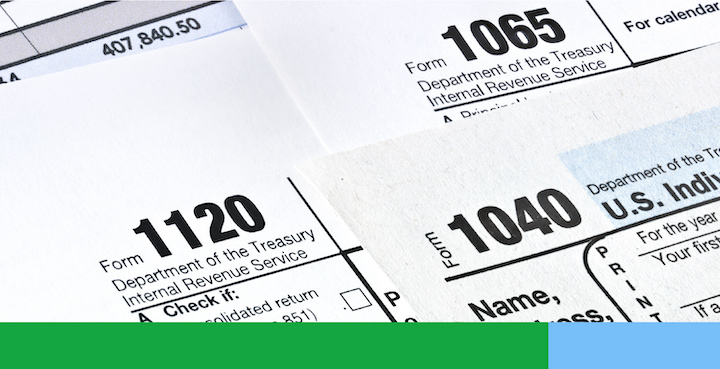

Small Business Tax Forms

A guide to small business tax brackets in 2022-2023

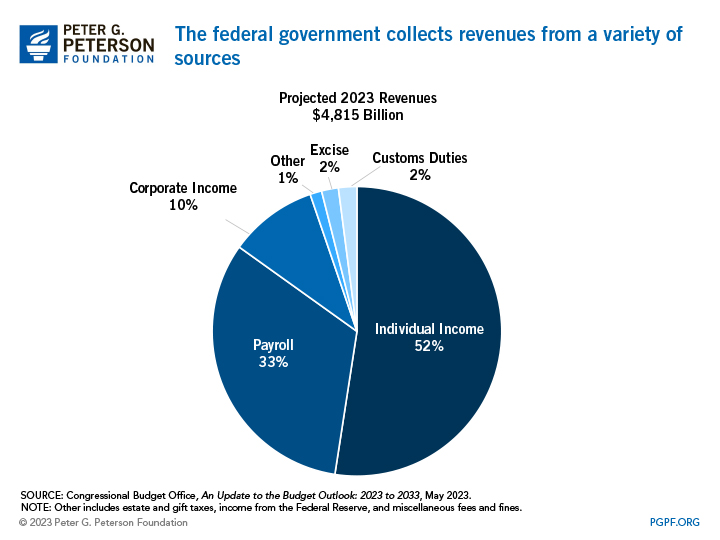

Understanding the Budget: Revenues

Employers: The Social Security Wage Base is Increasing in 2022 - BGM

Business Taxes: Annual v. Quarterly Filing for Small Businesses

Income Limit For Maximum Social Security Tax 2023 - Financial Samurai

Here Are the Federal Income Tax Brackets for 2022 and 2023

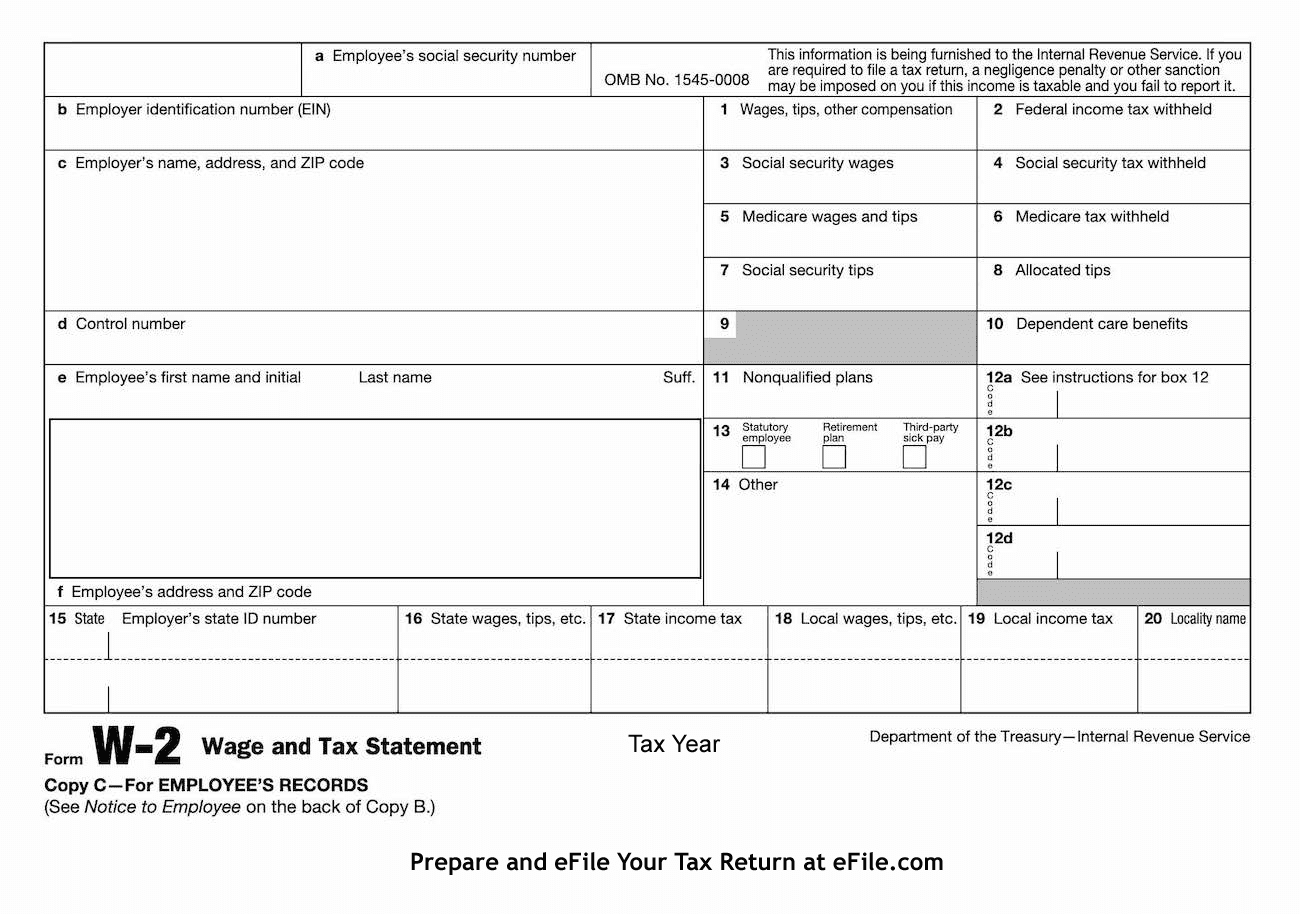

Form W-2, Wage and Tax Statement for Hourly & Salary Workers

Recomendado para você

-

What Is FICA Tax? A Complete Guide for Small Businesses04 abril 2025

What Is FICA Tax? A Complete Guide for Small Businesses04 abril 2025 -

What is FICA tax?04 abril 2025

What is FICA tax?04 abril 2025 -

FICA Tax Exemption for Nonresident Aliens Explained04 abril 2025

FICA Tax Exemption for Nonresident Aliens Explained04 abril 2025 -

What is the FICA Tax and How Does it Connect to Social Security?04 abril 2025

-

What are FICA Tax Payable? – SuperfastCPA CPA Review04 abril 2025

What are FICA Tax Payable? – SuperfastCPA CPA Review04 abril 2025 -

FICA Tax - An Explanation - RMS Accounting04 abril 2025

FICA Tax - An Explanation - RMS Accounting04 abril 2025 -

FICA Tax Tip Fairness Pro Beauty Association04 abril 2025

FICA Tax Tip Fairness Pro Beauty Association04 abril 2025 -

Should We Eliminate the Social Security Tax Cap? Here Are the Pros and Cons04 abril 2025

Should We Eliminate the Social Security Tax Cap? Here Are the Pros and Cons04 abril 2025 -

FICA TAX PROVISIONS (1967-1980)04 abril 2025

FICA TAX PROVISIONS (1967-1980)04 abril 2025 -

What is FICA and How To Calculate FICA Tax 2023 With Complete Guide?04 abril 2025

What is FICA and How To Calculate FICA Tax 2023 With Complete Guide?04 abril 2025

você pode gostar

-

IIT Gandhinagar's Opaque Admission Norms: Bias Against SC/ST Candidates?04 abril 2025

IIT Gandhinagar's Opaque Admission Norms: Bias Against SC/ST Candidates?04 abril 2025 -

Como vencer Articuno em Pokémon GO04 abril 2025

Como vencer Articuno em Pokémon GO04 abril 2025 -

Why Anya Taylor-Joy Thinks She's Too Ugly To Be In Movies04 abril 2025

Why Anya Taylor-Joy Thinks She's Too Ugly To Be In Movies04 abril 2025 -

Nerf Roblox Arsenal: Pulse Laser Lançador - Nerf04 abril 2025

Nerf Roblox Arsenal: Pulse Laser Lançador - Nerf04 abril 2025 -

a preppy roblox avatar wearing a smiley face t shirt04 abril 2025

a preppy roblox avatar wearing a smiley face t shirt04 abril 2025 -

![Highlights] Sora Yori mo Tooi Basho 06: Singapore and Durians – The HD wallpaper](https://e1.pxfuel.com/desktop-wallpaper/714/180/desktop-wallpaper-highlights-sora-yori-mo-tooi-basho-06-singapore-and-durians-the-sora-yori-mo-tooi-basho.jpg) Highlights] Sora Yori mo Tooi Basho 06: Singapore and Durians – The HD wallpaper04 abril 2025

Highlights] Sora Yori mo Tooi Basho 06: Singapore and Durians – The HD wallpaper04 abril 2025 -

Parking in Bath - Visit Bath04 abril 2025

Parking in Bath - Visit Bath04 abril 2025 -

How to Open a French Bank Account as an American in France - FrenchEntrée04 abril 2025

How to Open a French Bank Account as an American in France - FrenchEntrée04 abril 2025 -

forest - mobile9 Natureza, Gifs, Mensagens do papa francisco04 abril 2025

forest - mobile9 Natureza, Gifs, Mensagens do papa francisco04 abril 2025 -

/cdn.vox-cdn.com/uploads/chorus_image/image/69151598/Screen_Shot_2021_04_19_at_1.45.22_PM.0.png) Attack on Titan manga ending couldn't escape creator controversy04 abril 2025

Attack on Titan manga ending couldn't escape creator controversy04 abril 2025