Federal Insurance Contributions Act (FICA): What It Is, Who Pays

Por um escritor misterioso

Last updated 02 abril 2025

:max_bytes(150000):strip_icc()/papers-with-fica-federal-insurance-contributions-act-tax--625206358-2b7a46b78de54753a70d54c452429876.jpg)

The Federal Insurance Contributions Act (FICA) is a U.S. payroll tax deducted from workers

Federal Insurance Contributions Act (FICA)

What Is FICA Tax? A Guide to FICA Taxes for Business Owners (2023)

FICA Tax & Who Pays It

Federal Insurance Contributions Act (FICA) - What is Federal

Federal Insurance Contributions Act (FICA): Definition

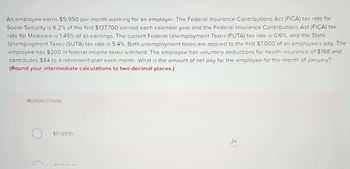

Answered: An employee earns $5,950 per month…

What is FICA Tax? - The TurboTax Blog

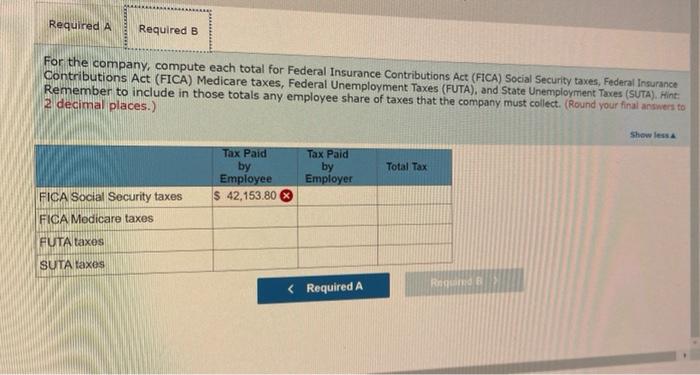

Solved Mest Company has nine employees. FICA Social Security

Solved] 1- An employee earned $43,600 during the year working for

Recomendado para você

-

FICA Tax: What It is and How to Calculate It02 abril 2025

-

What is Fica Tax?, What is Fica on My Paycheck02 abril 2025

What is Fica Tax?, What is Fica on My Paycheck02 abril 2025 -

What Is And How To Calculate FICA Taxes Explained, Social Security Taxes And Medicare Taxes02 abril 2025

What Is And How To Calculate FICA Taxes Explained, Social Security Taxes And Medicare Taxes02 abril 2025 -

What Is the FICA Tax and Why Does It Exist? - TheStreet02 abril 2025

What Is the FICA Tax and Why Does It Exist? - TheStreet02 abril 2025 -

What Is FICA Tax? A Guide to FICA Taxes for Business Owners (2023) - Shopify New Zealand02 abril 2025

What Is FICA Tax? A Guide to FICA Taxes for Business Owners (2023) - Shopify New Zealand02 abril 2025 -

What are FICA Tax Payable? – SuperfastCPA CPA Review02 abril 2025

What are FICA Tax Payable? – SuperfastCPA CPA Review02 abril 2025 -

FICA Tax in 2022-2023: What Small Businesses Need to Know02 abril 2025

FICA Tax in 2022-2023: What Small Businesses Need to Know02 abril 2025 -

What Are FICA Taxes And Why Do They Matter? - Quikaid02 abril 2025

What Are FICA Taxes And Why Do They Matter? - Quikaid02 abril 2025 -

FICA Tax - An Explanation - RMS Accounting02 abril 2025

FICA Tax - An Explanation - RMS Accounting02 abril 2025 -

What Is FICA Tax, Understanding Payroll Tax Requirements02 abril 2025

What Is FICA Tax, Understanding Payroll Tax Requirements02 abril 2025

você pode gostar

-

Roblox volta a funcionar após três dias fora do ar02 abril 2025

Roblox volta a funcionar após três dias fora do ar02 abril 2025 -

Suicide Squad: Rebirth Deluxe Edition Book 1 by Rob Williams02 abril 2025

Suicide Squad: Rebirth Deluxe Edition Book 1 by Rob Williams02 abril 2025 -

Pin de t3ddy b34r 🧸💞 em ~gacha life/adopt~ Esboços bonitos, Roupas de anime, Desenhos de bonecas tumblr02 abril 2025

Pin de t3ddy b34r 🧸💞 em ~gacha life/adopt~ Esboços bonitos, Roupas de anime, Desenhos de bonecas tumblr02 abril 2025 -

Pokemon Legends Arceus Shiny Giratina Max Effort Levels 6IV-EV Trained02 abril 2025

Pokemon Legends Arceus Shiny Giratina Max Effort Levels 6IV-EV Trained02 abril 2025 -

Perfect Character Builderman And Team Gaming Noob Oof Poster for Sale by Dakotahedge02 abril 2025

Perfect Character Builderman And Team Gaming Noob Oof Poster for Sale by Dakotahedge02 abril 2025 -

Marvel's Spider-Man 2 Game (2023), Characters & Release Date02 abril 2025

Marvel's Spider-Man 2 Game (2023), Characters & Release Date02 abril 2025 -

![PDF] MONTE CARLO TREE SEARCH: A TUTORIAL](https://d3i71xaburhd42.cloudfront.net/0cc84d4edbad94c0a5692b2df6b33640ce64bb12/7-Figure6-1.png) PDF] MONTE CARLO TREE SEARCH: A TUTORIAL02 abril 2025

PDF] MONTE CARLO TREE SEARCH: A TUTORIAL02 abril 2025 -

) How to watch and stream IMPOSSIBLE SIMON SAYS IN FLEE THE FACILITY! - Roblox Flee the Facility - 2018 on Roku02 abril 2025

How to watch and stream IMPOSSIBLE SIMON SAYS IN FLEE THE FACILITY! - Roblox Flee the Facility - 2018 on Roku02 abril 2025 -

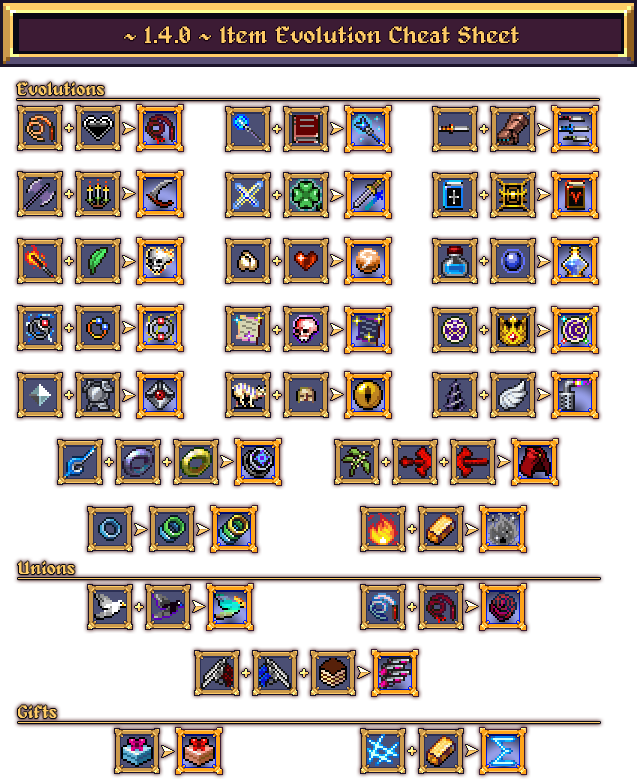

Vampire Survivors Item Evolution Cheat Sheet (1.4.0 + DLCs) - SteamAH02 abril 2025

Vampire Survivors Item Evolution Cheat Sheet (1.4.0 + DLCs) - SteamAH02 abril 2025 -

Puerto Rico's02 abril 2025

Puerto Rico's02 abril 2025