Online gaming industry for 28% GST on gross gaming revenue not on entry amount

Por um escritor misterioso

Last updated 10 abril 2025

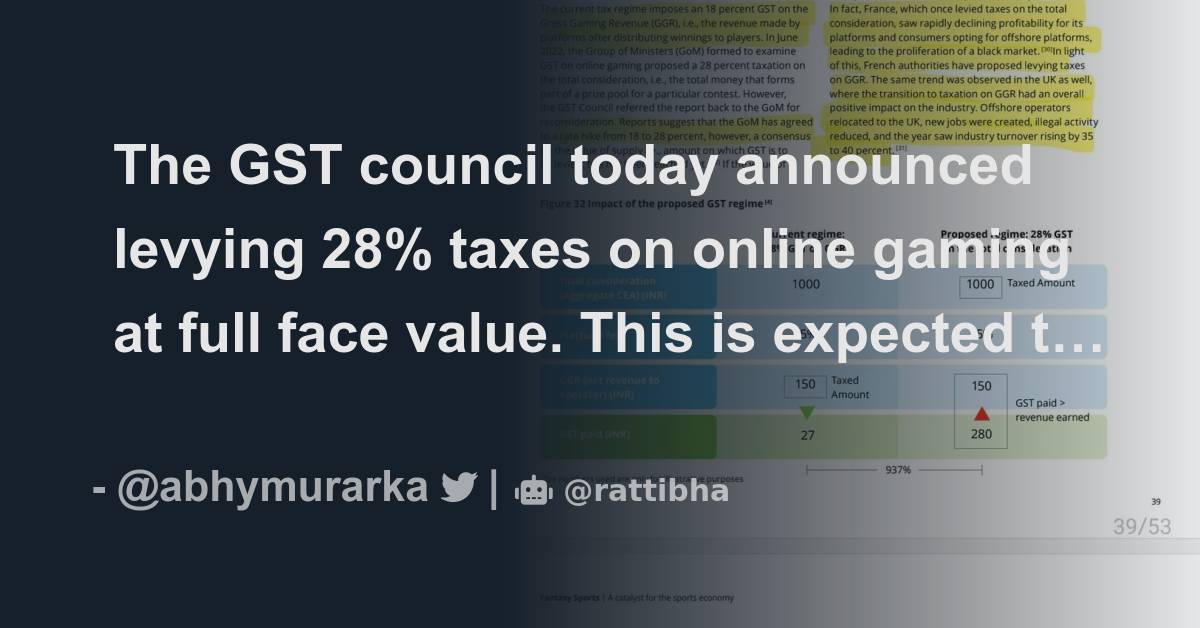

GGR is the fee charged by an online skill gaming platform as service charges to facilitate the participation of players in a game on their platform while Contest Entry Amount (CEA) is the entire amount deposited by the player to enter a contest on the platform.

The GST council today announced levying 28% taxes on online gaming

India's $3-billion Online Gaming Industry is Battling the Odds

)

Online gaming industry agrees for 28% GST only on GGR not on entry

Will 28% GST kill the online gaming industry in India?

GST council to levy 28% tax on online gaming, casinos, horse

Industry rancorous over 28% GST on online gaming. What does it

Indian Online Gaming will accept 28% GST on Gross Revenue, not on

Online gaming industry for 28% GST on gross gaming revenue not on

28% GST on online gaming 'unconstitutional', will lead to job

Overtaxing online gaming will favour grey operators

Online gaming industry for 28% GST on gross gaming revenue not on

Recomendado para você

-

The Rise of Gameschooling: New Virtual Convention to Celebrate Students & Game Designers Finding Fun Ways to Learn – The 7410 abril 2025

The Rise of Gameschooling: New Virtual Convention to Celebrate Students & Game Designers Finding Fun Ways to Learn – The 7410 abril 2025 -

E-gaming solution - 52 Entertainment10 abril 2025

E-gaming solution - 52 Entertainment10 abril 2025 -

7,342 Online Game Infographic Images, Stock Photos, 3D objects, & Vectors10 abril 2025

7,342 Online Game Infographic Images, Stock Photos, 3D objects, & Vectors10 abril 2025 -

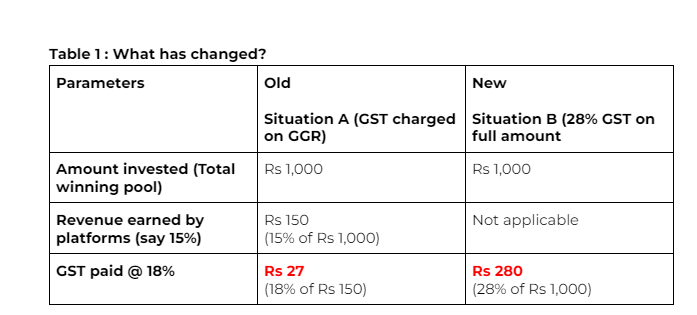

Chart: The Most Important Gaming Platforms in 201910 abril 2025

Chart: The Most Important Gaming Platforms in 201910 abril 2025 -

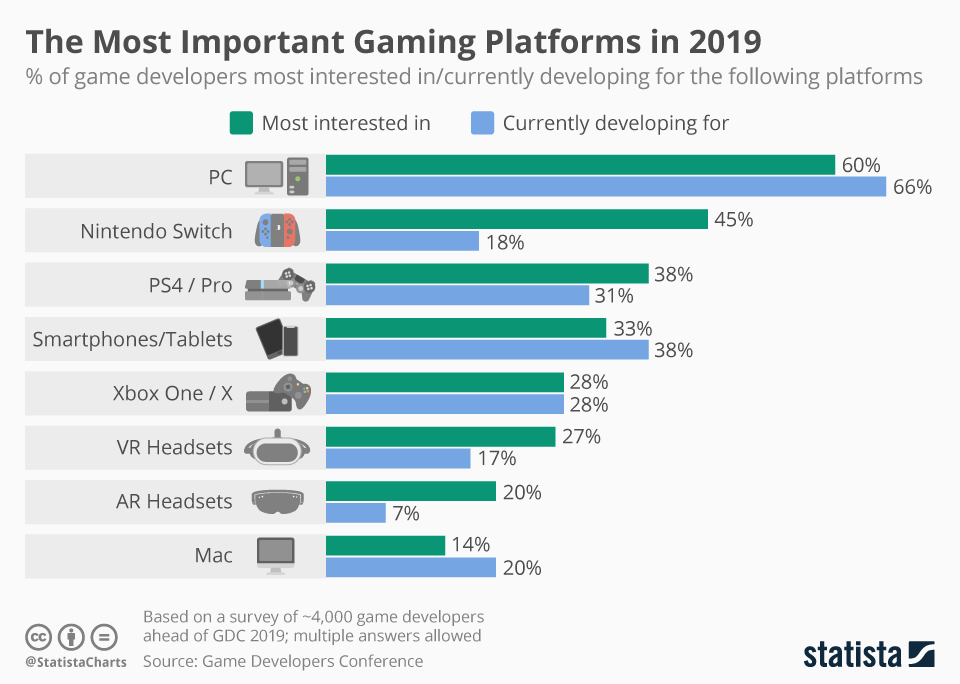

Online Gaming: The Rise of a Multi-Billion Dollar Industry10 abril 2025

Online Gaming: The Rise of a Multi-Billion Dollar Industry10 abril 2025 -

Game Vault (Online Gaming Platform)10 abril 2025

-

Survey shows Virginia online gamers struggle against insomnia10 abril 2025

Survey shows Virginia online gamers struggle against insomnia10 abril 2025 -

How online gaming industry is growing so fast in 2023, David M10 abril 2025

-

Online Gaming Platform Market Analysis & Forecast for Next 510 abril 2025

Online Gaming Platform Market Analysis & Forecast for Next 510 abril 2025 -

Gaming addiction. Man bearded hipster gamer headphones and keyboard. Play computer games. Online gaming platform. Gaming modern leisure. Cyber sport arena. Gaming PC build guide. Graphics settings Stock Photo by ©stetsik 51056504410 abril 2025

Gaming addiction. Man bearded hipster gamer headphones and keyboard. Play computer games. Online gaming platform. Gaming modern leisure. Cyber sport arena. Gaming PC build guide. Graphics settings Stock Photo by ©stetsik 51056504410 abril 2025

você pode gostar

-

Riot releases League of Legends' newest Avatar Creator - Not A Gamer10 abril 2025

Riot releases League of Legends' newest Avatar Creator - Not A Gamer10 abril 2025 -

POKI ONE N HALF - 547 Photos & 645 Reviews - 3030 University Ave10 abril 2025

POKI ONE N HALF - 547 Photos & 645 Reviews - 3030 University Ave10 abril 2025 -

Ben GIF - Ben - Discover & Share GIFs10 abril 2025

Ben GIF - Ben - Discover & Share GIFs10 abril 2025 -

![ART] Volume 18 of Karakai Jouzu no Takagi-san & Volume 16 of Karakai Jouzu no (Moto) Takagi-san is Out Today : r/manga](https://i.redd.it/5h54eiee2a491.jpg) ART] Volume 18 of Karakai Jouzu no Takagi-san & Volume 16 of Karakai Jouzu no (Moto) Takagi-san is Out Today : r/manga10 abril 2025

ART] Volume 18 of Karakai Jouzu no Takagi-san & Volume 16 of Karakai Jouzu no (Moto) Takagi-san is Out Today : r/manga10 abril 2025 -

Hellsing Ultimate Brasil10 abril 2025

-

Apartamento na Rua Godofredo Marques, 48, Camorim em Rio de Janeiro, por R$ 499.000 - Viva Real10 abril 2025

Apartamento na Rua Godofredo Marques, 48, Camorim em Rio de Janeiro, por R$ 499.000 - Viva Real10 abril 2025 -

148 Idiom Examples To Enrich Your Language10 abril 2025

148 Idiom Examples To Enrich Your Language10 abril 2025 -

ask dhmis! (dont' hug me im white sause)10 abril 2025

ask dhmis! (dont' hug me im white sause)10 abril 2025 -

Lakas talaga ni kuya sly #kuyasly #slytheminer #lazysly #fypシ #fypage10 abril 2025

-

Esports logo appealing to gamers, Logo design contest10 abril 2025