What is a K-1 Trust Distribution? - CPA Firm, Accounting & Taxes

Por um escritor misterioso

Last updated 13 abril 2025

Tax Implications of Trust and Estate Distributions

Do I Have to Pay Income Tax on My Trust Distributions?

IRS Income Tax Forms: A Checklist for Small Businesses

Trust and estate income tax returns under the TCJA - Journal of Accountancy

How To Read Schedule K-1?

Tax Update: Trust 1041 & Gift Tax, Marcum LLP

Form 1041 Schedule K-1 FAQs - TaxSlayer Pro's Blog for Professional Tax Preparers

Reporting foreign trust and estate distributions to U.S. beneficiaries: Part 3

Shareholder Salary vs. Dividends: Tax Implications & Tips

Fiduciary tax 101

What is a Schedule K-1 Tax Form? - TurboTax Tax Tips & Videos

Recomendado para você

-

SSS Mobile – Apps no Google Play13 abril 2025

-

Stream SSS EEE music Listen to songs, albums, playlists for free13 abril 2025

Stream SSS EEE music Listen to songs, albums, playlists for free13 abril 2025 -

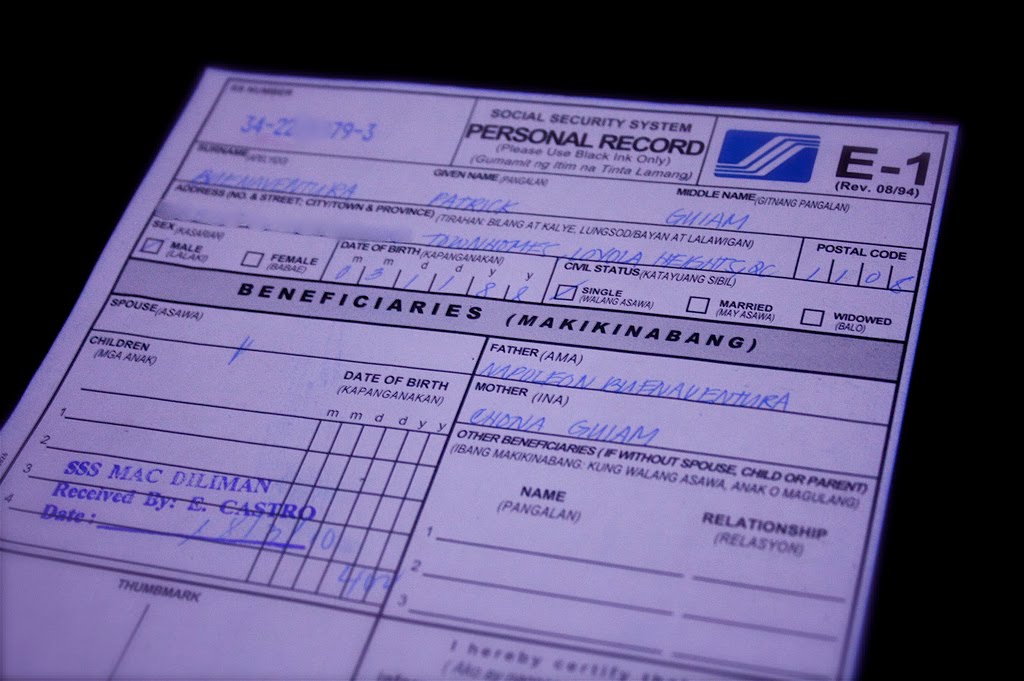

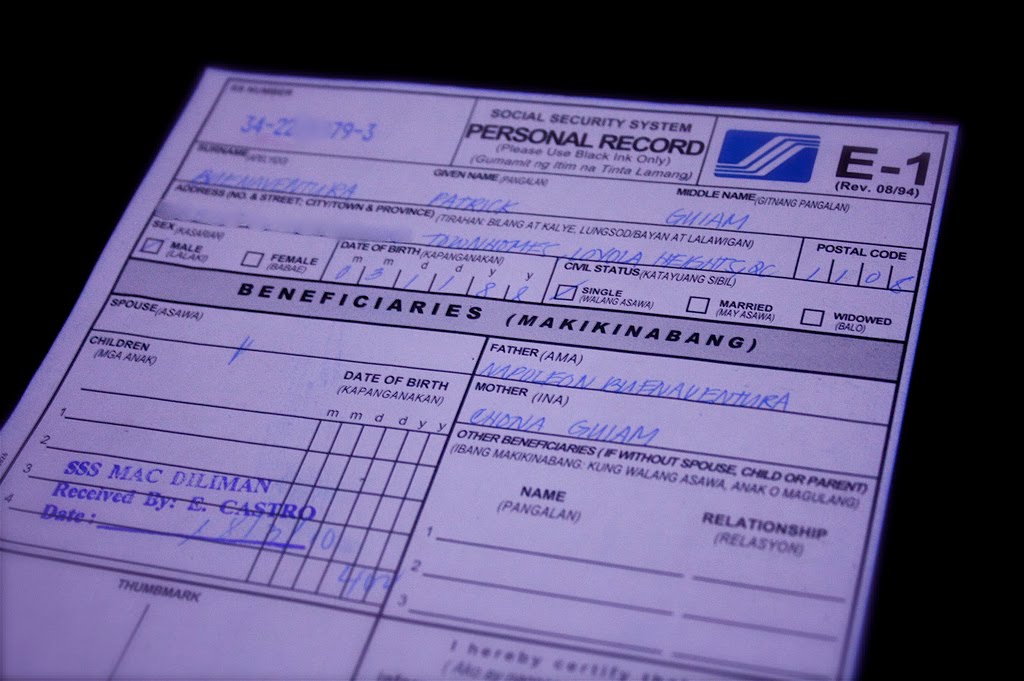

OUR LITTLE CORNERS: Lost Document13 abril 2025

OUR LITTLE CORNERS: Lost Document13 abril 2025 -

Symptom Severity scale (SSS) and Extent of Somatic Symptoms (ESS13 abril 2025

Symptom Severity scale (SSS) and Extent of Somatic Symptoms (ESS13 abril 2025 -

Sss electronics13 abril 2025

-

2023 Used Audi Q5 S line Premium 45 TFSI quattro at13 abril 2025

2023 Used Audi Q5 S line Premium 45 TFSI quattro at13 abril 2025 -

The Good Earth13 abril 2025

The Good Earth13 abril 2025 -

O-I's Texas factory closure disrupts local glass recycling13 abril 2025

O-I's Texas factory closure disrupts local glass recycling13 abril 2025 -

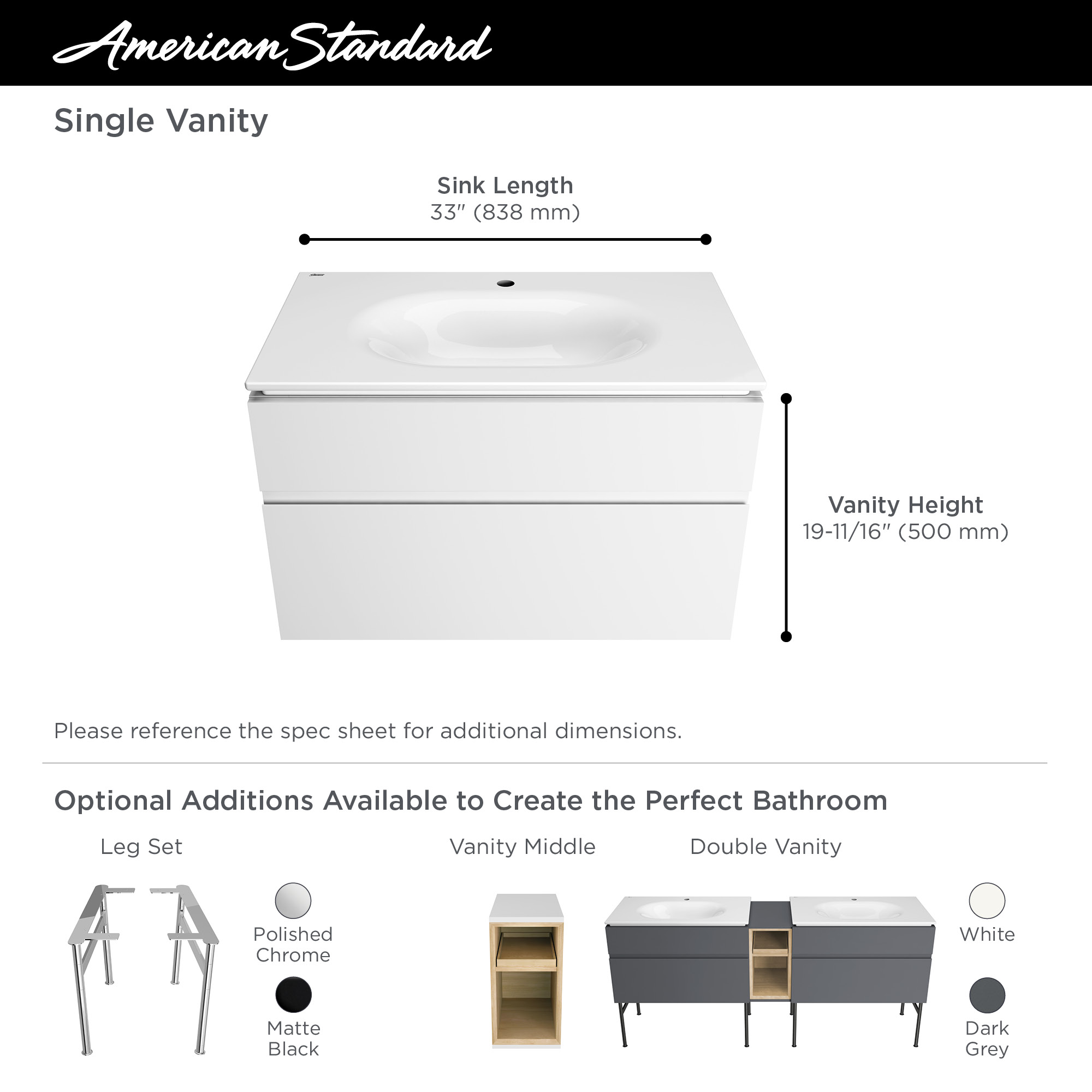

Studio® S 33-Inch Vanity13 abril 2025

Studio® S 33-Inch Vanity13 abril 2025 -

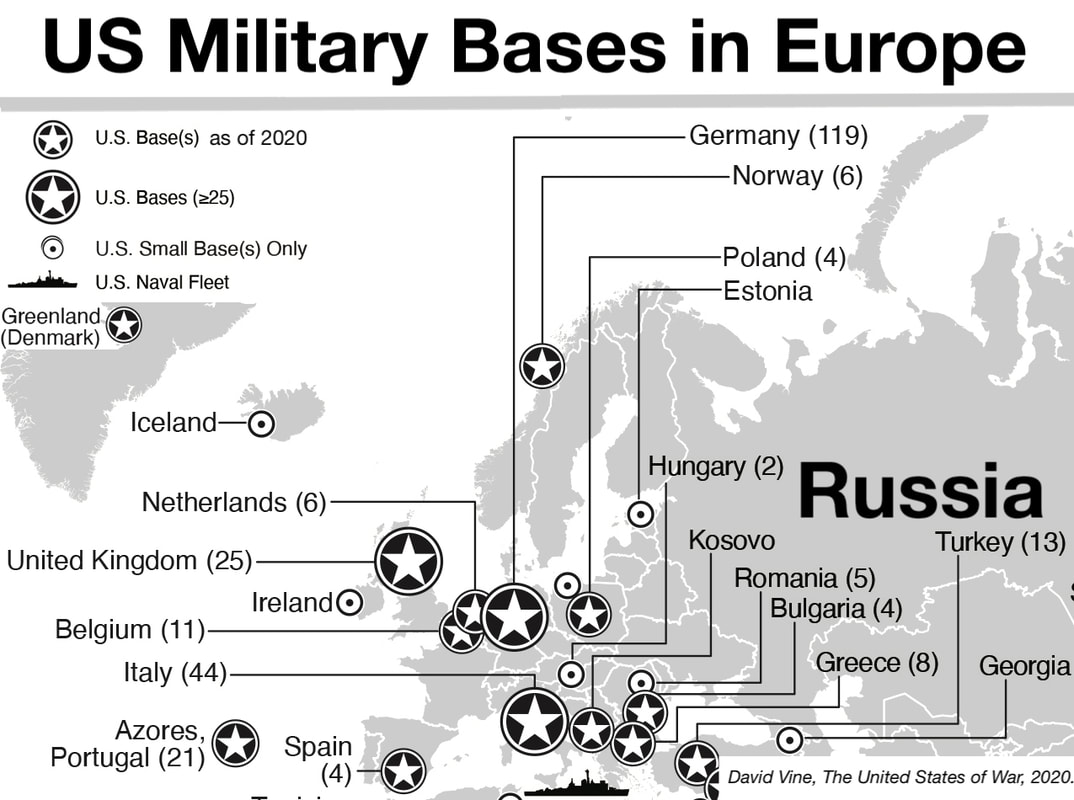

OVERSEAS BASE REALIGNMENT AND CLOSURE COALITION - Overseas Base13 abril 2025

OVERSEAS BASE REALIGNMENT AND CLOSURE COALITION - Overseas Base13 abril 2025

você pode gostar

-

Na terra dos animais falantes de Richard Zimler; Ilustração: Patrícia Figueiredo - Livro - WOOK13 abril 2025

-

Valor - Modelo de Apresentações Google para Negócios Criativos13 abril 2025

Valor - Modelo de Apresentações Google para Negócios Criativos13 abril 2025 -

Barb Stranger Things Shannon Purser Actress Interview13 abril 2025

Barb Stranger Things Shannon Purser Actress Interview13 abril 2025 -

Nacional de tênis: Quali da etapa de Campos do Jordão começa amanhã13 abril 2025

Nacional de tênis: Quali da etapa de Campos do Jordão começa amanhã13 abril 2025 -

Yu-Gi-Oh! 5D's Theme Song Lyrics13 abril 2025

Yu-Gi-Oh! 5D's Theme Song Lyrics13 abril 2025 -

Super Classic Spider Solitaire android iOS apk download for free-TapTap13 abril 2025

Super Classic Spider Solitaire android iOS apk download for free-TapTap13 abril 2025 -

Idiom Worksheets-15 Idioms, Worksheets, Idioms posters13 abril 2025

Idiom Worksheets-15 Idioms, Worksheets, Idioms posters13 abril 2025 -

Mini Caixa De Bambu Porta Joias Anel Colar Brincos Caixas De13 abril 2025

Mini Caixa De Bambu Porta Joias Anel Colar Brincos Caixas De13 abril 2025 -

Walmart Supercenter, 11930 Narcoossee Rd, Orlando, FL, Parking Garages - MapQuest13 abril 2025

Walmart Supercenter, 11930 Narcoossee Rd, Orlando, FL, Parking Garages - MapQuest13 abril 2025 -

F1 Racing - Play on13 abril 2025

F1 Racing - Play on13 abril 2025