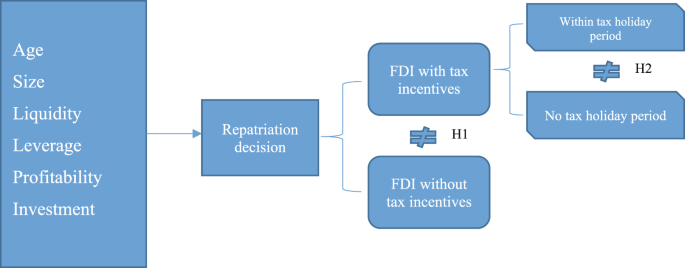

Tax holidays and profit-repatriation rates for FDI firms: the case of the Czech Republic

Por um escritor misterioso

Last updated 15 abril 2025

Skilled Labor Force - FasterCapital

PDF) Net profit flow per country from 1980 to 2009: The long-term

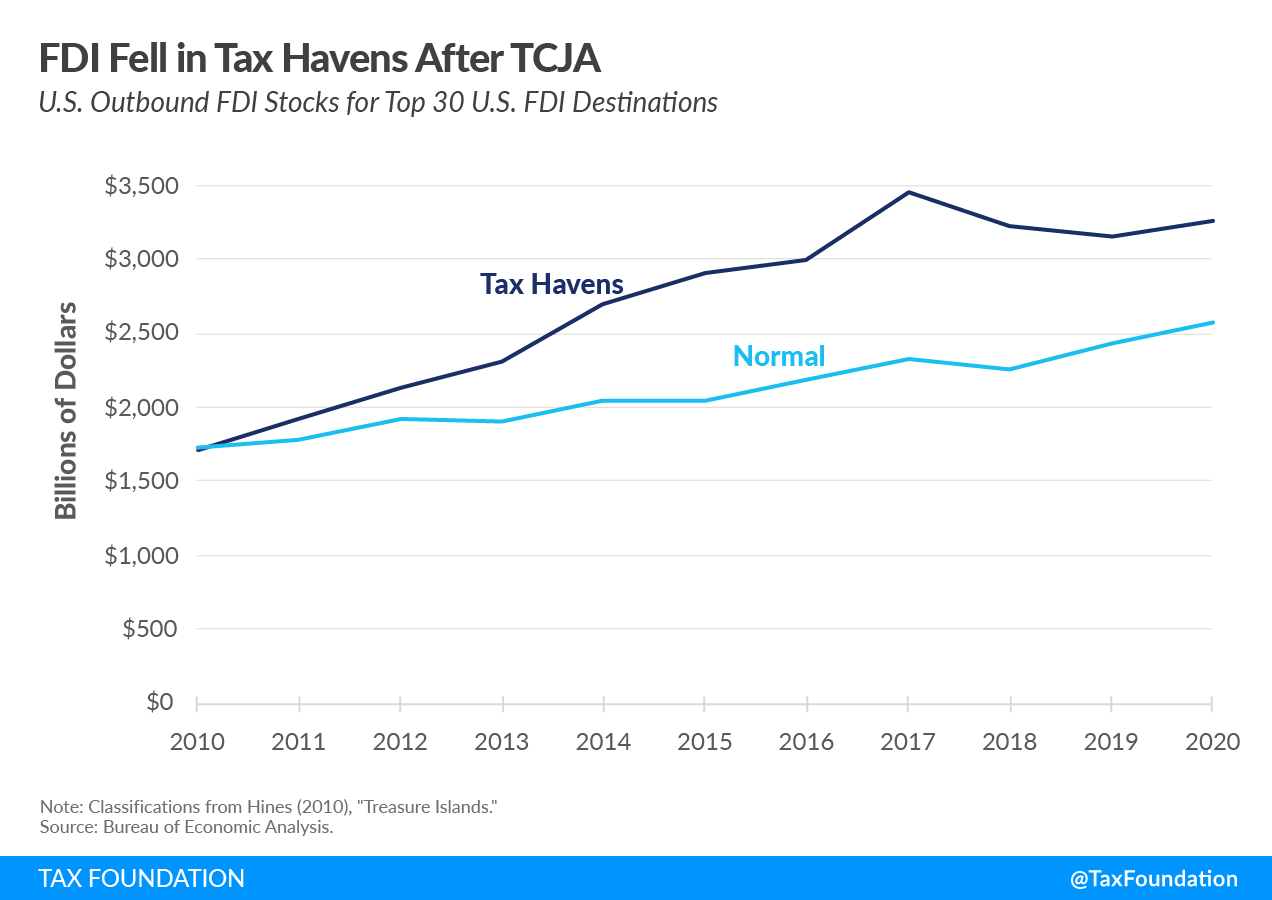

US Tax Data Explorer Taxes in the United States

Ownership chain 3: The interaction effect in the periphery

Doing Business in the Czech Republic 2017 by PP AGENCY - Issuu

Territorial vs. Worldwide Corporate Taxation in: IMF Working

Foreign Direct Investment in New Member State of the EU and

A Global Perspective on Territorial Taxation

Foreign Direct Investment in Southeastern Europe: How (and How

PDF) Does Lowering Dividend Tax Rates Increase Dividends

Recomendado para você

-

God Control – Contabilidade em São Paulo15 abril 2025

God Control – Contabilidade em São Paulo15 abril 2025 -

Peritos em consultoria da J.S. Held são reconhecidos pela Who's Who Legal (WWL)15 abril 2025

Peritos em consultoria da J.S. Held são reconhecidos pela Who's Who Legal (WWL)15 abril 2025 -

Arquivo para Técnico de Contabilidade - Domina Concursos15 abril 2025

Arquivo para Técnico de Contabilidade - Domina Concursos15 abril 2025 -

Ciclo da contabilidade de custos15 abril 2025

Ciclo da contabilidade de custos15 abril 2025 -

Vetores de Aviões De Transporte Entrega No Tempo Contabilidade De Computador Controle E Contabilização De Mercadorias Logística E Entrega Set Coleção Ícones No Plano Esboço Estilo Monocromático Isométrico Vector Símbolo Conservado Em15 abril 2025

Vetores de Aviões De Transporte Entrega No Tempo Contabilidade De Computador Controle E Contabilização De Mercadorias Logística E Entrega Set Coleção Ícones No Plano Esboço Estilo Monocromático Isométrico Vector Símbolo Conservado Em15 abril 2025 -

JK Bet: novo cliente da Control F5 Gaming - Control F515 abril 2025

JK Bet: novo cliente da Control F5 Gaming - Control F515 abril 2025 -

Controle Contabilidade SLZ - Apps on Google Play15 abril 2025

-

Qual o Custo para manter uma empresa aberta ?15 abril 2025

Qual o Custo para manter uma empresa aberta ?15 abril 2025 -

MONTANDO SEU ESCRITÓRIO DE CONTABILIDADE: GUIA PRÁTICO E FÁCIL eBook : CABRAL, ZÉLIO: : Loja Kindle15 abril 2025

MONTANDO SEU ESCRITÓRIO DE CONTABILIDADE: GUIA PRÁTICO E FÁCIL eBook : CABRAL, ZÉLIO: : Loja Kindle15 abril 2025 -

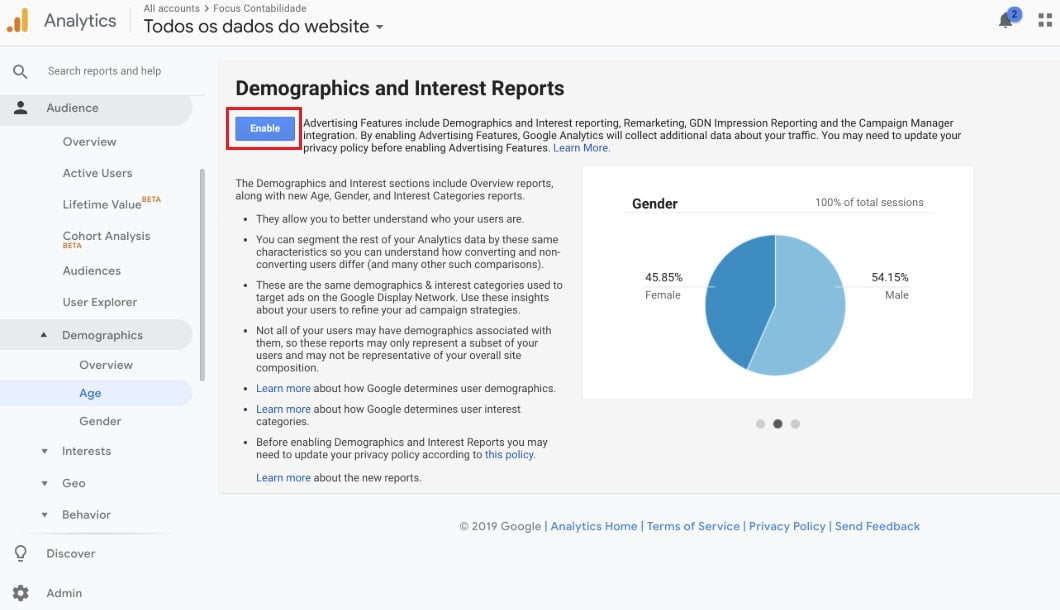

The Google Analytics graphs does not appear. What should I do? - Reportei15 abril 2025

The Google Analytics graphs does not appear. What should I do? - Reportei15 abril 2025

você pode gostar

-

Sponsored Post: The First Naruto Open World 3D Mobile MMORPG Is Revealed In Naruto: Slugfest! - Crunchyroll News15 abril 2025

Sponsored Post: The First Naruto Open World 3D Mobile MMORPG Is Revealed In Naruto: Slugfest! - Crunchyroll News15 abril 2025 -

Disney+ Just Changed Thor: Love and Thunder's Questionable CGI15 abril 2025

Disney+ Just Changed Thor: Love and Thunder's Questionable CGI15 abril 2025 -

king legacy atualizou confira tudo #kinglegacy #kinglegacyfruits #king15 abril 2025

-

Street Fighter s Blanka Bumper Sticker Window Vinyl Decal 5 : Automotive15 abril 2025

Street Fighter s Blanka Bumper Sticker Window Vinyl Decal 5 : Automotive15 abril 2025 -

Berserk The Complete Watch Order 2023, by Bharti Jha15 abril 2025

Berserk The Complete Watch Order 2023, by Bharti Jha15 abril 2025 -

FIFA 23 - AS MELHORES PROMESSAS ESPANHOLAS COM FACE REAL PARA SEU MODO CARREIRA REALISTA!15 abril 2025

FIFA 23 - AS MELHORES PROMESSAS ESPANHOLAS COM FACE REAL PARA SEU MODO CARREIRA REALISTA!15 abril 2025 -

Papa's Burgeria Mod APK v1.2.3 (Unlimited money,Free purchase15 abril 2025

Papa's Burgeria Mod APK v1.2.3 (Unlimited money,Free purchase15 abril 2025 -

eFootball PES 2023 PPSSPP World Cup Qatar English Version Full Update Transfers & Kits + Camera PS515 abril 2025

eFootball PES 2023 PPSSPP World Cup Qatar English Version Full Update Transfers & Kits + Camera PS515 abril 2025 -

Mighty the Armadillo, Sonic Art Assets DVD Wiki15 abril 2025

Mighty the Armadillo, Sonic Art Assets DVD Wiki15 abril 2025 -

Ro on X: D side mighty the armadillo / X15 abril 2025

Ro on X: D side mighty the armadillo / X15 abril 2025