Tax Underpayment Penalty: What It Is, Examples, and How to Avoid One

Por um escritor misterioso

Last updated 01 abril 2025

:max_bytes(150000):strip_icc()/Term-Definitions_Underpayment-penalty-Resized-7d6a14e797ad4b1584b7f659fff3a568.jpg)

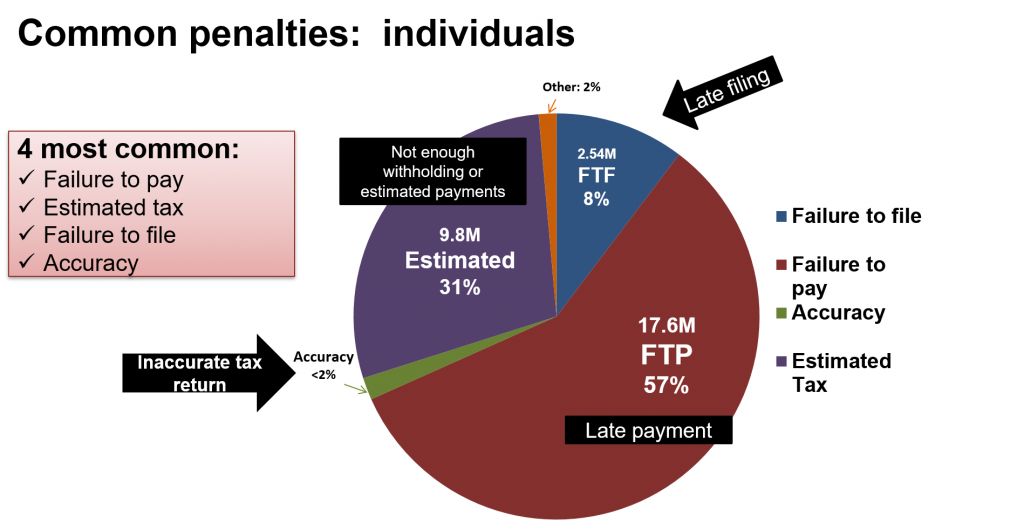

An underpayment penalty is an IRS fee for failing to pay enough of your total tax liability during the year. Here’s how to determine if you owe an underpayment penalty.

Safe harbors and other ways to avoid estimated tax penalties - Don't Mess With Taxes

Estimated Tax Payments Are Due: Four Things You Need to Know

Time Is Running Out To Reduce 2022 Tax Burden Using PTE Payments - U of I Tax School

What are the IRS penalty rates? - IRS Mind

Estimated Tax Penalty: The Correct Way to Make Estimated Tax Payments for 2021

Avoiding Underpayment of Tax Penalty - TaxSlayer®

Underpayment Penalty? Turbo Tax tells me I may owe?

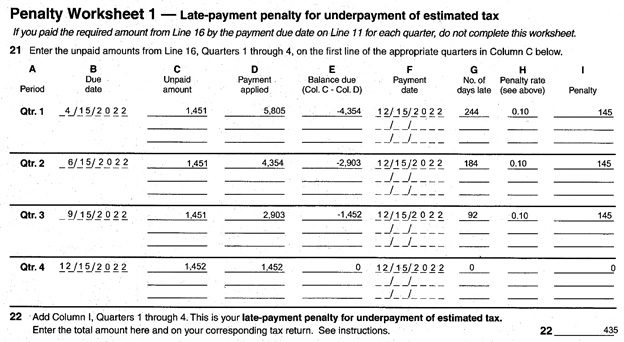

IRS Form 2210 walkthrough (Underpayment of Estimated Tax by Individuals, Estates, and Trusts)

Tax returns 2019: IRS again lowers underpayment penalty after outcry - CBS News

:max_bytes(150000):strip_icc()/irs-pub-433.asp-Final-060f721b11b441b0a4b85b4ec6c6186a.jpg)

IRS Notice 433: Interest and Penalty Information

:max_bytes(150000):strip_icc()/Term-Definitions_Underpayment-penalty-Resized-7d6a14e797ad4b1584b7f659fff3a568.jpg)

Tax Underpayment Penalty: What It Is, Examples, and How to Avoid One

Recomendado para você

-

Penalty Shooters 2 🕹️ Play on CrazyGames01 abril 2025

Penalty Shooters 2 🕹️ Play on CrazyGames01 abril 2025 -

Does a Penalty Shootout Count as a Win?01 abril 2025

Does a Penalty Shootout Count as a Win?01 abril 2025 -

Why the penalty shoot-out was introduced and how it has changed01 abril 2025

Why the penalty shoot-out was introduced and how it has changed01 abril 2025 -

:max_bytes(150000):strip_icc():focal(830x391:832x393)/megan-rapinoe-missed-penalty-080823-1-3467d144959b484d8eb3d7a8a58640cb.jpg) Megan Rapinoe Explains Her Laugh After Missing Penalty Kick in01 abril 2025

Megan Rapinoe Explains Her Laugh After Missing Penalty Kick in01 abril 2025 -

Geir Jordet on X: The penalty shootout in football is the essence01 abril 2025

Geir Jordet on X: The penalty shootout in football is the essence01 abril 2025 -

What is the Panenka? Penalty kick technique, how to do it01 abril 2025

What is the Panenka? Penalty kick technique, how to do it01 abril 2025 -

Penalty Kick Wiz 🕹️ Play on CrazyGames01 abril 2025

-

Pollard's late penalty sends South Africa into World Cup final01 abril 2025

Pollard's late penalty sends South Africa into World Cup final01 abril 2025 -

FIFA Women's World Cup: Chloe Kelly's 111kph match-winning penalty01 abril 2025

FIFA Women's World Cup: Chloe Kelly's 111kph match-winning penalty01 abril 2025 -

/cdn.vox-cdn.com/uploads/chorus_image/image/71652167/999470052.0.jpg) World Cup rules: How extra time, penalty kicks work at 202201 abril 2025

World Cup rules: How extra time, penalty kicks work at 202201 abril 2025

você pode gostar

-

Como combinar cores - Hojemais de Andradina SP01 abril 2025

Como combinar cores - Hojemais de Andradina SP01 abril 2025 -

Womens SCP 173 Peanut Containment Breach Scary V-Neck T-Shirt : Clothing, Shoes & Jewelry01 abril 2025

Womens SCP 173 Peanut Containment Breach Scary V-Neck T-Shirt : Clothing, Shoes & Jewelry01 abril 2025 -

I Heard Jayfeather was the Warrior cat of the week. Here's my Jayfeather design I did not too long ago! : r/WarriorCats01 abril 2025

I Heard Jayfeather was the Warrior cat of the week. Here's my Jayfeather design I did not too long ago! : r/WarriorCats01 abril 2025 -

Palmeiras x Cerro Porteño-PAR: informações, estatísticas e01 abril 2025

Palmeiras x Cerro Porteño-PAR: informações, estatísticas e01 abril 2025 -

![Lilly as majin android 21 by xaviir20 -- Fur Affinity [dot] net](https://t.furaffinity.net/26301949@600-1517947982.jpg) Lilly as majin android 21 by xaviir20 -- Fur Affinity [dot] net01 abril 2025

Lilly as majin android 21 by xaviir20 -- Fur Affinity [dot] net01 abril 2025 -

Foursquare Tops Ten Million Members01 abril 2025

Foursquare Tops Ten Million Members01 abril 2025 -

Skull and Bones: We try out the pirate adventure for ourselves01 abril 2025

Skull and Bones: We try out the pirate adventure for ourselves01 abril 2025 -

The Crew 3 could be called Motorfest and set in Hawaii01 abril 2025

The Crew 3 could be called Motorfest and set in Hawaii01 abril 2025 -

Desenho de carro para colorir para crianças e crianças somente imagem01 abril 2025

Desenho de carro para colorir para crianças e crianças somente imagem01 abril 2025 -

NHL: Cross-Checks01 abril 2025

NHL: Cross-Checks01 abril 2025