The perennial challenge to counter Too-Big-to-Fail in banking: Empirical evidence from the new international regulation dealing with Global Systemically Important Banks - ScienceDirect

Por um escritor misterioso

Last updated 15 abril 2025

The perennial challenge to counter Too-Big-to-Fail in banking: Empirical evidence from the new international regulation dealing with Global Systemically Important Banks - ScienceDirect

IMPLICIT BANK DEBT GUARANTEES: COSTS, BENEFITS AND RISKS - Schich - 2018 - Journal of Economic Surveys - Wiley Online Library

On Becoming an O-SII (“Other Systemically Important Institution”) - ScienceDirect

Dealing with the Challenges of Macro Financial Linkages in Emerging Markets by World Bank Publications - Issuu

Solved 1. Too Big to Fail and banks' ability to create money

The perennial challenge to counter Too-Big-to-Fail in banking: Empirical evidence from the new international regulation dealing with Global Systemically Important Banks - ScienceDirect

The perennial challenge to counter Too-Big-to-Fail in banking: Empirical evidence from the new international regulation dealing with Global Systemically Important Banks - ScienceDirect

PDF) Risk Spillovers and Interconnectedness between Systemically Important Institutions

The perennial challenge to counter Too-Big-to-Fail in banking: Empirical evidence from the new international regulation dealing with Global Systemically Important Banks - ScienceDirect

Evaluation of too-big-to-fail reforms: Lessons for the COVID-19 pandemic

Sustainability March-2 2023 - Browse Articles

Important Gaps Remain In Too Big To Fail Bank Reforms

Recomendado para você

-

Clique aqui para download - Caruana Financeira15 abril 2025

Clique aqui para download - Caruana Financeira15 abril 2025 -

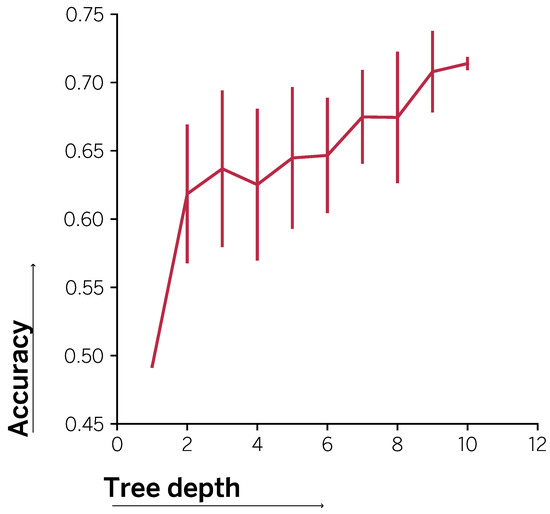

Entropy, Free Full-Text15 abril 2025

Entropy, Free Full-Text15 abril 2025 -

PDF) Quantification of qualitative data: the case of the Central Bank of Armenia15 abril 2025

PDF) Quantification of qualitative data: the case of the Central Bank of Armenia15 abril 2025 -

The Rothschilds of the Mafia on Aruba15 abril 2025

The Rothschilds of the Mafia on Aruba15 abril 2025 -

Full article: The impact of credit shocks on the European labour market15 abril 2025

-

China Banks Rush to Raise Funds After Cash Crunch Spooks Market : r/baba15 abril 2025

China Banks Rush to Raise Funds After Cash Crunch Spooks Market : r/baba15 abril 2025 -

Government Gazette No. 18105 - doi photography competition15 abril 2025

Government Gazette No. 18105 - doi photography competition15 abril 2025 -

Banking reputation and CSR: a stakeholder value approach - Naples15 abril 2025

Banking reputation and CSR: a stakeholder value approach - Naples15 abril 2025 -

Paraguay: Selected Issues in: IMF Staff Country Reports Volume 2019 Issue 112 (2019)15 abril 2025

Paraguay: Selected Issues in: IMF Staff Country Reports Volume 2019 Issue 112 (2019)15 abril 2025 -

PDF) Systemic risk analytics: A data-driven multi-agent financial network (MAFN) approach15 abril 2025

PDF) Systemic risk analytics: A data-driven multi-agent financial network (MAFN) approach15 abril 2025

você pode gostar

-

Here Are The Record Of The Year Nominees At The 2024 GRAMMYs15 abril 2025

-

Best German Handball Game Sound Effects Library15 abril 2025

Best German Handball Game Sound Effects Library15 abril 2025 -

Vikings (season 2) - Wikipedia15 abril 2025

Vikings (season 2) - Wikipedia15 abril 2025 -

GTA 6 trailer announced: Everything we know so far about highly anticipated video game15 abril 2025

GTA 6 trailer announced: Everything we know so far about highly anticipated video game15 abril 2025 -

Quadro decorativo emoldurado Tanjiro Desenho Demon Slayer Arte para quarto sala15 abril 2025

Quadro decorativo emoldurado Tanjiro Desenho Demon Slayer Arte para quarto sala15 abril 2025 -

The FASTEST WAY to GET POINTS in Roblox Funky Friday? (VIP Server Analysis)15 abril 2025

The FASTEST WAY to GET POINTS in Roblox Funky Friday? (VIP Server Analysis)15 abril 2025 -

Pirates of Penzance. Libretto. English - PICRYL - Public Domain Media Search Engine Public Domain Image15 abril 2025

Pirates of Penzance. Libretto. English - PICRYL - Public Domain Media Search Engine Public Domain Image15 abril 2025 -

Genérico Vestido Infantil Azul Longo Princesa Cinderela Daminha Frozen Aniversário Festa Luxo15 abril 2025

Genérico Vestido Infantil Azul Longo Princesa Cinderela Daminha Frozen Aniversário Festa Luxo15 abril 2025 -

Buy State of Decay 2: Juggernaut Edition Cd Key XBOX ONE Europe15 abril 2025

Buy State of Decay 2: Juggernaut Edition Cd Key XBOX ONE Europe15 abril 2025 -

Mickey mouse clubhouse Mickey-s adventures in wonderland end15 abril 2025

Mickey mouse clubhouse Mickey-s adventures in wonderland end15 abril 2025