Tier 1 Capital Ratio: Definition and Formula for Calculation

Por um escritor misterioso

Last updated 17 abril 2025

:max_bytes(150000):strip_icc()/Tier_1_Capital_Ratio_final_v3-057aabaee3b247228bde4b73c66ae9de.png)

The tier 1 capital ratio is the ratio of a bank’s core tier 1 capital—its equity capital and disclosed reserves—to its total risk-weighted assets.

Profitability Ratio, Definition, Formula, & Examples - Video & Lesson Transcript

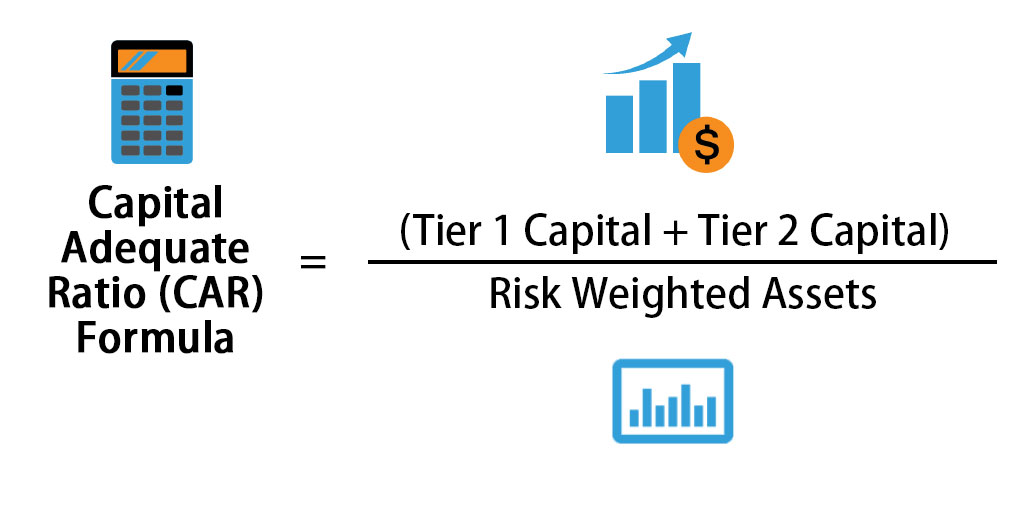

Capital Adequacy Ratio Formula

Optimal capital adequacy ratios for banks - ScienceDirect

Human Capital ROI: Definition, Formula, and Calculation - AIHR

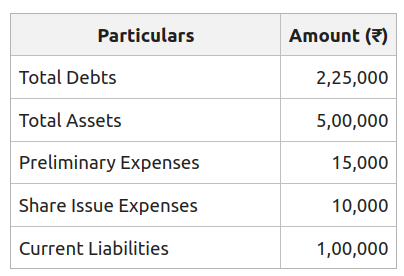

Total Assets to Debt Ratio: Meaning, Formula and Examples - GeeksforGeeks

Regulatory Capital Ratio: How Tier 1 Capital Plays a Vital Role - FasterCapital

What Is the Debt-to-Capital Ratio?

Tier 1 Capital - The Easy Way to See the Strength of a Bank's Balance Sheet

Return on Equity, Formula, Ratio & Examples - Video & Lesson Transcript

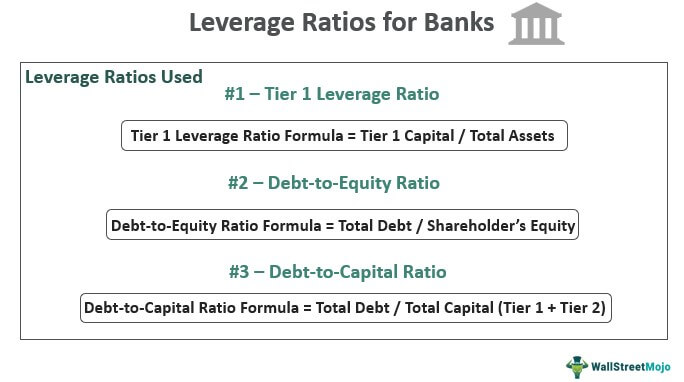

Leverage Ratios for Banks - Definition, Top 3 Leverage Ratios

Capital Adequacy Ratio - What Is It, Formula, Examples, Relevance

Capital Adequacy Ratio Step by Step calculation of CAR with Advantages

Capital adequacy ratio: definition, formula, importance

Recomendado para você

-

Genshin Impact Character Tier List: Best Characters17 abril 2025

Genshin Impact Character Tier List: Best Characters17 abril 2025 -

Zodiac Signs In The Tier List - 6 Top Tier Zodiac Signs17 abril 2025

Zodiac Signs In The Tier List - 6 Top Tier Zodiac Signs17 abril 2025 -

English Expression word with meaning (Top-tier).17 abril 2025

English Expression word with meaning (Top-tier).17 abril 2025 -

Top Tier Showmen17 abril 2025

-

Tier 1, 2, & 3 Suppliers Difference Explained17 abril 2025

-

Top Tier Providence: Secretly Cultivate for a Thousand Years17 abril 2025

Top Tier Providence: Secretly Cultivate for a Thousand Years17 abril 2025 -

TopTier Trader Review (5% Discount Code) - Funded Trading17 abril 2025

TopTier Trader Review (5% Discount Code) - Funded Trading17 abril 2025 -

Tier - Definition, Meaning & Synonyms17 abril 2025

-

Behind the Ballot: The top tier remains the same, but who's No. 117 abril 2025

Behind the Ballot: The top tier remains the same, but who's No. 117 abril 2025 -

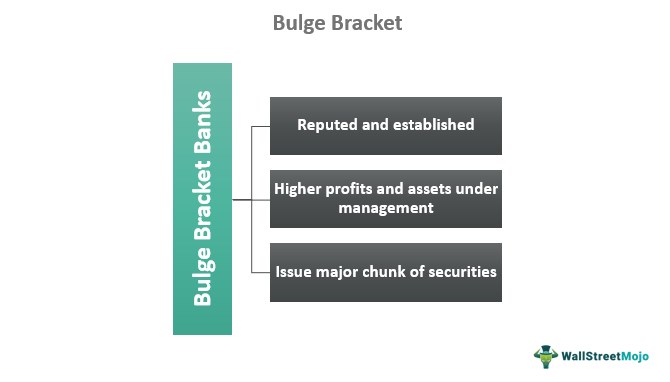

Bulge Bracket - Meaning, Investment Banks, Vs Boutique17 abril 2025

Bulge Bracket - Meaning, Investment Banks, Vs Boutique17 abril 2025

você pode gostar

-

Poster da peça de teatro de Kimetsu no Yaiba17 abril 2025

Poster da peça de teatro de Kimetsu no Yaiba17 abril 2025 -

Kit Bonecos - menino de camiseta com listras – Kiboo Criativos17 abril 2025

Kit Bonecos - menino de camiseta com listras – Kiboo Criativos17 abril 2025 -

Cabo Verde enfrenta hoje Guiné Conacri no primeiro dos três jogos17 abril 2025

Cabo Verde enfrenta hoje Guiné Conacri no primeiro dos três jogos17 abril 2025 -

slither.io Poster for Sale by Finley05517 abril 2025

slither.io Poster for Sale by Finley05517 abril 2025 -

MELHOR MAPA de FLAMENGO NO ROBLOX! 🔴 Centro de Treinamento do Flamengo ⚫17 abril 2025

MELHOR MAPA de FLAMENGO NO ROBLOX! 🔴 Centro de Treinamento do Flamengo ⚫17 abril 2025 -

World's End Harem Fantasia (Shuumatsu no Harem Fantasia) vol.7 - Young Jump Comics (Japanese version)17 abril 2025

World's End Harem Fantasia (Shuumatsu no Harem Fantasia) vol.7 - Young Jump Comics (Japanese version)17 abril 2025 -

James First Name Meaning Art Print-any Name Meaning Art17 abril 2025

James First Name Meaning Art Print-any Name Meaning Art17 abril 2025 -

De volta aos anos 2000? Bleach, Naruto e One Piece voltam a ser17 abril 2025

De volta aos anos 2000? Bleach, Naruto e One Piece voltam a ser17 abril 2025 -

Monkey D. Luffy, Fan Art : r/OnePiece17 abril 2025

Monkey D. Luffy, Fan Art : r/OnePiece17 abril 2025 -

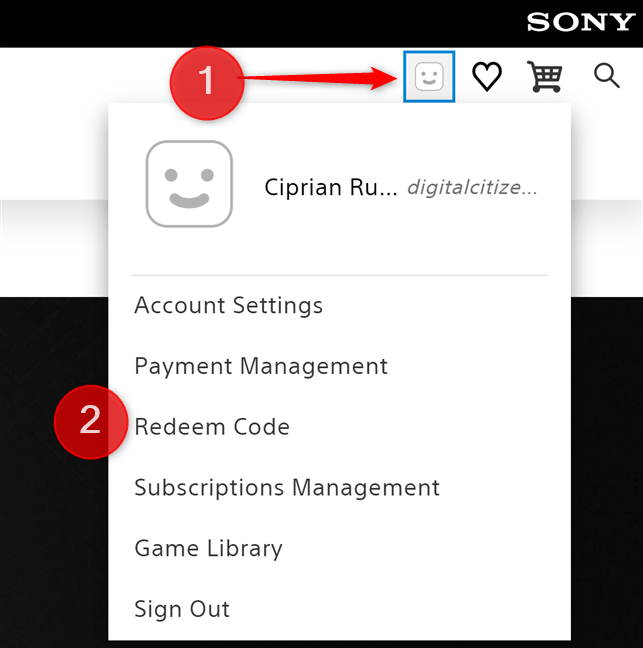

How to buy and redeem PlayStation Gift Cards and games from17 abril 2025

How to buy and redeem PlayStation Gift Cards and games from17 abril 2025