Tie Breaker Rule in Tax Treaties

Por um escritor misterioso

Last updated 03 abril 2025

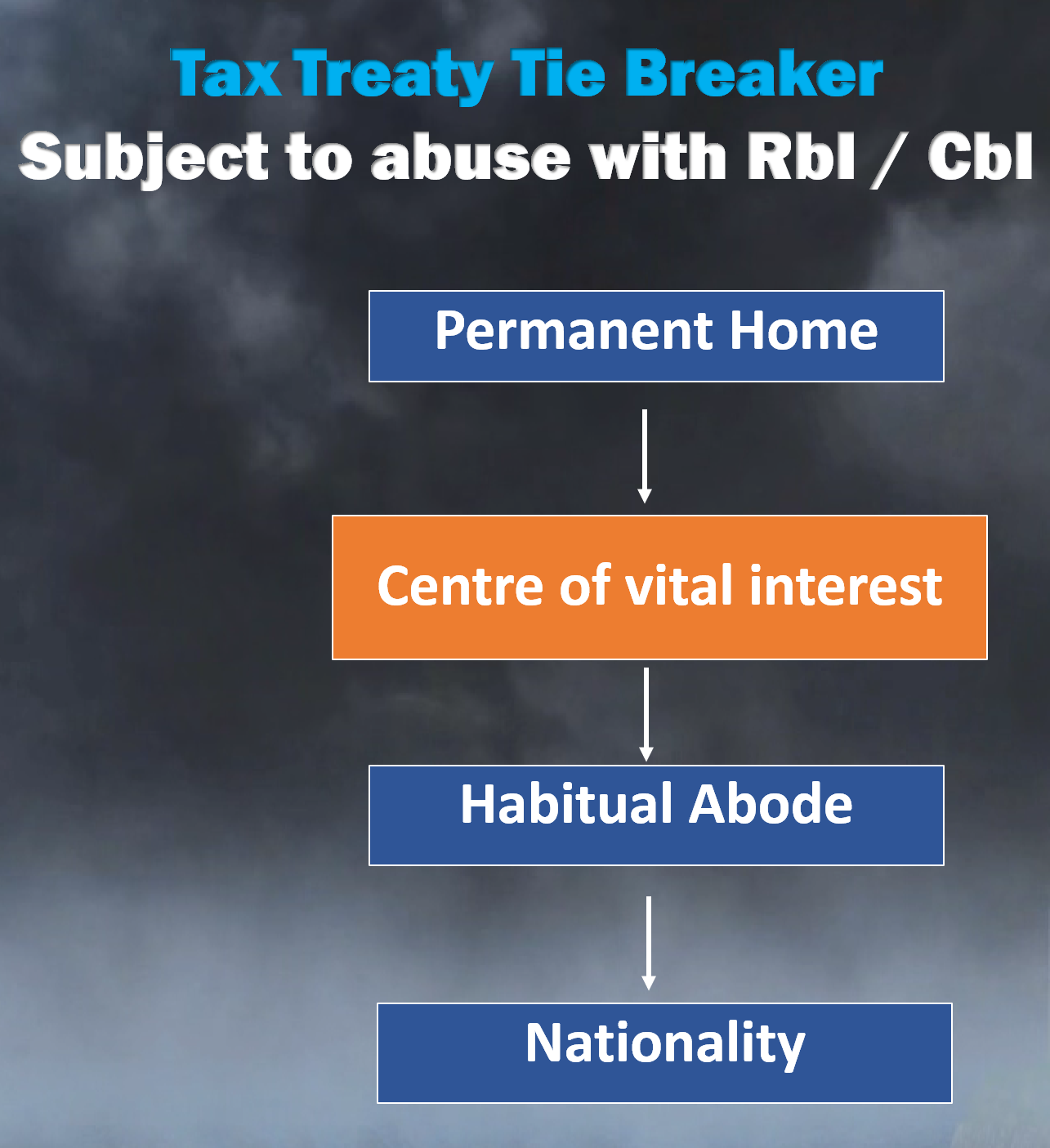

Hello Connections, Let’s briefly discuss the Tie Breaker Rule in Tax Treaties. Tie Breaker Rule are used when an individual becomes resident in both contracting states due to their domestic laws/rules, to determine the residential status of such individual for the purpose of taxability of income.

How To Handle Dual Residents: IRS Tiebreakers

U.S. Tax Issues For Visitors And Work Permit Holders

Dual residence and tax treaties' tie-breaker rules: Can a temporary accommodation amount to habitual abode?

Tie Breaker Rule in Tax Treaties

India - The Dilemma Of Dual Residence – Can Vital Interests Fluctuate Overnight? - Conventus Law

How US citizens and Green Card holders living in India can file tax - The Economic Times

Chapter 8 Are Tax Treaties Worth It for Developing Economies? in: Corporate Income Taxes under Pressure

U.S. Australia Tax Treaty (Guidelines)

Who Gets to Tax You? Tie Breaker Rules in Tax Treaties

Unraveling the United States- People's Republic of China Income Tax Treaty

:max_bytes(150000):strip_icc()/114274370-56a870af3df78cf7729e1a2a.jpg)

IRS Tiebreaker Rules for Claiming Dependents

The Tax Times: LB&I Adds a Practice Unit Determining an Individual's Residency for Treaty Purposes

How To Handle Dual Residents: The I.R.S. View On Treaty Tie-Breaker Rules - - United States

Recomendado para você

-

Tie-Breaker Configurations Download Scientific Diagram03 abril 2025

Tie-Breaker Configurations Download Scientific Diagram03 abril 2025 -

/pic966113.jpg) TieBreaker, Board Game03 abril 2025

TieBreaker, Board Game03 abril 2025 -

Tie Breaker Park - Visit Hopkinsville – Christian County03 abril 2025

Tie Breaker Park - Visit Hopkinsville – Christian County03 abril 2025 -

Rigs on Biz…Relationships, Your Secret Tie Breaker (491 words) - Ed Rigsbee association and membership growth03 abril 2025

Rigs on Biz…Relationships, Your Secret Tie Breaker (491 words) - Ed Rigsbee association and membership growth03 abril 2025 -

Tie Breaker Chalkboard Pregnancy Announcement - Set of 3 Printable Photo Props / Baby Announcement / Chalkboard Signs / Tie Breaker Coming03 abril 2025

Tie Breaker Chalkboard Pregnancy Announcement - Set of 3 Printable Photo Props / Baby Announcement / Chalkboard Signs / Tie Breaker Coming03 abril 2025 -

Tie-Breaker Managers in an LLC Harvard Business Services, Inc.03 abril 2025

Tie-Breaker Managers in an LLC Harvard Business Services, Inc.03 abril 2025 -

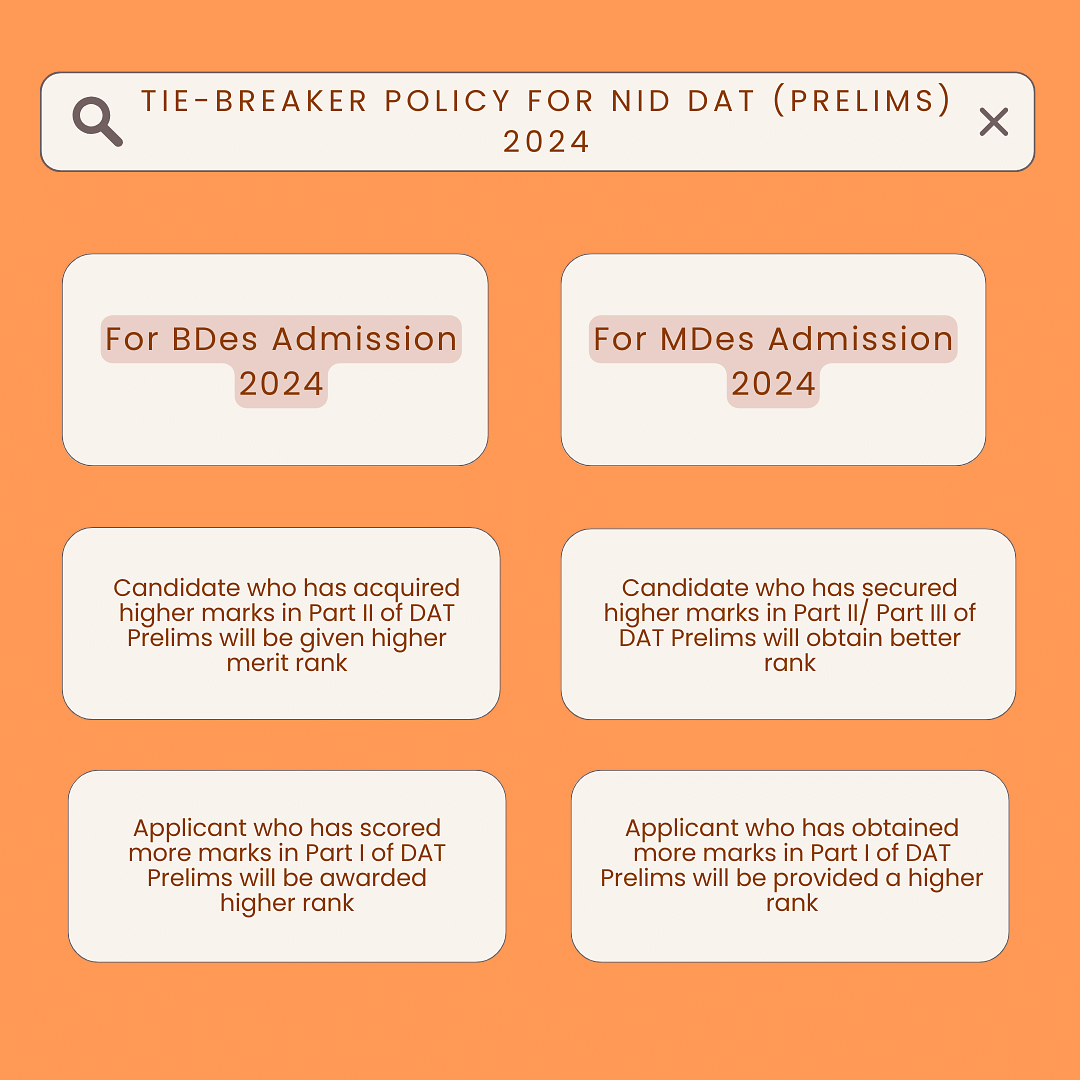

NID 2024 Tie-Breaker Policy03 abril 2025

NID 2024 Tie-Breaker Policy03 abril 2025 -

How Does the Express Entry Tie Breaker Rule Work?03 abril 2025

How Does the Express Entry Tie Breaker Rule Work?03 abril 2025 -

Tie Break (@tiebreaksports) / X03 abril 2025

Tie Break (@tiebreaksports) / X03 abril 2025 -

Tie Breaker Prizm Tungsten Polarized Lenses, Rose Gold Frame Sunglasses03 abril 2025

Tie Breaker Prizm Tungsten Polarized Lenses, Rose Gold Frame Sunglasses03 abril 2025

você pode gostar

-

Boneco Dragon Ball Z Goku Super Saiyajin Power 20cm - Sacks Center03 abril 2025

Boneco Dragon Ball Z Goku Super Saiyajin Power 20cm - Sacks Center03 abril 2025 -

Capacidade pulmonar, Grand Theft Auto Wiki03 abril 2025

Capacidade pulmonar, Grand Theft Auto Wiki03 abril 2025 -

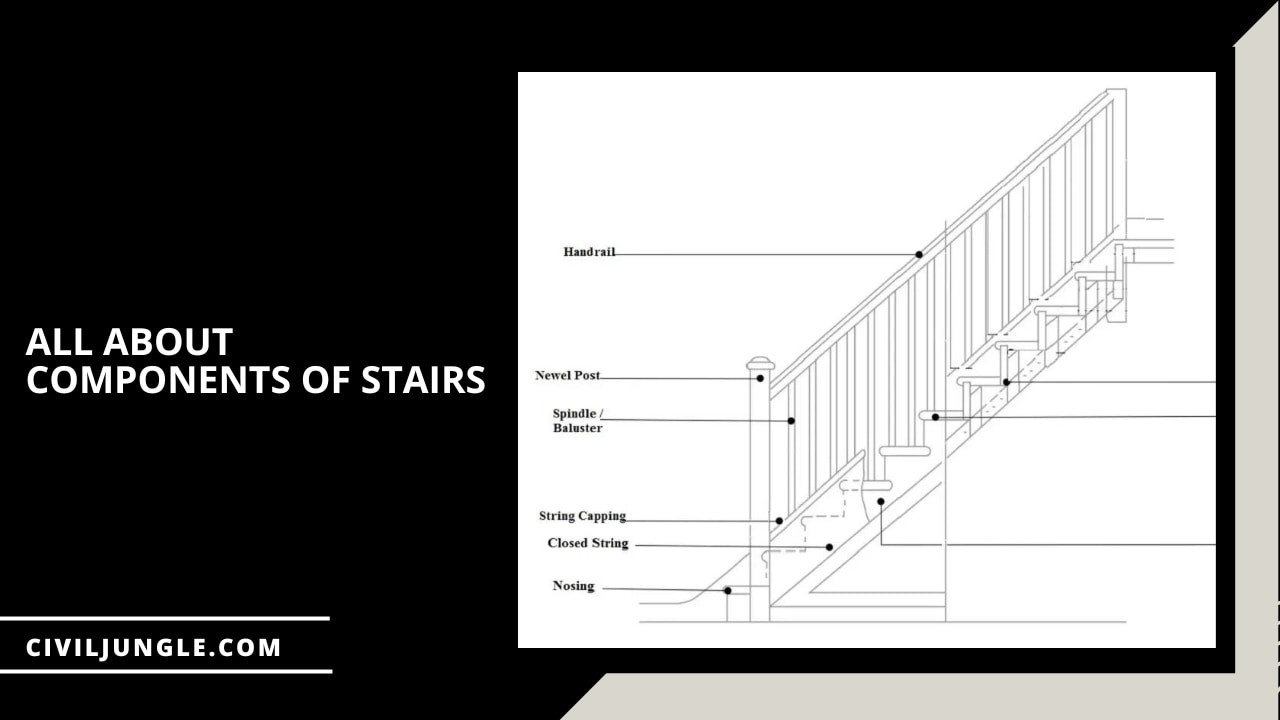

What Are the Components of Stairs?03 abril 2025

-

PS4 gets its own preview program03 abril 2025

PS4 gets its own preview program03 abril 2025 -

We Escaped The NEW LEVELS of The VR Backrooms (Noclip VR Update)03 abril 2025

We Escaped The NEW LEVELS of The VR Backrooms (Noclip VR Update)03 abril 2025 -

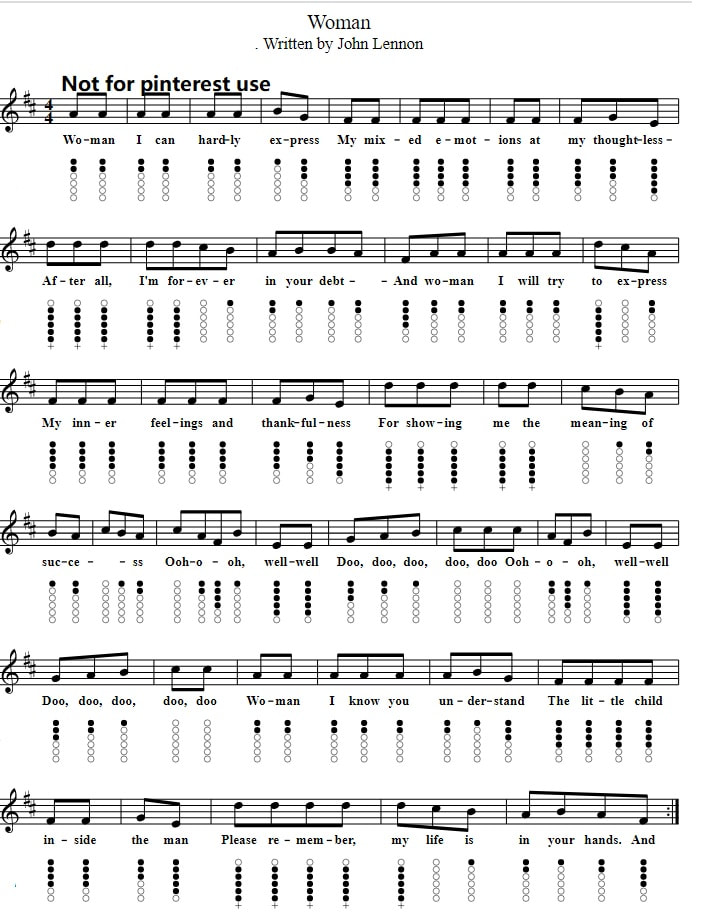

Woman John Lennon Tin Whistle Sheet Music Tab - Irish folk songs03 abril 2025

Woman John Lennon Tin Whistle Sheet Music Tab - Irish folk songs03 abril 2025 -

Vara de aço inoxidável do espeto do churrasco de 50 pces, espetos reutilizáveis do ferro do kebab para o piquenique de acampamento03 abril 2025

Vara de aço inoxidável do espeto do churrasco de 50 pces, espetos reutilizáveis do ferro do kebab para o piquenique de acampamento03 abril 2025 -

Hey Castlevania Fans, excited to share publisher Merge Games and03 abril 2025

-

Jotaro falando: STAR PLATINUM, ZA WARUDO03 abril 2025

Jotaro falando: STAR PLATINUM, ZA WARUDO03 abril 2025 -

WDN - World Dubbing News on X: 👨🏫 Novos dubladores juntam-se03 abril 2025

WDN - World Dubbing News on X: 👨🏫 Novos dubladores juntam-se03 abril 2025