Overview of FICA Tax- Medicare & Social Security

Por um escritor misterioso

Last updated 28 março 2025

FICA represents the Federal Insurance Contributions Act, and it's a government tax that businesses and workers pay. FICA Taxes are the fundamental subsidizing focal point for Social Security benefits.

Keyword:current fica tax rate - FasterCapital

Historical Social Security and FICA Tax Rates for a Family of Four

Overview of FICA Tax- Medicare & Social Security

Maximum Taxable Income Amount For Social Security Tax (FICA)

How to Pay Social Security and Medicare Taxes: 10 Steps

What are FICA Taxes? 2022-2023 Rates and Instructions

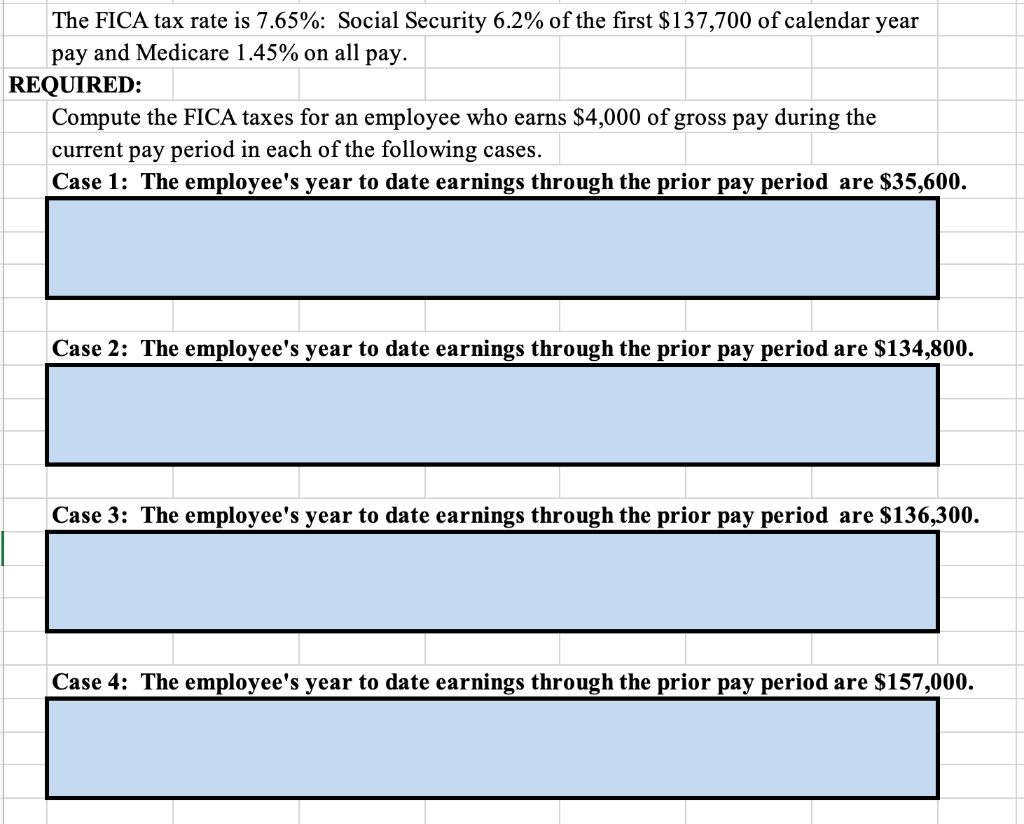

Solved The FICA tax rate is 7.65%: Social Security 6.2% of

Federal Insurance Contributions Act - Wikipedia

Social Security Administration's Master Earnings File: Background

2024 Social Security Wage Base

What Are FICA Taxes? – Forbes Advisor

2019 Payroll Tax Updates: Social Security Wage Base, Medicare

Recomendado para você

-

:max_bytes(150000):strip_icc()/fica-taxes-social-security-and-medicare-taxes-398257_FINAL-5bbd10af46e0fb00266df9ec-b3794e561e094118ad5b5ed3c6898880.png) Learn About FICA, Social Security, and Medicare Taxes28 março 2025

Learn About FICA, Social Security, and Medicare Taxes28 março 2025 -

2023 FICA Tax Limits and Rates (How it Affects You)28 março 2025

2023 FICA Tax Limits and Rates (How it Affects You)28 março 2025 -

FICA Refund: How to claim it on your 1040 Tax Return?28 março 2025

FICA Refund: How to claim it on your 1040 Tax Return?28 março 2025 -

Do You Have To Pay Tax On Your Social Security Benefits?28 março 2025

Do You Have To Pay Tax On Your Social Security Benefits?28 março 2025 -

What is FICA tax? Are you struggling to understand what the FICA tax is and if you need to pay it as a small business owner? Check out this video, and28 março 2025

-

What Are FICA Taxes And Why Do They Matter? - Quikaid28 março 2025

What Are FICA Taxes And Why Do They Matter? - Quikaid28 março 2025 -

How Do I Get a FICA Tax Refund for F1 Students?28 março 2025

How Do I Get a FICA Tax Refund for F1 Students?28 março 2025 -

How to get your FICA tax REFUND?, Form 843 & Form 8316, F1 Student, International Student28 março 2025

How to get your FICA tax REFUND?, Form 843 & Form 8316, F1 Student, International Student28 março 2025 -

What Is FICA Tax, Understanding Payroll Tax Requirements28 março 2025

What Is FICA Tax, Understanding Payroll Tax Requirements28 março 2025 -

Keyword:current fica tax rate - FasterCapital28 março 2025

Keyword:current fica tax rate - FasterCapital28 março 2025

você pode gostar

-

Tesco Extra: The UK's first 'Big Tesco' was built in Essex and there's nowhere else like it - Essex Live28 março 2025

Tesco Extra: The UK's first 'Big Tesco' was built in Essex and there's nowhere else like it - Essex Live28 março 2025 -

Carros Rebaixados e Som Exempl - Apps on Google Play28 março 2025

-

49 Technoblade, never dies ideas minecraft rs, dream team28 março 2025

49 Technoblade, never dies ideas minecraft rs, dream team28 março 2025 -

Pizzaria e Pastelaria Donatello - Pizzaria em Jardim Ivana28 março 2025

-

Kimi Wa Natsu No Naka Manga Online Free - Manganelo28 março 2025

Kimi Wa Natsu No Naka Manga Online Free - Manganelo28 março 2025 -

Gochuumon wa Usagi Desu ka (Is The Order A Rabbit?) Image #1780496 - Zerochan28 março 2025

Gochuumon wa Usagi Desu ka (Is The Order A Rabbit?) Image #1780496 - Zerochan28 março 2025 -

Street Fighter 6 mod lets Pokemon fans play as Mewtwo - Dexerto28 março 2025

Street Fighter 6 mod lets Pokemon fans play as Mewtwo - Dexerto28 março 2025 -

Caixa Bob Completa com Sub de 12 , Pode Ser Usada Como Residencial28 março 2025

-

Trailer de Somali and the Forest Spirit28 março 2025

Trailer de Somali and the Forest Spirit28 março 2025 -

PlayStation 3 - LEGO Dimensions - Sonic the Hedgehog - The Models Resource28 março 2025

PlayStation 3 - LEGO Dimensions - Sonic the Hedgehog - The Models Resource28 março 2025