Enterprise Risk Management and Performance Improvement: A Study with Brazilian Nonfinancial Firms

Por um escritor misterioso

Last updated 15 abril 2025

25)

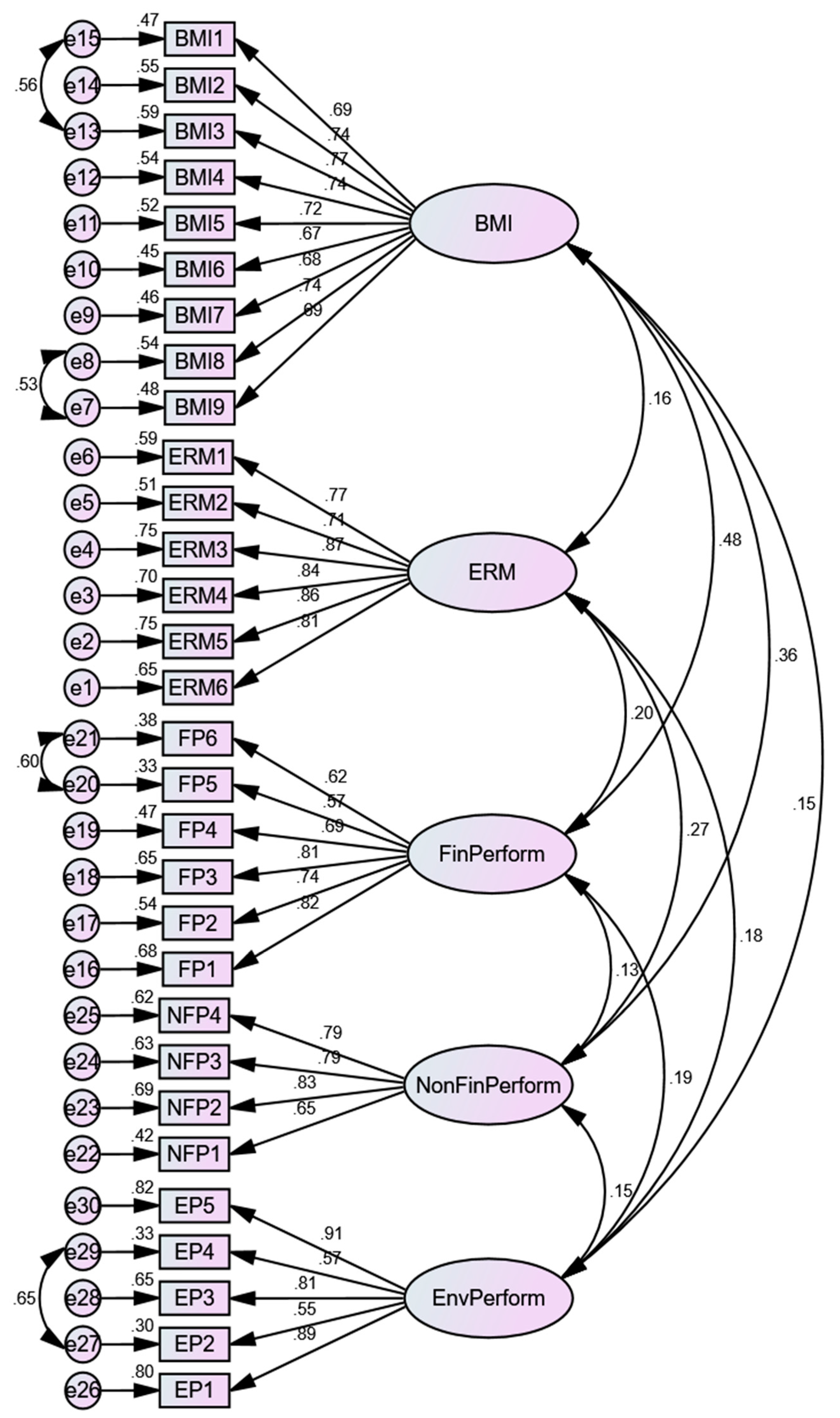

Purpose – This research aimed to study the relationship between Enterprise Risk Management (ERM) and performance improvement.Design/methodology/approach – A questionnaire was used as an instrument of data collection that was passed to managers of nonfinancial companies listed among the 500 largest and best firms in Brazil. The data from this study were analyzed with descriptive statistics and multivariate analysis of correlation and association.Findings – The results showed that the main drivers of risk management were regulation, stakeholder demands, and business competitiveness. Among the practices that have been used, managers spotlight the utility of basic methods, more subjective, while technical methods, more quantitative, were of secondary importance. It was evidenced that the risks were weighted in the main activities of the organization. As a result, it was demonstrated that improved performance is associated with the maturity level of risk management and the level of stakeholders’ involvement in risk management.Research limitations/implications – Other researches could examine how this process was developed in other countries and expand the number of organizations studied.Practical implications – This study provides empirical evidence about theorist assumptions about the relationship between ERM and performance improvement.Social implications – This study demonstrates the importance of human aspects for the processes of risk management and how external factors can influence this process.Originality/value – It gives a broader and deeper comprehension of the process of risk management at nonfinancial firms in Brazil.

PDF) Enterprise Risk Management and Corporate Performance in Nigerian Non-Financial Quoted Companies

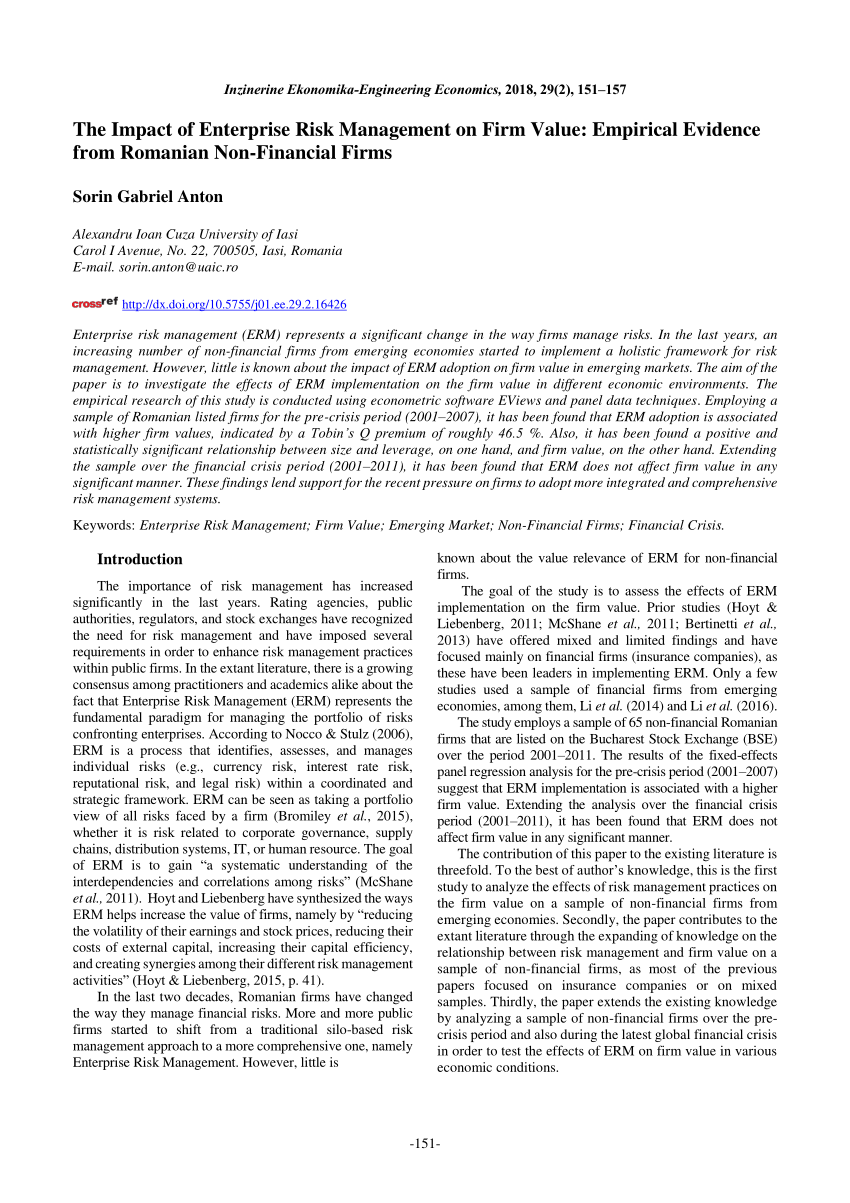

PDF) The Impact of Enterprise Risk Management on Firm Value: Empirical Evidence from Romanian Non-financial Firms

HR Plays a Pivotal Role as People Risks Become Business Risks

September 2023 financial reporting, governance, and risk management

PDF] Review of Literature: Implementation of Enterprise Risk Management into Higher Education

Analyzing Banking Risk (Fourth Edition) by World Bank Publications - Issuu

Here's why bowties and barrier management improve risk management

PDF) Does enterprise risk management influence market value – A long-term perspective

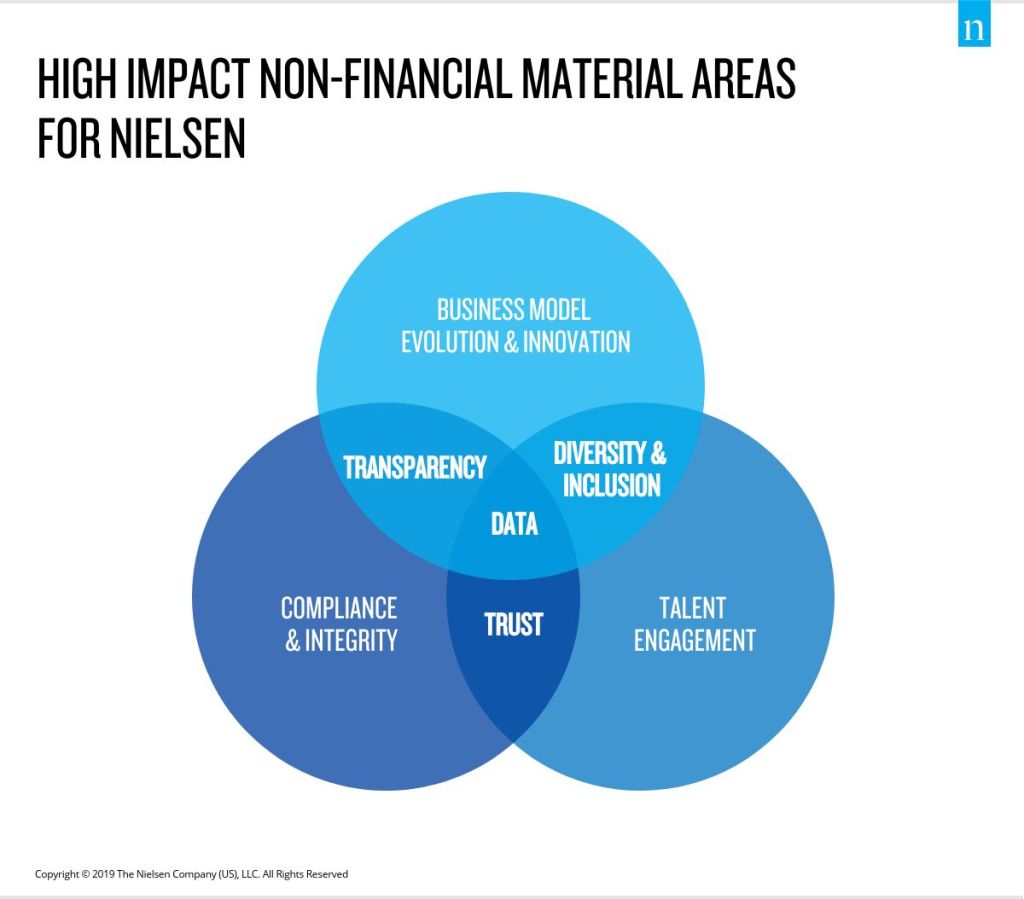

2019-2020 Nielsen Non-financial Materiality Assessment

Non-Financial Risks Reshape Banks' Credit Portfolios

JRFM, Free Full-Text

Risk Management Software from Enablon

How new COSO guidance will help with internal control over ESG reporting

Recomendado para você

-

TIME CONTROL CONTABILIDADE15 abril 2025

-

Time Control Contabilidade15 abril 2025

-

Time Control Contabilidade - O trabalho em equipe é essencial para conquistar melhores resultados! 🏆💙 ⠀⠀⠀⠀⠀⠀⠀⠀⠀ #familiaazul #timecontrol #conduzimosprojetosdevida #timeazul #contabilidade #TC202115 abril 2025

-

Control Contábil - Apps on Google Play15 abril 2025

-

Qual a importância da segurança da informação na contabilidade? - Gnaritas15 abril 2025

Qual a importância da segurança da informação na contabilidade? - Gnaritas15 abril 2025 -

Just-In-Time Privilege Elevation15 abril 2025

Just-In-Time Privilege Elevation15 abril 2025 -

Contabilidade Online, Abrir Empresa Grátis15 abril 2025

Contabilidade Online, Abrir Empresa Grátis15 abril 2025 -

Descomplicando paginação no GAE. “The purpose of software engineering is…, by Roberto Elero Junior15 abril 2025

Descomplicando paginação no GAE. “The purpose of software engineering is…, by Roberto Elero Junior15 abril 2025 -

Digital Leaders Spotlight: Portal Mais Transparência, Portugal15 abril 2025

Digital Leaders Spotlight: Portal Mais Transparência, Portugal15 abril 2025 -

CONTABILIDADE ESPECIALIZADA EM PROGRAMADOR E DESENVOLVEDOR15 abril 2025

CONTABILIDADE ESPECIALIZADA EM PROGRAMADOR E DESENVOLVEDOR15 abril 2025

você pode gostar

-

Day 1 - song and lyrics by Red Velvet15 abril 2025

-

You Can Now Emulate PS4 Games On PC15 abril 2025

You Can Now Emulate PS4 Games On PC15 abril 2025 -

Shinobi Master Senran Kagura: New Link [ English Community15 abril 2025

-

56 fotos de stock e banco de imagens de Mandrake Flower - Getty Images15 abril 2025

56 fotos de stock e banco de imagens de Mandrake Flower - Getty Images15 abril 2025 -

4-Player Chess Set, Shop Today. Get it Tomorrow!15 abril 2025

4-Player Chess Set, Shop Today. Get it Tomorrow!15 abril 2025 -

roblox avatar en 202315 abril 2025

roblox avatar en 202315 abril 2025 -

Isekai Ojisan – 07 – Power Trip – RABUJOI – An Anime Blog15 abril 2025

Isekai Ojisan – 07 – Power Trip – RABUJOI – An Anime Blog15 abril 2025 -

Here is a list of the version exclusives in Scarlet and Violet, aside from some of the paradox Pokemon - iFunny Brazil15 abril 2025

Here is a list of the version exclusives in Scarlet and Violet, aside from some of the paradox Pokemon - iFunny Brazil15 abril 2025 -

![IgorsLab] NVIDIA Reflex and NVIDIA Boost in practice test: Skill enhancer or marketing - What remains of the promise? : r/nvidia](https://external-preview.redd.it/sz3ZQoix38TQ4xYz-DwFxT8vQjsfrNON8_KCiko5AYY.jpg?width=640&crop=smart&auto=webp&s=2221564f90968b303b1bbb7f0f09c88f61731dae) IgorsLab] NVIDIA Reflex and NVIDIA Boost in practice test: Skill enhancer or marketing - What remains of the promise? : r/nvidia15 abril 2025

IgorsLab] NVIDIA Reflex and NVIDIA Boost in practice test: Skill enhancer or marketing - What remains of the promise? : r/nvidia15 abril 2025 -

Watch Jedi Junkies15 abril 2025

Watch Jedi Junkies15 abril 2025