Breaking Down The Impact Of UK's Value Added Tax On Sellers

Por um escritor misterioso

Last updated 03 abril 2025

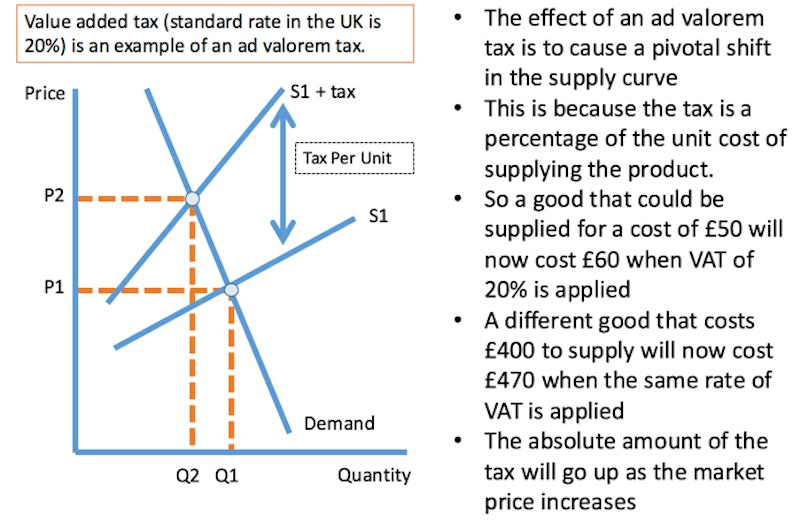

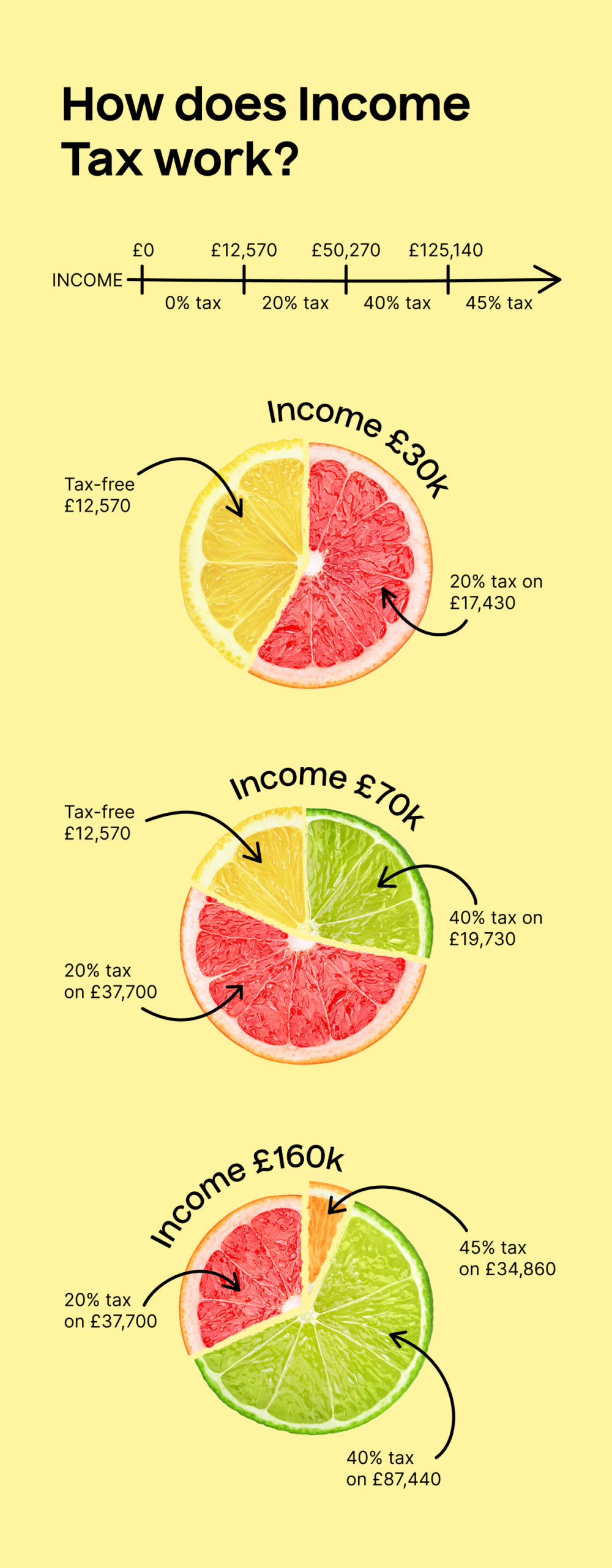

recently announced that sellers on its U.K. platform will be required to pay a 20% value-added tax on fees paid to the company beginning August this year. The new VAT is applicable to sellers that have annual turnover (sum total of all goods sold through the website) in excess of £85,000.

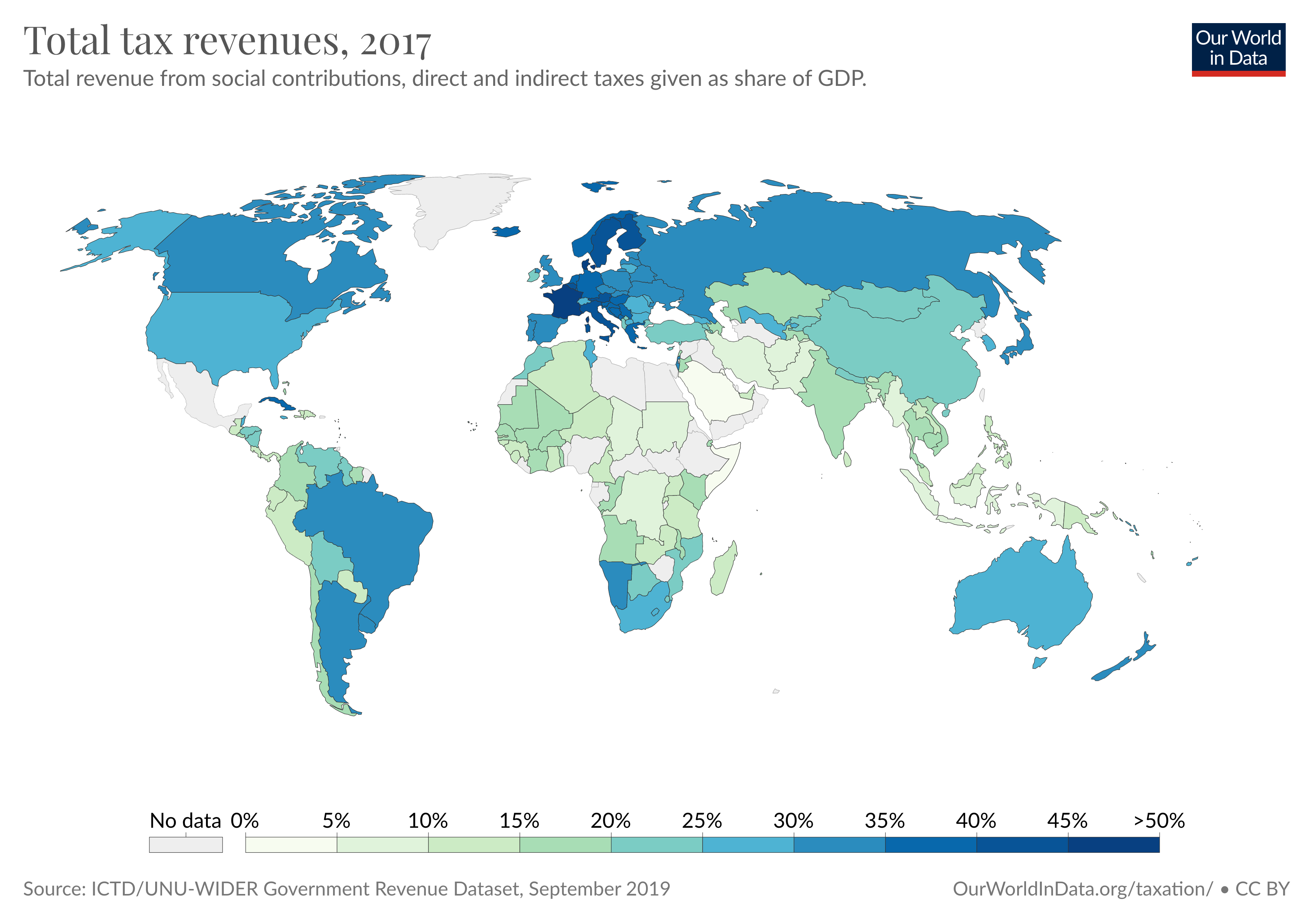

Taxation - Our World in Data

Taxation in the United States - Wikipedia

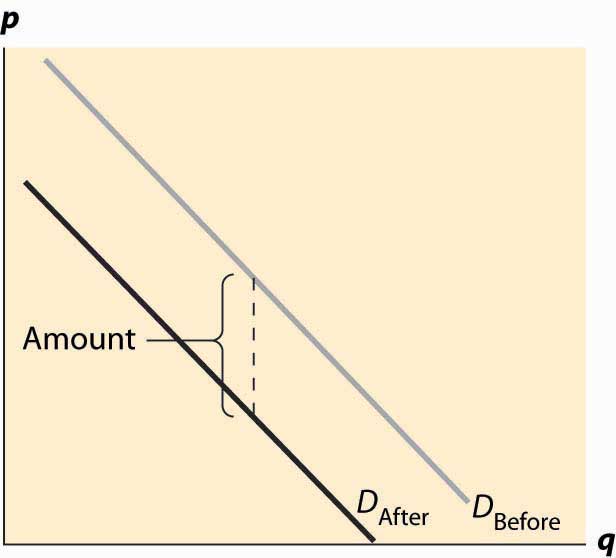

Effects of Taxes

The Value Added Tax in the United Kingdom

:max_bytes(150000):strip_icc()/GoodsandServicesTax-36b9fbf71b1048a8ad617e0318af9c6b.jpg)

What Are Some Examples of a Value-Added Tax (VAT)?

Business Tax in the UK: Everything You Need to Know - NerdWallet UK

Micro and Macro Effects of Higher VAT (Edexcel 25 Mark Question), Economics

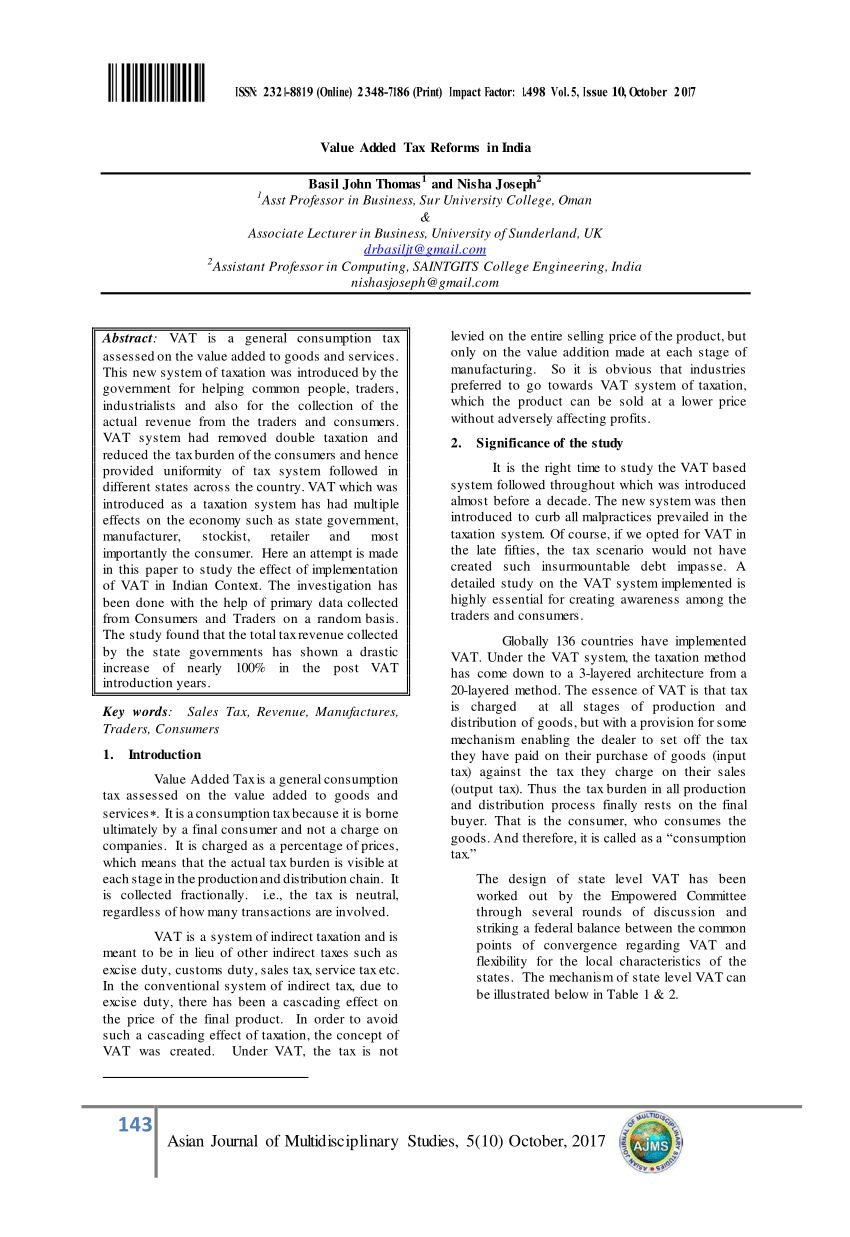

PDF) Value Added Tax Reforms

What tax do you pay if you sell on ? – TaxScouts

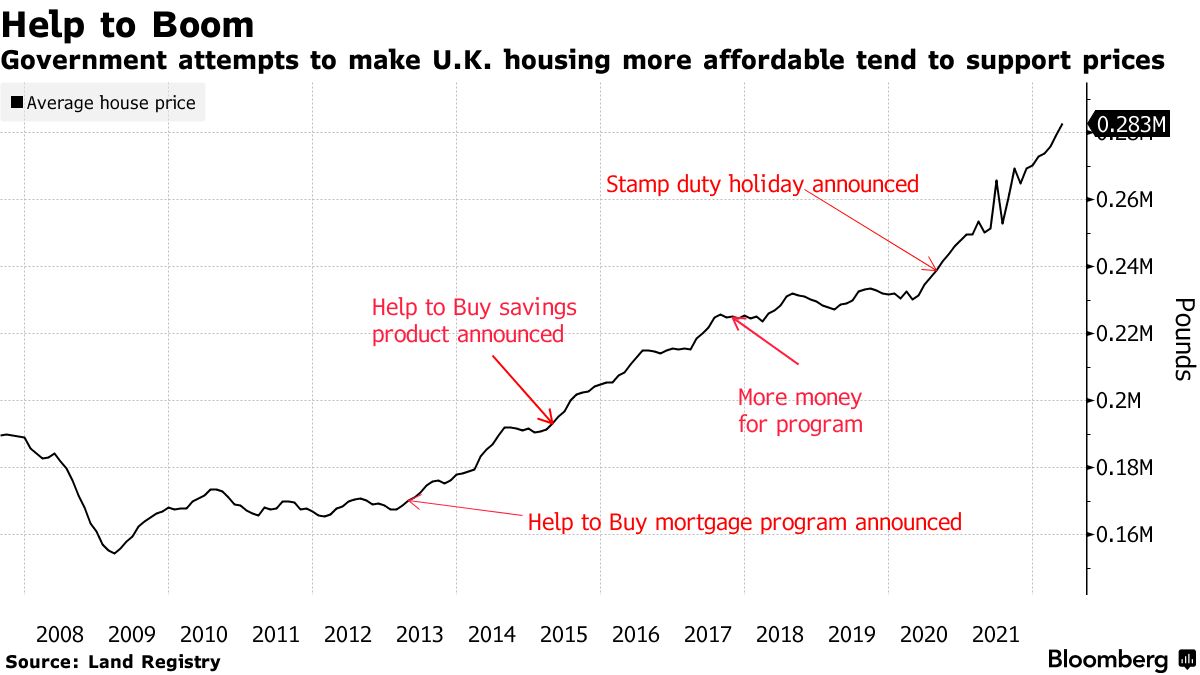

Stamp Duty Cut: UK Lowers Property Tax With Biggest Relief for First-Time Buyers - Bloomberg

What is the difference between sales tax and VAT?

Effects of Taxes

Recomendado para você

-

Open UK 2023 - Coming to Manchester and London03 abril 2025

Open UK 2023 - Coming to Manchester and London03 abril 2025 -

UK (@_UK) / X03 abril 2025

UK (@_UK) / X03 abril 2025 -

Online Selling - ECommerce - ASCOM03 abril 2025

Online Selling - ECommerce - ASCOM03 abril 2025 -

Automatically importing Orders03 abril 2025

Automatically importing Orders03 abril 2025 -

.co.uk03 abril 2025

-

Seller Update - Fee Changes - ChannelX03 abril 2025

Seller Update - Fee Changes - ChannelX03 abril 2025 -

Dropshipping UK, Complete Updated Guide03 abril 2025

Dropshipping UK, Complete Updated Guide03 abril 2025 -

7 Best UK Online Vouchers, Discount Codes - Dec 2023 - Honey03 abril 2025

7 Best UK Online Vouchers, Discount Codes - Dec 2023 - Honey03 abril 2025 -

Christmas Cashback Discounts, Offers & Deals03 abril 2025

Christmas Cashback Discounts, Offers & Deals03 abril 2025 -

The Ultimate Guide to VAT (For US, UK, EU Sellers) - A2X03 abril 2025

The Ultimate Guide to VAT (For US, UK, EU Sellers) - A2X03 abril 2025

você pode gostar

-

Jojo's Bizarre Adventure Part 6 - STONE OCEAN - STONE OCEAN (Opening Theme) by Kyle Xian03 abril 2025

Jojo's Bizarre Adventure Part 6 - STONE OCEAN - STONE OCEAN (Opening Theme) by Kyle Xian03 abril 2025 -

Xadrez Star WARS - Planeta Agostini Montijo • OLX Portugal03 abril 2025

-

Revista Fecomércio PR - nº 92 by Federação do Comércio de Bens, Serviços e Turismo do Paraná - Issuu03 abril 2025

Revista Fecomércio PR - nº 92 by Federação do Comércio de Bens, Serviços e Turismo do Paraná - Issuu03 abril 2025 -

Gabby's Dollhouse (TV Series 2021– ) - IMDb03 abril 2025

Gabby's Dollhouse (TV Series 2021– ) - IMDb03 abril 2025 -

Lex Fridman on X: It was an honor and pleasure to meet and have a03 abril 2025

Lex Fridman on X: It was an honor and pleasure to meet and have a03 abril 2025 -

Rian Johnson Says He's 'Even More Proud' of 'Star Wars: The Last03 abril 2025

Rian Johnson Says He's 'Even More Proud' of 'Star Wars: The Last03 abril 2025 -

Get Zunesha in this - ONE PIECE TREASURE CRUISE03 abril 2025

-

Among US, MOD MENU by Platinmods03 abril 2025

Among US, MOD MENU by Platinmods03 abril 2025 -

Meaning of 私、アイドル宣言 (Watashi, Idol Sengen) by CHiCO with03 abril 2025

-

Hirogaru Sky Precure Anime GIF - Hirogaru sky precure Anime Pretty Cure - Discover & Share GIFs03 abril 2025

Hirogaru Sky Precure Anime GIF - Hirogaru sky precure Anime Pretty Cure - Discover & Share GIFs03 abril 2025