Independent Contractor: Definition, How Taxes Work, and Example

Por um escritor misterioso

Last updated 19 março 2025

:max_bytes(150000):strip_icc()/independent-contractor.asp-FINAL-6904c017dfbf4da18e90cf4db4af91e7.png)

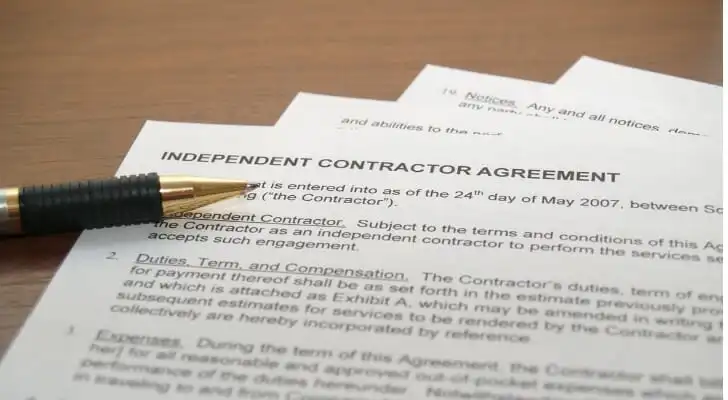

An independent contractor is a person or entity engaged in a work performance agreement with another entity as a non-employee.

How to Pay 1099 Contractors?

What do the Expense entries on the Schedule C mean? – Support

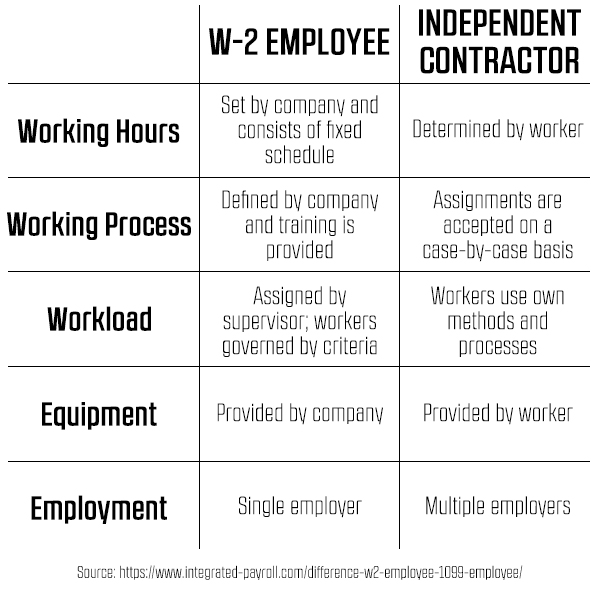

What's the difference between a contractor and an employee? - Odin

:max_bytes(150000):strip_icc()/gig-economy-final-e11918cb36e74a7db354bf0bf519c12e.jpg)

Gig Economy: Definition, Factors Behind It, Critique & Gig Work

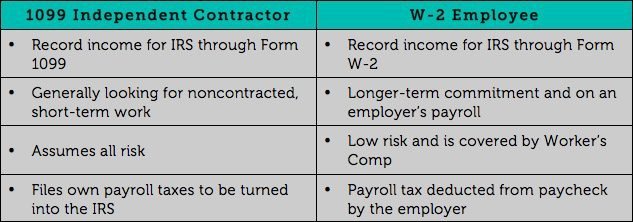

Do You Need a W-2 Employee or a 1099 Contractor? - How to Start

An Independent Contractor's Guide to Taxes - SmartAsset

:max_bytes(150000):strip_icc()/form-1099-nec-nonemployee-compensation-definition-5181240-final-040005b7ae304574a63f6af389f9df5b.png)

What Are 10 Things You Should Know About 1099s?

1099 Form Vs W2 Form

:max_bytes(150000):strip_icc()/california-assembly-bill-5-ab5-4773201-final-5dededce82a84362b2c83cbebb18abcd.png)

California Assembly Bill 5 (AB5): What's In It and What It Means

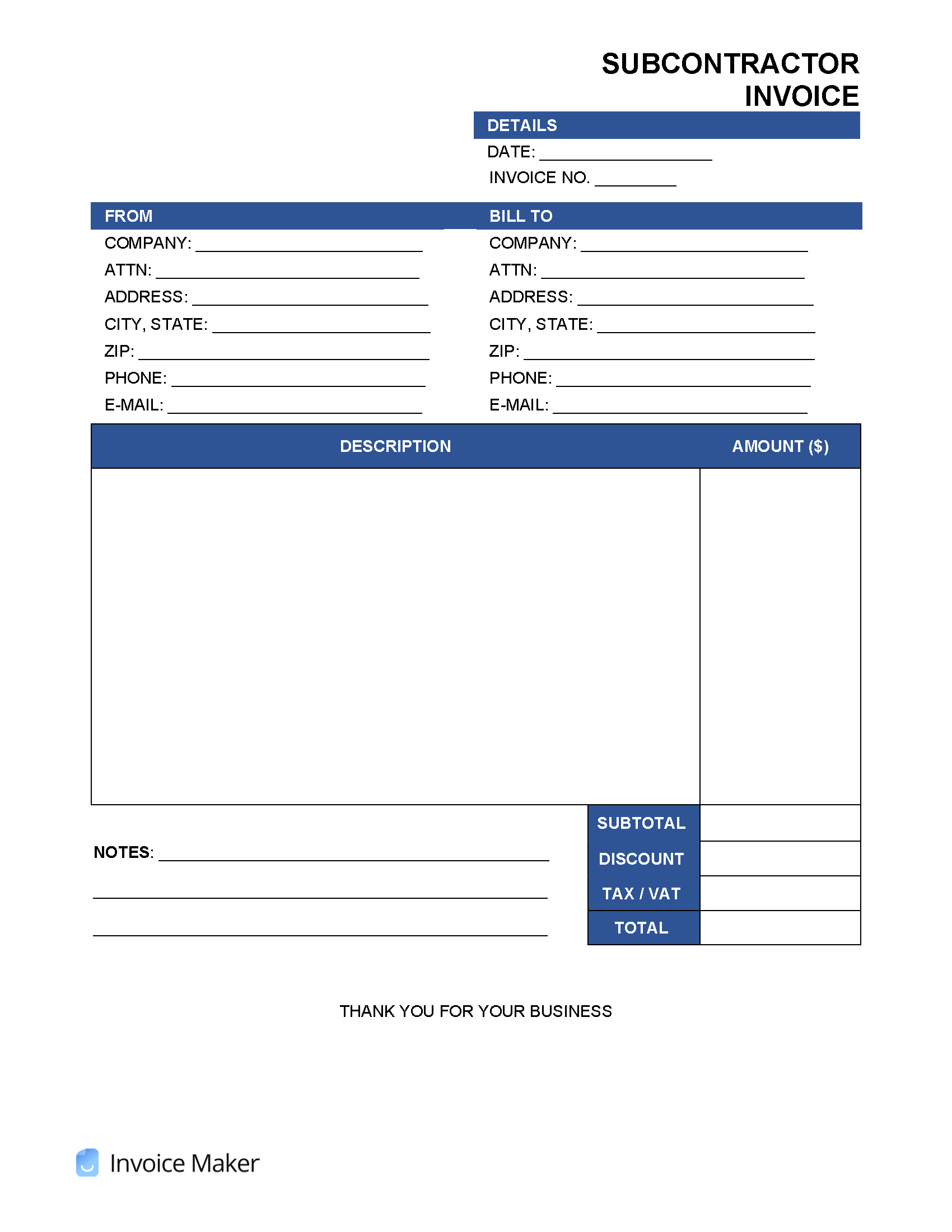

Independent Contractor (1099) Invoice Template

Guide to Taxes for Independent Contractors (2023)

Guide to Independent Contractor Jobs: Gigs and Freelance Jobs

1099 vs W-2: What's the difference?

Recomendado para você

-

101 Business Slang Terms, Jargon and Acronyms (You'll Hate)19 março 2025

101 Business Slang Terms, Jargon and Acronyms (You'll Hate)19 março 2025 -

Rule 63 - Wikipedia19 março 2025

Rule 63 - Wikipedia19 março 2025 -

Rule 63, Teh Meme Wiki19 março 2025

Rule 63, Teh Meme Wiki19 março 2025 -

Politicizing war: Viktor Orbán's right-wing authoritarian populist regime and the Russian invasion of Ukraine - ECPS19 março 2025

Politicizing war: Viktor Orbán's right-wing authoritarian populist regime and the Russian invasion of Ukraine - ECPS19 março 2025 -

Various periods19 março 2025

Various periods19 março 2025 -

B DeVos and her cone of silence on for-profit colleges19 março 2025

B DeVos and her cone of silence on for-profit colleges19 março 2025 -

![I found this on urban dictionary and thought it would make sense here [KABT, urban dictionary] : r/menwritingwomen](https://preview.redd.it/w9jlkgn3z5h71.png?auto=webp&s=2a6c88900c920f33e42dbbbfc4c96c3531eaab9e) I found this on urban dictionary and thought it would make sense here [KABT, urban dictionary] : r/menwritingwomen19 março 2025

I found this on urban dictionary and thought it would make sense here [KABT, urban dictionary] : r/menwritingwomen19 março 2025 -

Bangladesh - Wikipedia19 março 2025

Bangladesh - Wikipedia19 março 2025 -

Chemputation and the Standardization of Chemical Informatics19 março 2025

-

TikTok slang: A complete guide to the meanings behind each phrase - PopBuzz19 março 2025

TikTok slang: A complete guide to the meanings behind each phrase - PopBuzz19 março 2025

você pode gostar

-

Tecido Tricoline Natal Xadrez Verde - 50cm x 1,50mt - Loja Lider Tecidos19 março 2025

Tecido Tricoline Natal Xadrez Verde - 50cm x 1,50mt - Loja Lider Tecidos19 março 2025 -

Shadow & Sonic Hedgehog Sonic and shadow, Sonic the hedgehog, Hedgehog movie19 março 2025

Shadow & Sonic Hedgehog Sonic and shadow, Sonic the hedgehog, Hedgehog movie19 março 2025 -

Crash Bandicoot - IGN19 março 2025

Crash Bandicoot - IGN19 março 2025 -

Vampire: The Masquerade - Bloodhunt preview - Niche Gamer19 março 2025

Vampire: The Masquerade - Bloodhunt preview - Niche Gamer19 março 2025 -

XY OU - A Tribute to Macho Man Randy Savage-Hawlucha19 março 2025

XY OU - A Tribute to Macho Man Randy Savage-Hawlucha19 março 2025 -

Power Unknown! Android 16 Breaks His Silence!, Dragon Ball Wiki19 março 2025

Power Unknown! Android 16 Breaks His Silence!, Dragon Ball Wiki19 março 2025 -

![Qoo News] “Koi to Producer: EVOL×LOVE” Anime Premieres on July 15](https://i0.wp.com/news.qoo-app.com/en/wp-content/uploads/sites/3/2020/06/20061507112018.jpg) Qoo News] “Koi to Producer: EVOL×LOVE” Anime Premieres on July 1519 março 2025

Qoo News] “Koi to Producer: EVOL×LOVE” Anime Premieres on July 1519 março 2025 -

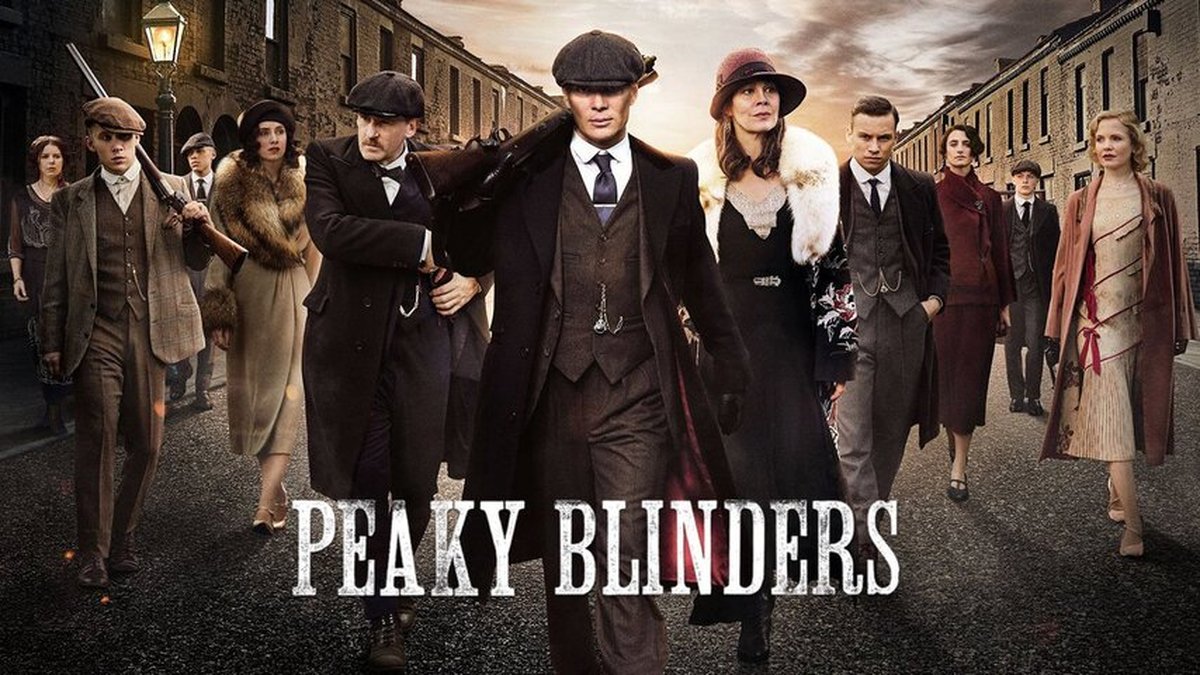

Com 100% de aprovação dos críticos, 6ª e ÚLTIMA temporada de 'Peaky Blinders' estreia em 1º na Netflix - CinePOP19 março 2025

Com 100% de aprovação dos críticos, 6ª e ÚLTIMA temporada de 'Peaky Blinders' estreia em 1º na Netflix - CinePOP19 março 2025 -

Colleen Hoover19 março 2025

-

70+ ROBLOX : Music Codes : WORKING (ID) 2021 - 2022 ( P-37) - in 202319 março 2025

70+ ROBLOX : Music Codes : WORKING (ID) 2021 - 2022 ( P-37) - in 202319 março 2025