Students on an F1 Visa Don't Have to Pay FICA Taxes —

Por um escritor misterioso

Last updated 28 março 2025

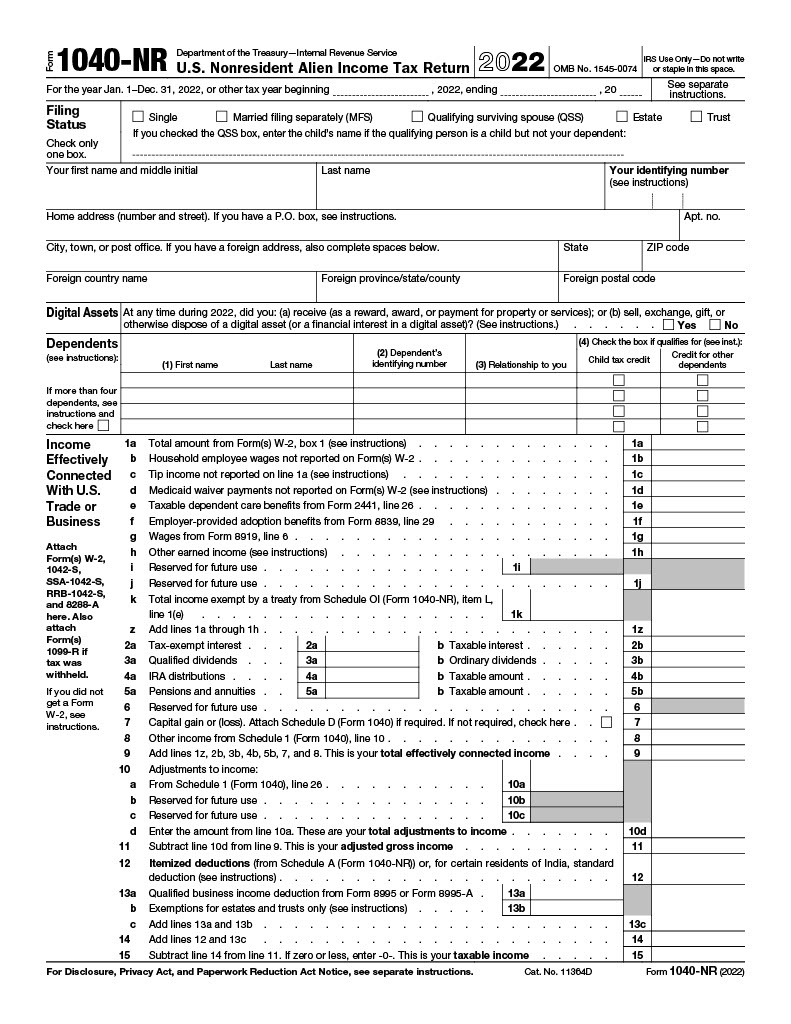

In general, non-US citizens employed in the U.S. are required to pay FICA taxes. However, those with single intent, or non-immigrant status (or F1 visa holders) are exempt from FICA taxes.

Can You Opt Out of Paying Social Security Taxes?

How to File US Tax Return as an International Student

Social Security Number (SSN) for International Students on F1 Visa or J1 Visa

Can I Deduct Student Loan Interest On My Taxes If The Loan Was From A Non-US Bank? —

Tax FAQs International Student Tax Return and Refund

FICA Tax Rate: What Are Employer Responsibilities? - NerdWallet

F1 Visa Students Stock Trading – Allowed? Invest: Buy, Sell, Taxes? [2023]

How do Undocumented Immigrants Pay Federal Taxes? An Explainer

The Complete J1 Student Guide to Tax in the US

Students Taxes: Education Tax Credits, Deductions, & FAFSA

Alien Registration Number - How to Find Your A-Number

Recomendado para você

-

What is Fica Tax?, What is Fica on My Paycheck28 março 2025

What is Fica Tax?, What is Fica on My Paycheck28 março 2025 -

What is the FICA Tax and How Does It Work? - Ramsey28 março 2025

What is the FICA Tax and How Does It Work? - Ramsey28 março 2025 -

What Is FICA, and How Much Is FICA Tax? Payroll taxes, Business tax, Financial life hacks28 março 2025

What Is FICA, and How Much Is FICA Tax? Payroll taxes, Business tax, Financial life hacks28 março 2025 -

FICA Tax: 4 Steps to Calculating FICA Tax in 202328 março 2025

FICA Tax: 4 Steps to Calculating FICA Tax in 202328 março 2025 -

Historical Social Security and FICA Tax Rates for a Family of Four28 março 2025

Historical Social Security and FICA Tax Rates for a Family of Four28 março 2025 -

FICA Tax Tip Credit for Salons & Spas - Rosy Salon Software28 março 2025

FICA Tax Tip Credit for Salons & Spas - Rosy Salon Software28 março 2025 -

Paychex on X: With the possibility of FICA tax rates fluctuating each year, it's essential to stay informed. Discover everything you need to know about these taxes and how to calculate them.28 março 2025

Paychex on X: With the possibility of FICA tax rates fluctuating each year, it's essential to stay informed. Discover everything you need to know about these taxes and how to calculate them.28 março 2025 -

FICA refund for F1 visa / OPT / CPT students – 1040NRA.com28 março 2025

FICA refund for F1 visa / OPT / CPT students – 1040NRA.com28 março 2025 -

2019 US Tax Season in Numbers for Sprintax Customers28 março 2025

2019 US Tax Season in Numbers for Sprintax Customers28 março 2025 -

FICA Tax Tip Fairness Pro Beauty Association28 março 2025

FICA Tax Tip Fairness Pro Beauty Association28 março 2025

você pode gostar

-

1 - The Kings Avatar 2 Quanzhi Gaoshou EP 1 - Vídeo Dailymotion28 março 2025

-

Elite: Dangerous – why the classic space game still has fans enraptured, Games28 março 2025

Elite: Dangerous – why the classic space game still has fans enraptured, Games28 março 2025 -

Border Cafe in Harvard Square has closed for good28 março 2025

Border Cafe in Harvard Square has closed for good28 março 2025 -

Hajimete no Gal 1. Bölüm İzle - Anime izle28 março 2025

Hajimete no Gal 1. Bölüm İzle - Anime izle28 março 2025 -

Fantasia Cosplay Satou Kazuma Konosuba Sob Confecção28 março 2025

Fantasia Cosplay Satou Kazuma Konosuba Sob Confecção28 março 2025 -

MALACASA 12-Piece White Porcelain Dinnerware at28 março 2025

MALACASA 12-Piece White Porcelain Dinnerware at28 março 2025 -

Eu quero jogo minecraft mim jogar28 março 2025

Eu quero jogo minecraft mim jogar28 março 2025 -

Life thinking Meme Generator - Imgflip28 março 2025

Life thinking Meme Generator - Imgflip28 março 2025 -

青鬼3 - Apps on Google Play28 março 2025

-

Venger's old school gaming blog: Advanced Game Mastering28 março 2025

Venger's old school gaming blog: Advanced Game Mastering28 março 2025