Tax Evasion: Meaning, Definition, and Penalties

Por um escritor misterioso

Last updated 26 março 2025

:max_bytes(150000):strip_icc()/taxevasion.asp_final-8be1e7bf4edc49d3add2ba8af2a2d521.png)

Tax evasion is an illegal practice where a person or entity intentionally does not pay due taxes.

:max_bytes(150000):strip_icc()/tax-avoidance-vs-evasion-397671-v3-5b71dfc846e0fb0025e54177.png)

Tax Avoidance and Tax Evasion — What Is the Difference?

:max_bytes(150000):strip_icc()/evasion-8693b3a5461a4bb1972a6bf5f81c0cf3.jpg)

What Is Tax Evasion?

:max_bytes(150000):strip_icc()/tax_avoidance.asp-Final-9d7e3d82dc5c4ce293256ff9d548494d.png)

Tax Evasion: Meaning, Definition, and Penalties

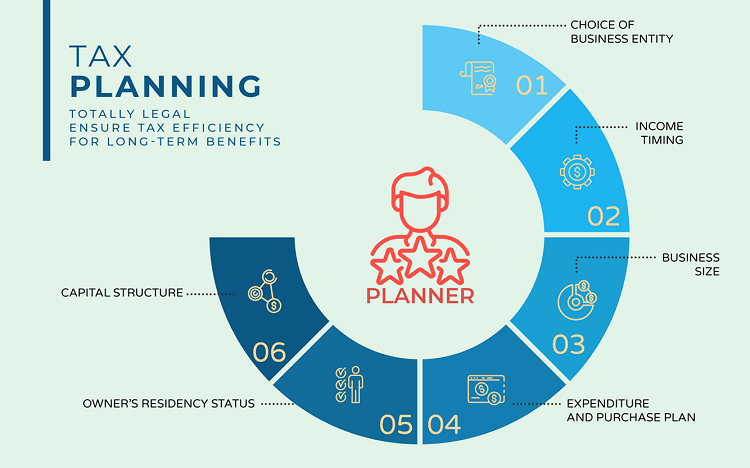

Tax Avoidance - Difference Between Tax Evasion, Avoidance & Planning

Differences Between Tax Evasion, Tax Avoidance And Tax Planning

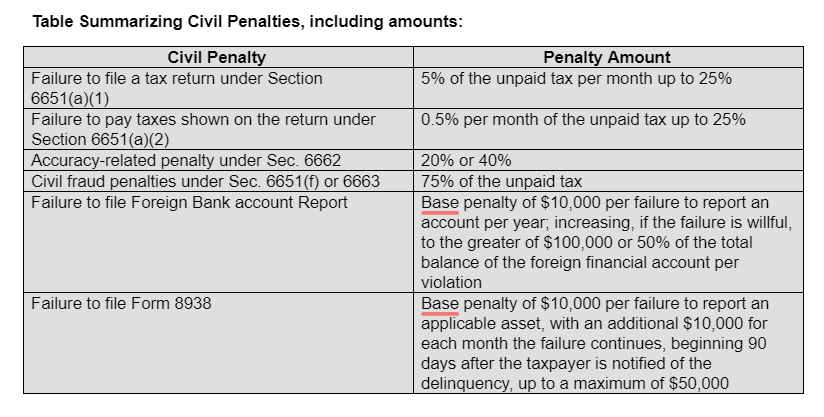

Penalties and prosecutions

Tax evasion in the United States - Wikipedia

Tax Evasion vs. Tax Avoidance: What Are the Legal Risks? - Wampler & Passanise Criminal Defense Lawyers

Difference Between Tax Planning

Tax Evasion, What You Need To Know - The Tax Lawyer

Penalties for Claiming False Deductions

Understanding the IRS and Cryptocurrency: Penalties, Tax Evasion, and Compliance

5 Things Everyone Should Know About Tax Evasion And Fraud

Difference Between Tax Evasion and Tax Avoidance

Recomendado para você

-

Define Evade, Evade Meaning, Evade Examples, Evade Synonyms, Evade Images, Evade Vernacular, Evade Usage, Evade Rootwords26 março 2025

Define Evade, Evade Meaning, Evade Examples, Evade Synonyms, Evade Images, Evade Vernacular, Evade Usage, Evade Rootwords26 março 2025 -

The Quotable Ayn Rand: 'You Can Avoid Reality, But26 março 2025

The Quotable Ayn Rand: 'You Can Avoid Reality, But26 março 2025 -

Evade Meaning In Urdu, Bachna بچنا26 março 2025

Evade Meaning In Urdu, Bachna بچنا26 março 2025 -

I'm still terrified from that event, Lil nas jump scare has26 março 2025

-

evade meaning definition of evade at26 março 2025

evade meaning definition of evade at26 março 2025 -

English - Words Related to Crime (in Hindi) Offered by Unacademy26 março 2025

English - Words Related to Crime (in Hindi) Offered by Unacademy26 março 2025 -

The State of Hindi's Burgeoning Digital Media26 março 2025

The State of Hindi's Burgeoning Digital Media26 março 2025 -

Frog - Wikipedia26 março 2025

Frog - Wikipedia26 março 2025 -

Coronavirus spike proteins may evolve to evade human immune system26 março 2025

Coronavirus spike proteins may evolve to evade human immune system26 março 2025 -

Ban Evasion: How It Works & Real-Life Examples26 março 2025

você pode gostar

-

2022 novo modelo 12kwstyle bicicleta elétrica da sujeira motocicleta elétrica - AliExpress26 março 2025

2022 novo modelo 12kwstyle bicicleta elétrica da sujeira motocicleta elétrica - AliExpress26 março 2025 -

Roblox egg dance This ugly rat is so cute 🥰😔💅 #fypppppppppppppppppp26 março 2025

-

Shitake Mushrooms (1 lb)26 março 2025

Shitake Mushrooms (1 lb)26 março 2025 -

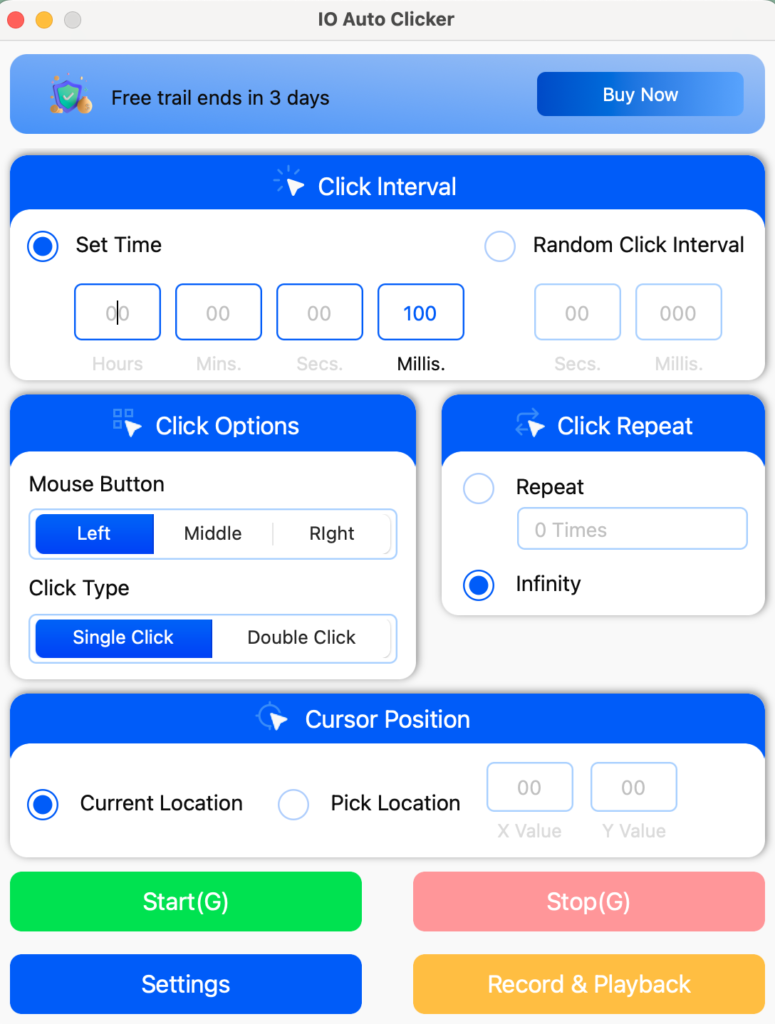

Auto Clicker for Mac - Free Download (2023 Latest Version26 março 2025

Auto Clicker for Mac - Free Download (2023 Latest Version26 março 2025 -

Bebê Reborn - Recém Nascida Vinil Siliconado Pronta Entrega26 março 2025

Bebê Reborn - Recém Nascida Vinil Siliconado Pronta Entrega26 março 2025 -

Red Dead Redemption Ps4 e Ps5 PSN MIDIA DIGITAL - LA Games - Produtos Digitais e pelo melhor preço é aqui!26 março 2025

Red Dead Redemption Ps4 e Ps5 PSN MIDIA DIGITAL - LA Games - Produtos Digitais e pelo melhor preço é aqui!26 março 2025 -

Casting Time/Interruption Cards, Ragnarok Wiki, Fandom in 202326 março 2025

Casting Time/Interruption Cards, Ragnarok Wiki, Fandom in 202326 março 2025 -

21 personagens principais de Boku no Hero Academia (e seus poderes26 março 2025

21 personagens principais de Boku no Hero Academia (e seus poderes26 março 2025 -

Direito e Xadrez26 março 2025

Direito e Xadrez26 março 2025 -

GetBackers Anime nerd, Anime images, Old anime26 março 2025

GetBackers Anime nerd, Anime images, Old anime26 março 2025