Brazil Lending Rate: per Annum: Pre-Fixed: Corporate Entities: Vendor: Banco Cedula S.A., Economic Indicators

Por um escritor misterioso

Last updated 07 abril 2025

Brazil Lending Rate: per Annum: Pre-Fixed: Corporate Entities: Vendor: Banco Cedula S.A. data was reported at 0.000 % pa in Jul 2019. This stayed constant from the previous number of 0.000 % pa for Jul 2019. Brazil Lending Rate: per Annum: Pre-Fixed: Corporate Entities: Vendor: Banco Cedula S.A. data is updated daily, averaging 0.000 % pa from Jan 2012 to 03 Jul 2019, with 1865 observations. The data reached an all-time high of 14.290 % pa in 27 Apr 2013 and a record low of 0.000 % pa in 03 Jul 2019. Brazil Lending Rate: per Annum: Pre-Fixed: Corporate Entities: Vendor: Banco Cedula S.A. data remains active status in CEIC and is reported by Central Bank of Brazil. The data is categorized under Brazil Premium Database’s Interest and Foreign Exchange Rates – Table BR.MB045: Lending Rate: per Annum: by Banks: Pre-Fixed: Corporate Entities: Vendor. Lending Rate: Daily: Interest rates disclosed represent the total cost of the transaction to the client, also including taxes and operating. These rates correspond to the average fees in the period indicated in the tables. There are presented only institutions that had granted during the period determined. In general, institutions practicing different rates within the same type of credit. Thus, the rate charged to a customer may differ from the average. Several factors such as the time and volume of the transaction, as well as the guarantees offered, explain the differences between interest rates. Certain institutions grant allowance of the use of the term overdraft. However, this is not considered in the calculation of rates of this type. It should be noted that the overdraft is a modality that has high interest rates. Thus, its use should be restricted to short periods. If the customer needs resources for a longer period, should find ways to offer lower rates. The Brazilian Central Bank publishes these data with a delay about 20 days with relation to the reference period, thus allowing sufficient time for all Financial Institutions to deliver the relevant information. Interest rates presented in this set of tables correspond to averages weighted by the values of transactions conducted in the five working days specified in each table. These rates represent the average effective cost of loans to customers, consisting of the interest rates actually charged by financial institutions in their lending operations, increased tax burdens and operational incidents on the operations. The interest rates shown are the average of the rates charged in the various operations performed by financial institutions, in each modality. In one discipline, interest rates may differ between customers of the same financial institution. Interest rates vary according to several factors, such as the value and quality of collateral provided in the operation, the proportion of down payment operation, the history and the registration status of each client, the term of the transaction, among others . Institutions with “zero” did not operate on modalities for those periods or did not provide information to the Central Bank of Brazil. The Central Bank of Brazil assumes no responsibility for delay, error or other deficiency of information provided for purposes of calculating average rates presented in this

Itau Unibanco Holding S.A. Form 6-K Current Report Filed 2023-11-22

Using Agricultural Bonds For Pre - and Post-Harvest Finance in

Peru: Third Review Under the Stand-By Arrangement and Request for

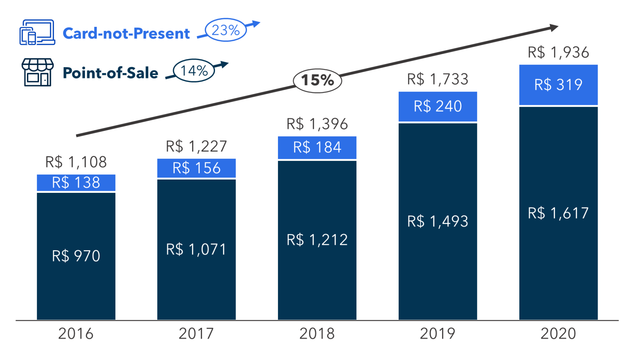

Brazil: Defining Fintech in LatAm

Brazil economic outlook

Inter & Co. Inc.: Briefly describe the history of the issuer Brief

Building the Mexican-Caribbean World (Part I) - Veracruz and the

Brazil's banks adjust risk appetite as inflation threatens asset

EX-99.1

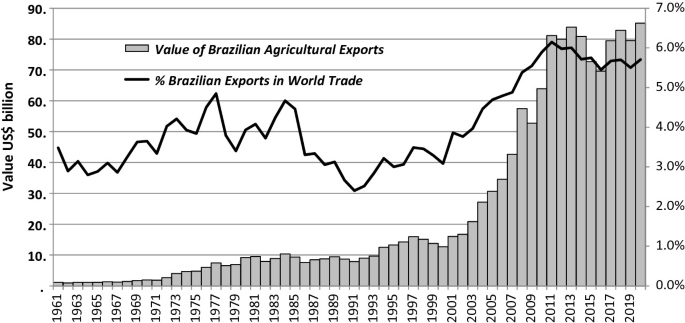

The Modernization of Brazilian Agriculture Since 1950

PDF) The Relationship Between Insurance and Entrepreneurship in

Recomendado para você

-

Clique aqui para download - Caruana Financeira07 abril 2025

Clique aqui para download - Caruana Financeira07 abril 2025 -

Jacob Barata Filho recebeu informação da Caruana sobre quebra de sigilo e quase fugiu, apontam documentos do MPF07 abril 2025

Jacob Barata Filho recebeu informação da Caruana sobre quebra de sigilo e quase fugiu, apontam documentos do MPF07 abril 2025 -

File:Caruana, Jaime (IMF 2008) (frame).jpg - Wikimedia Commons07 abril 2025

File:Caruana, Jaime (IMF 2008) (frame).jpg - Wikimedia Commons07 abril 2025 -

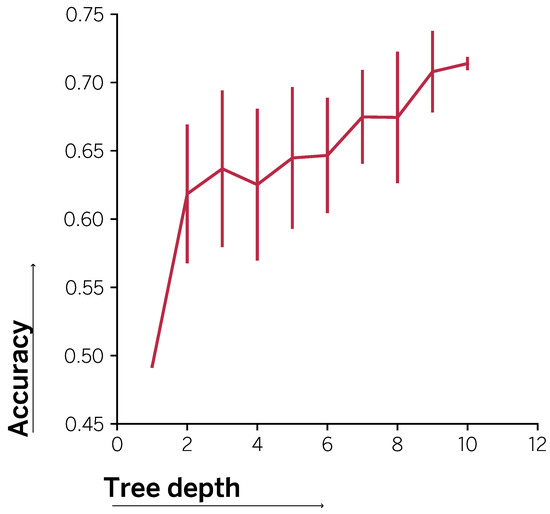

Entropy, Free Full-Text07 abril 2025

Entropy, Free Full-Text07 abril 2025 -

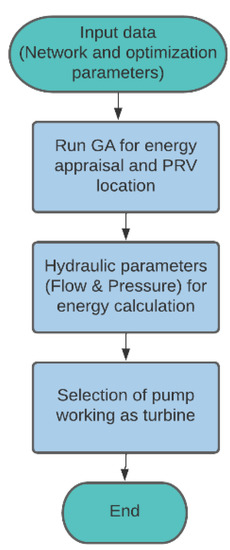

Water, Free Full-Text07 abril 2025

Water, Free Full-Text07 abril 2025 -

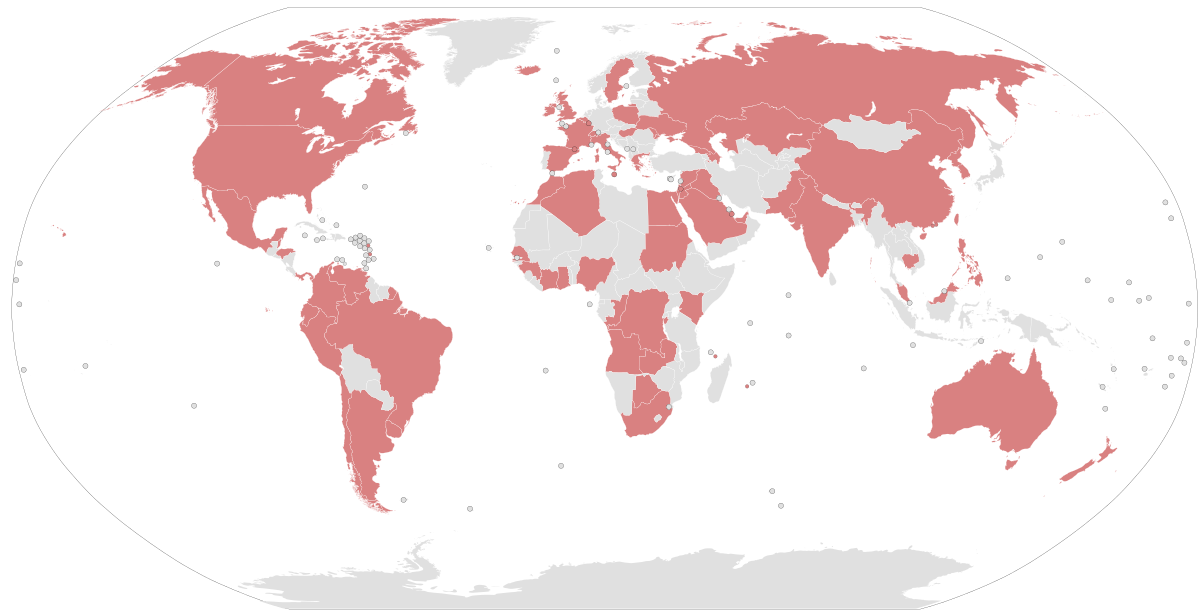

Panama Papers - Wikipedia07 abril 2025

Panama Papers - Wikipedia07 abril 2025 -

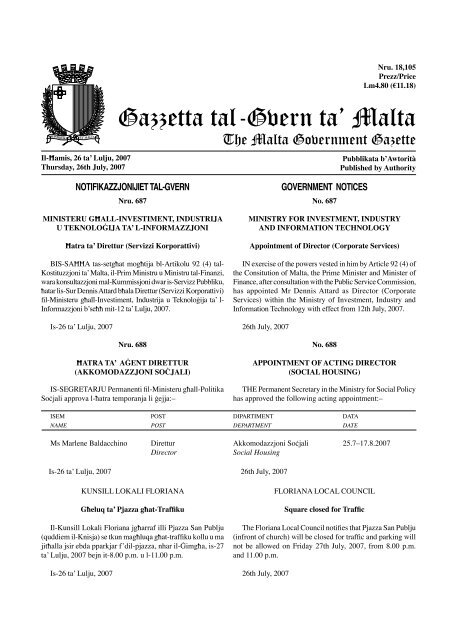

Government Gazette No. 18105 - doi photography competition07 abril 2025

Government Gazette No. 18105 - doi photography competition07 abril 2025 -

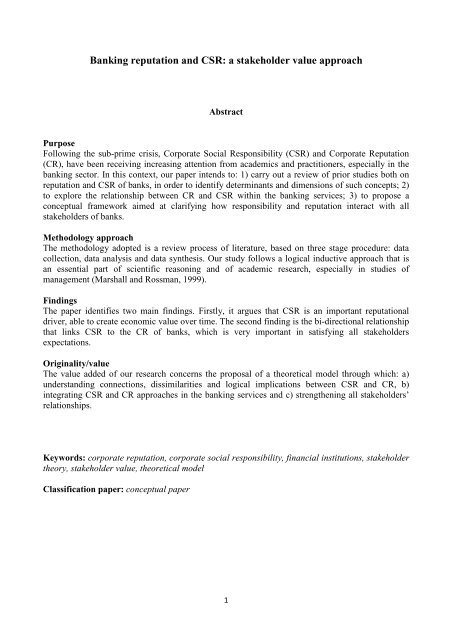

Banking reputation and CSR: a stakeholder value approach - Naples07 abril 2025

Banking reputation and CSR: a stakeholder value approach - Naples07 abril 2025 -

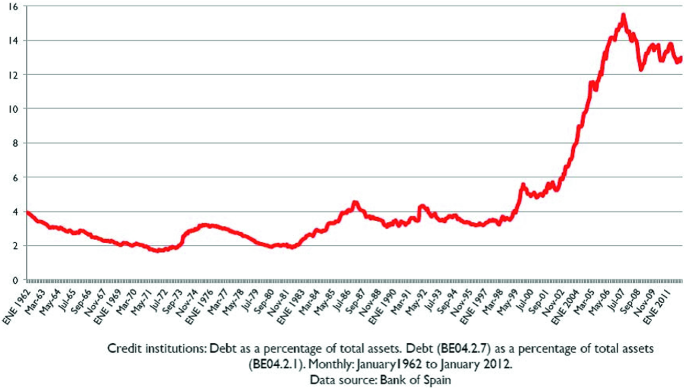

The Global Financial Crisis and the Spanish Banking System: Explaining Its Initial Success (2007–2010)07 abril 2025

The Global Financial Crisis and the Spanish Banking System: Explaining Its Initial Success (2007–2010)07 abril 2025 -

Eventos07 abril 2025

Eventos07 abril 2025

você pode gostar

-

COMO CHAMAR AMIGO DE VOLTA NO FREE FIRE. COMO COMPLETAR O EVENTO CHAMA A TROPA E PEGAR OS FRAGMENTOS07 abril 2025

COMO CHAMAR AMIGO DE VOLTA NO FREE FIRE. COMO COMPLETAR O EVENTO CHAMA A TROPA E PEGAR OS FRAGMENTOS07 abril 2025 -

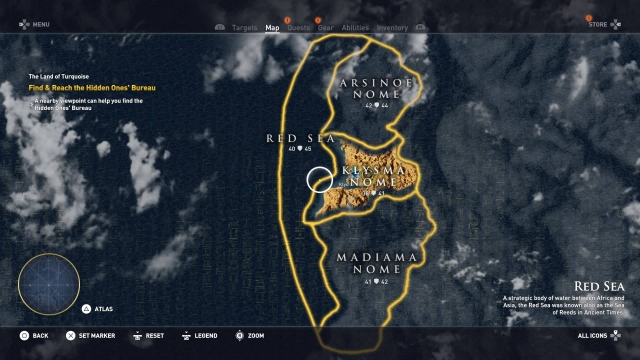

Assassin's Creed Origins: The Hidden Ones DLC Review07 abril 2025

Assassin's Creed Origins: The Hidden Ones DLC Review07 abril 2025 -

Sonic Mania, PC07 abril 2025

Sonic Mania, PC07 abril 2025 -

Pet Fighters Simulator Codes - Free Coins and Emeralds07 abril 2025

Pet Fighters Simulator Codes - Free Coins and Emeralds07 abril 2025 -

Cascata do Macaco Branco, Prefeitura de Sao Francisco de Assis RS07 abril 2025

Cascata do Macaco Branco, Prefeitura de Sao Francisco de Assis RS07 abril 2025 -

Curitiba, mais que criativa ou inteligente: educadora07 abril 2025

Curitiba, mais que criativa ou inteligente: educadora07 abril 2025 -

Call of Duty MW2 Season 3 Update Patch Notes Revealed07 abril 2025

-

Page 855 of 961 Entertainment News: Latest Entertainment News on Movies, Games, Television, Apps News in India - Fresherslive07 abril 2025

Page 855 of 961 Entertainment News: Latest Entertainment News on Movies, Games, Television, Apps News in India - Fresherslive07 abril 2025 -

Countdown to the Canadian Game Awards 2023 – Stephanie Greenall07 abril 2025

Countdown to the Canadian Game Awards 2023 – Stephanie Greenall07 abril 2025 -

Free Fire MAX Download for PC Windows 10, 7, 8 32/64 bit Free in 202307 abril 2025

Free Fire MAX Download for PC Windows 10, 7, 8 32/64 bit Free in 202307 abril 2025