Publication 970 (2022), Tax Benefits for Education

Por um escritor misterioso

Last updated 02 abril 2025

Publication 970 - Introductory Material Future Developments What's New Reminders

Educational Credits Covered California MAGI Income publication 970

Is College Tuition Tax-Deductible?

Are VA Education Benefits Taxable? - Military Supportive Colleges

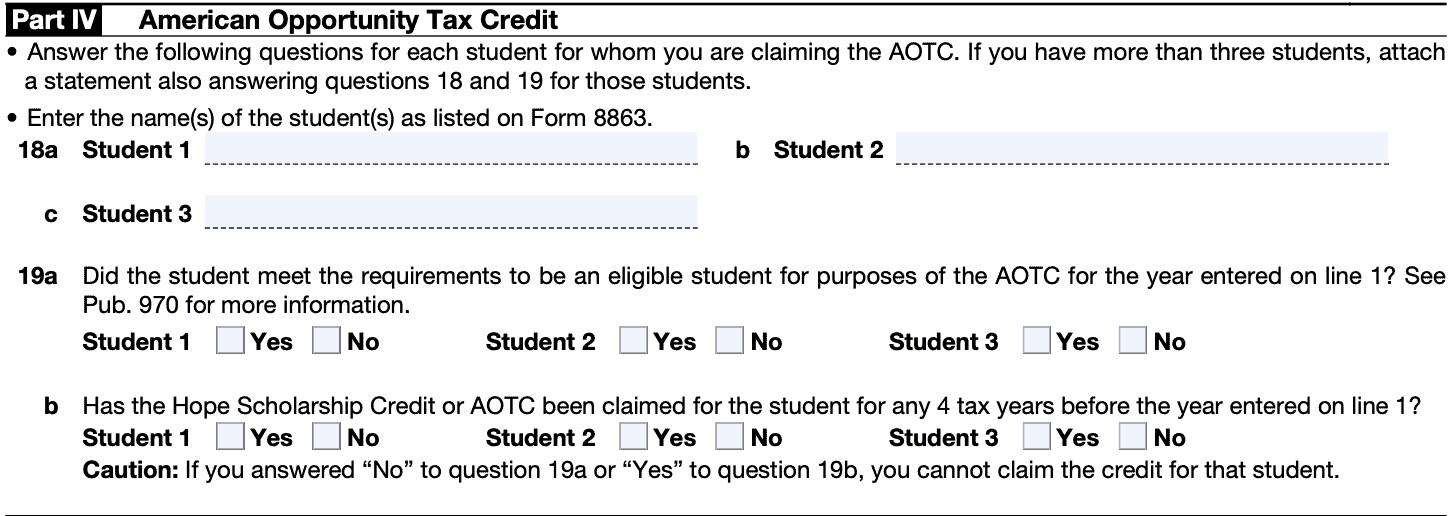

IRS Form 8862 Instructions

Other Tax Forms and Taxable Income

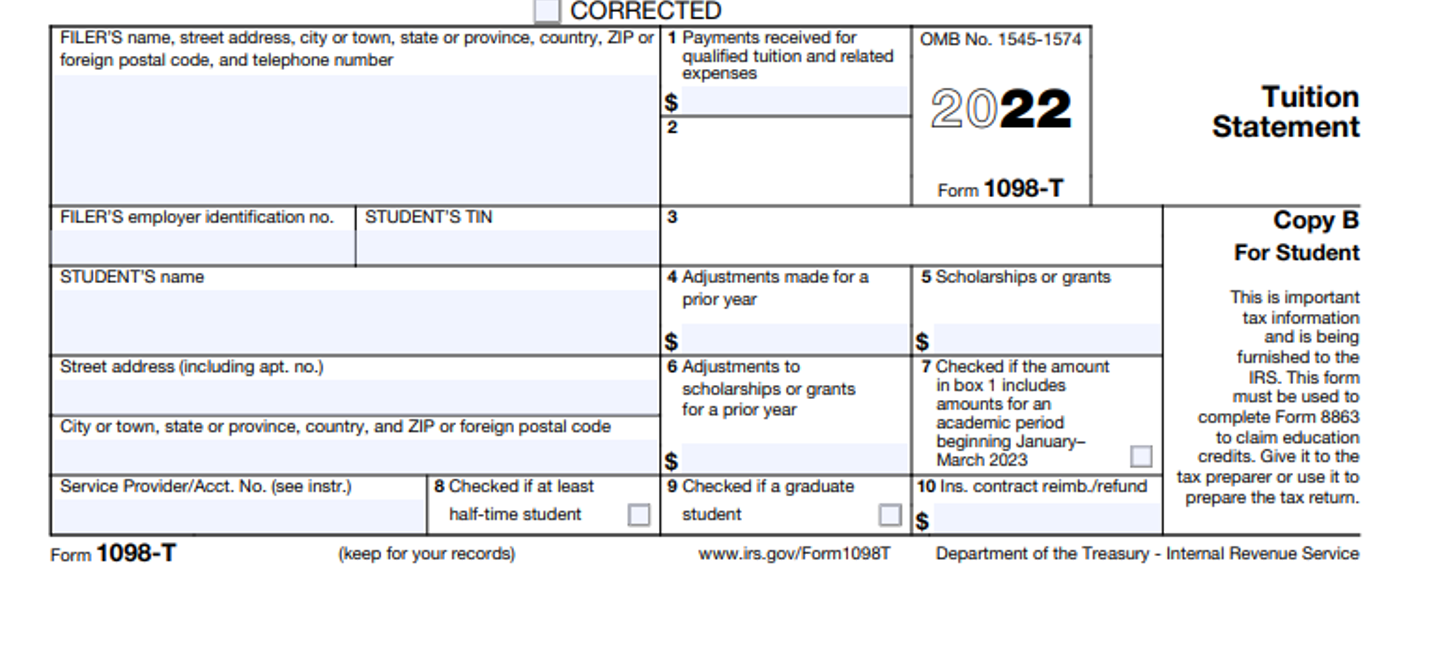

IRS Form 1098-T, Enrollment Services (RaiderConnect)

IRS CP 79- We Denied One or More Credits Claimed on Your Tax Return

Maximizing the higher education tax credits - Journal of Accountancy

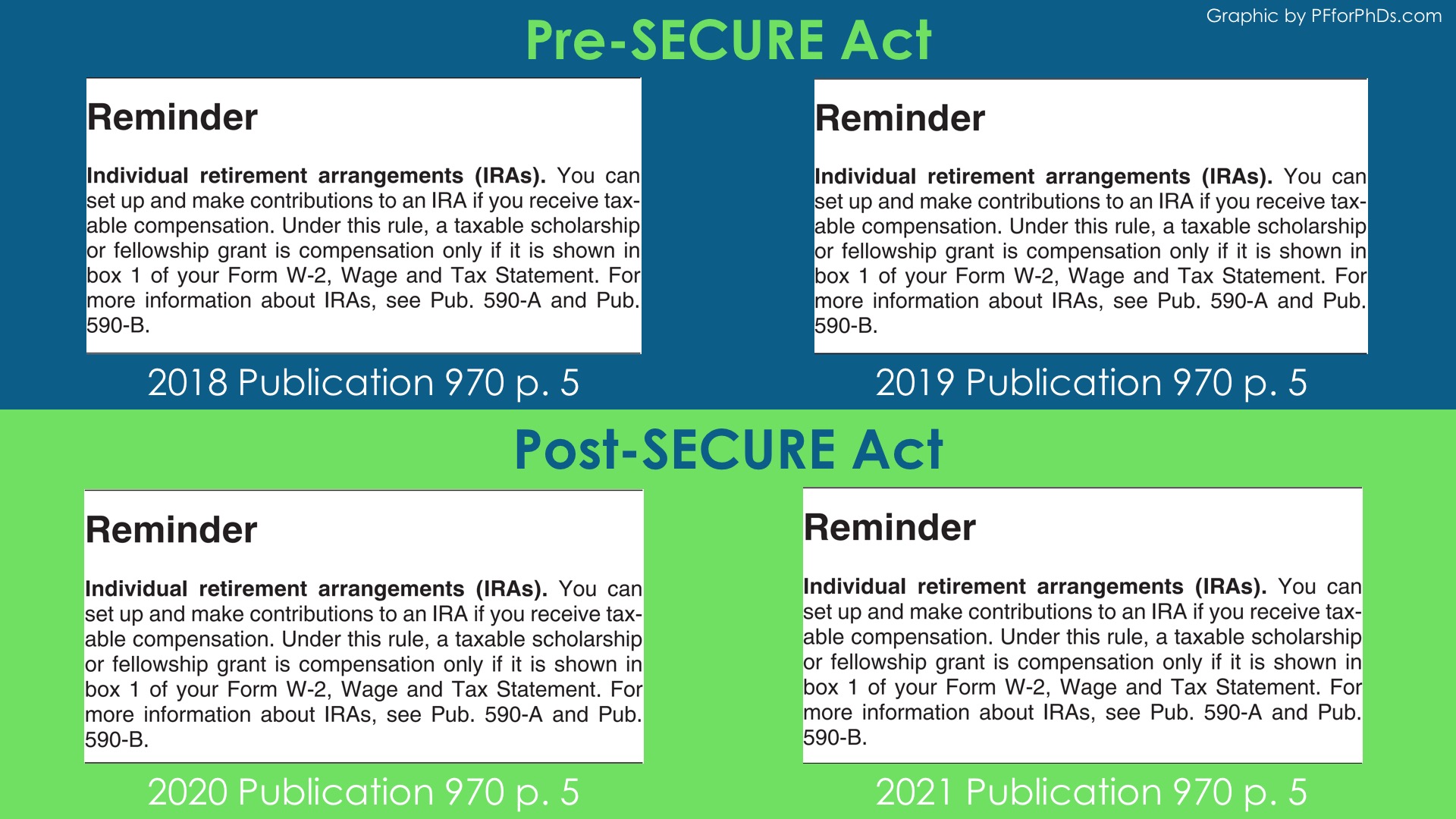

Is Fellowship Income Eligible to Be Contributed to an IRA? - Personal Finance for PhDs

Form 8917: Tuition and Fees Deduction: What it is, How it Works

Coverdell Education Savings Account: Exploring the Details in IRS Pub 970 - FasterCapital

Recomendado para você

-

Pin by Alex Adams on Body language02 abril 2025

Pin by Alex Adams on Body language02 abril 2025 -

Back to School - Chapter 1 - Page 7 by PlayboyVampire on DeviantArt02 abril 2025

Back to School - Chapter 1 - Page 7 by PlayboyVampire on DeviantArt02 abril 2025 -

eero on X: ✏️ Whether they're heading back to campus or studying at your dining table, get the upgrade they need to ace back to school 🎒 Shop now for 20%02 abril 2025

eero on X: ✏️ Whether they're heading back to campus or studying at your dining table, get the upgrade they need to ace back to school 🎒 Shop now for 20%02 abril 2025 -

Five Star 2 Pocket Folder, Stay-Put Folder, Plastic Colored Folders with Pockets & Prong Fasteners for 3-Ring Binders, For Home School Supplies & Home02 abril 2025

Five Star 2 Pocket Folder, Stay-Put Folder, Plastic Colored Folders with Pockets & Prong Fasteners for 3-Ring Binders, For Home School Supplies & Home02 abril 2025 -

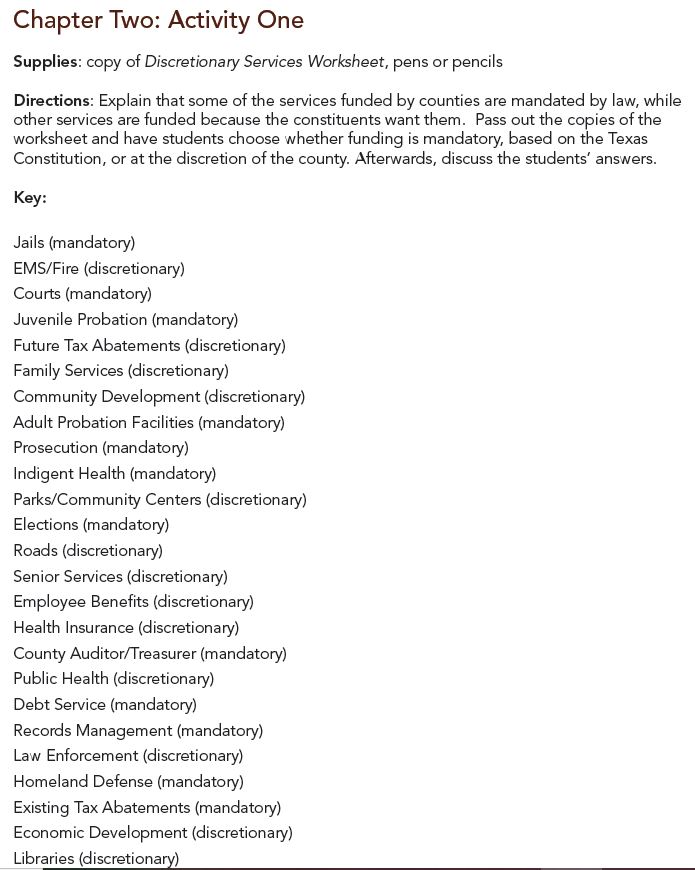

Back To School Basics - Discretionary Services Answers - Texas County Progress02 abril 2025

Back To School Basics - Discretionary Services Answers - Texas County Progress02 abril 2025 -

Fed Up with Lunch: The School Lunch Project: How One Anonymous Teacher Revealed the Truth About School Lunches --And How We Can Change Them!02 abril 2025

Fed Up with Lunch: The School Lunch Project: How One Anonymous Teacher Revealed the Truth About School Lunches --And How We Can Change Them!02 abril 2025 -

My Weird School Special #5 Back to School, Weird kids rule by Dan Gutman - Chapter 1 - 302 abril 2025

My Weird School Special #5 Back to School, Weird kids rule by Dan Gutman - Chapter 1 - 302 abril 2025 -

1 Peter Book I: Chapter 1: Volume 23 of Heavenly Citizens in Earthly Shoes, An Exposition of the Scriptures for Disciples and Young Christians02 abril 2025

1 Peter Book I: Chapter 1: Volume 23 of Heavenly Citizens in Earthly Shoes, An Exposition of the Scriptures for Disciples and Young Christians02 abril 2025 -

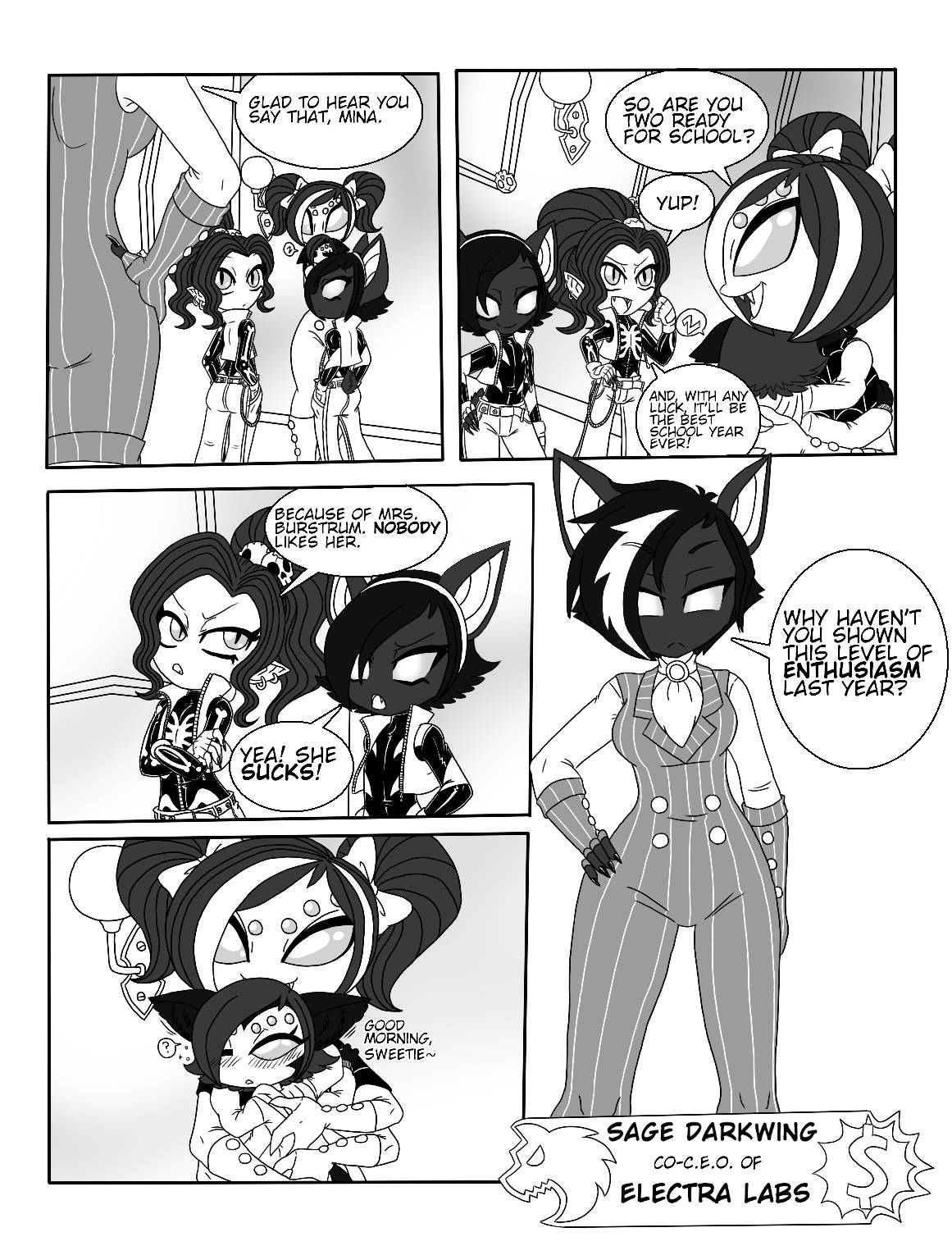

Back to School - Chapter 1 - Page 5 by PlayboyVampire on DeviantArt02 abril 2025

Back to School - Chapter 1 - Page 5 by PlayboyVampire on DeviantArt02 abril 2025 -

All photos about Back to School: All Grown Up page 273 - Mangago02 abril 2025

All photos about Back to School: All Grown Up page 273 - Mangago02 abril 2025

você pode gostar

-

Rare Limited Collection Boneca Cabeças para Meninas, Marrom e Branco, Ásia Princesa Boneca Cabeça, Brinquedos de02 abril 2025

Rare Limited Collection Boneca Cabeças para Meninas, Marrom e Branco, Ásia Princesa Boneca Cabeça, Brinquedos de02 abril 2025 -

HALF LIFE 2 Thirdperson FIX (with download Link!)02 abril 2025

HALF LIFE 2 Thirdperson FIX (with download Link!)02 abril 2025 -

HOW TO DRAW YELLOW Rainbow Friends Chapter 2 - Easy Step by Step Drawing02 abril 2025

HOW TO DRAW YELLOW Rainbow Friends Chapter 2 - Easy Step by Step Drawing02 abril 2025 -

Steam Community :: Dice Kingdoms02 abril 2025

Steam Community :: Dice Kingdoms02 abril 2025 -

Cenário Móveis - A loja mais completa em móveis finos e de luxo em Goiânia e Brasília02 abril 2025

Cenário Móveis - A loja mais completa em móveis finos e de luxo em Goiânia e Brasília02 abril 2025 -

Ultra Street Fighter II: The Final Challengers (Nintendo Switch, 2017) for sale online02 abril 2025

Ultra Street Fighter II: The Final Challengers (Nintendo Switch, 2017) for sale online02 abril 2025 -

Pin on Смешные фотографии животных02 abril 2025

Pin on Смешные фотографии животных02 abril 2025 -

Noob Roblox GIF - Noob ROBLOX Cool - Discover & Share GIFs02 abril 2025

Noob Roblox GIF - Noob ROBLOX Cool - Discover & Share GIFs02 abril 2025 -

Haunter coloring page Free Printable Coloring Pages02 abril 2025

Haunter coloring page Free Printable Coloring Pages02 abril 2025 -

ArtStation - rs Life 2 - NPC DESIGN - Dixie02 abril 2025

ArtStation - rs Life 2 - NPC DESIGN - Dixie02 abril 2025