2021 FICA Tax Rates

Por um escritor misterioso

Last updated 25 março 2025

Social Security and Medicare income limits and tax rates FICA tax is a combination of a Social Security tax and a Medicare tax. The Social Security tax is assessed on wages up to $142,800 ($137,700 in 2020); the Medicare tax is assessed on all wages.

Maximum Taxable Income Amount For Social Security Tax (FICA)

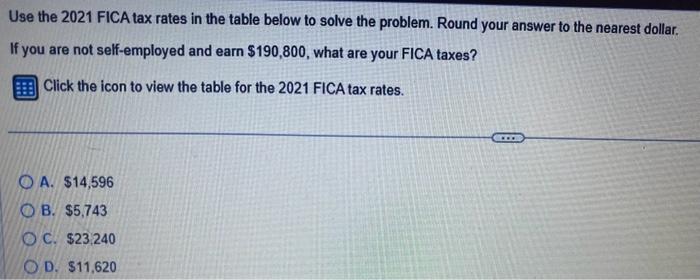

Solved Use the 2021 FICA tax rates in the table below to

Payroll tax - Wikipedia

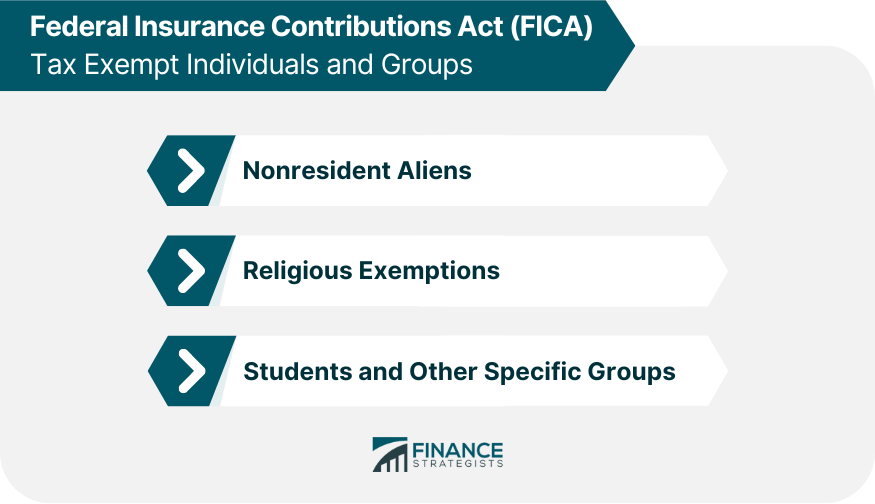

Withholding FICA Tax on Nonresident employees and Foreign Workers

Do You Have To Pay Tax On Your Social Security Benefits?

What is FED MED/EE Tax?

How to calculate fica taxes - The Tech Edvocate

The 2021 “Social Security wage base” is increasing - WellsColeman

Federal Insurance Contributions Act - Wikipedia

2019 Payroll Tax Updates: Social Security Wage Base, Medicare & FICA Tax Rates - CheckmateHCM

What are FICA Taxes? 2022-2023 Rates and Instructions

Social Security tax impact calculator - Bogleheads

Recomendado para você

-

What is FICA Tax? - Optima Tax Relief25 março 2025

What is FICA Tax? - Optima Tax Relief25 março 2025 -

What are FICA Tax Payable? – SuperfastCPA CPA Review25 março 2025

What are FICA Tax Payable? – SuperfastCPA CPA Review25 março 2025 -

What is a payroll tax?, Payroll tax definition, types, and employer obligations25 março 2025

What is a payroll tax?, Payroll tax definition, types, and employer obligations25 março 2025 -

What Is FICA on a Paycheck? FICA Tax Explained - Chime25 março 2025

What Is FICA on a Paycheck? FICA Tax Explained - Chime25 março 2025 -

What it means: COVID-19 Deferral of Employee FICA Tax25 março 2025

What it means: COVID-19 Deferral of Employee FICA Tax25 março 2025 -

FICA refund for F1 visa / OPT / CPT students – 1040NRA.com25 março 2025

FICA refund for F1 visa / OPT / CPT students – 1040NRA.com25 março 2025 -

FICA Tax - An Explanation - RMS Accounting25 março 2025

FICA Tax - An Explanation - RMS Accounting25 março 2025 -

FICA Tax Tip Fairness Pro Beauty Association25 março 2025

FICA Tax Tip Fairness Pro Beauty Association25 março 2025 -

Federal Insurance Contributions Act (FICA)25 março 2025

Federal Insurance Contributions Act (FICA)25 março 2025 -

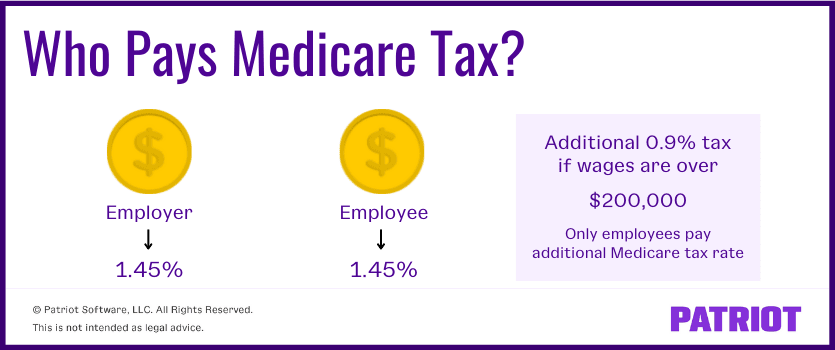

Unveiling the Mysteries of Medicare Tax: Employer & Employee Tax25 março 2025

Unveiling the Mysteries of Medicare Tax: Employer & Employee Tax25 março 2025

você pode gostar

-

The 2021 EmployerOne survey is now open - Community Futures Middlesex25 março 2025

The 2021 EmployerOne survey is now open - Community Futures Middlesex25 março 2025 -

Nathan Drake, PlayStation Wiki25 março 2025

Nathan Drake, PlayStation Wiki25 março 2025 -

Diário da Kazumi25 março 2025

-

Dinamo City-Tirana 2-3 (Golat dhe rastet e sfidës)25 março 2025

Dinamo City-Tirana 2-3 (Golat dhe rastet e sfidës)25 março 2025 -

desenhos tumblr 41 – – Desenhos para Colorir25 março 2025

desenhos tumblr 41 – – Desenhos para Colorir25 março 2025 -

um novo código de blox Fruit25 março 2025

-

Pokémon HD, Pikachu, Red (Pokémon), Blue (Pokémon), HD Wallpaper25 março 2025

Pokémon HD, Pikachu, Red (Pokémon), Blue (Pokémon), HD Wallpaper25 março 2025 -

Baixar Mahou Tsukai no Yome - Download & Assistir Online! - AnimesTC25 março 2025

Baixar Mahou Tsukai no Yome - Download & Assistir Online! - AnimesTC25 março 2025 -

Letter S Gold Plated Layered Diamante Initial Necklace - Lovisa25 março 2025

Letter S Gold Plated Layered Diamante Initial Necklace - Lovisa25 março 2025 -

Santo Anastacio, SP / BR, Clube dos Bancarios25 março 2025

Santo Anastacio, SP / BR, Clube dos Bancarios25 março 2025